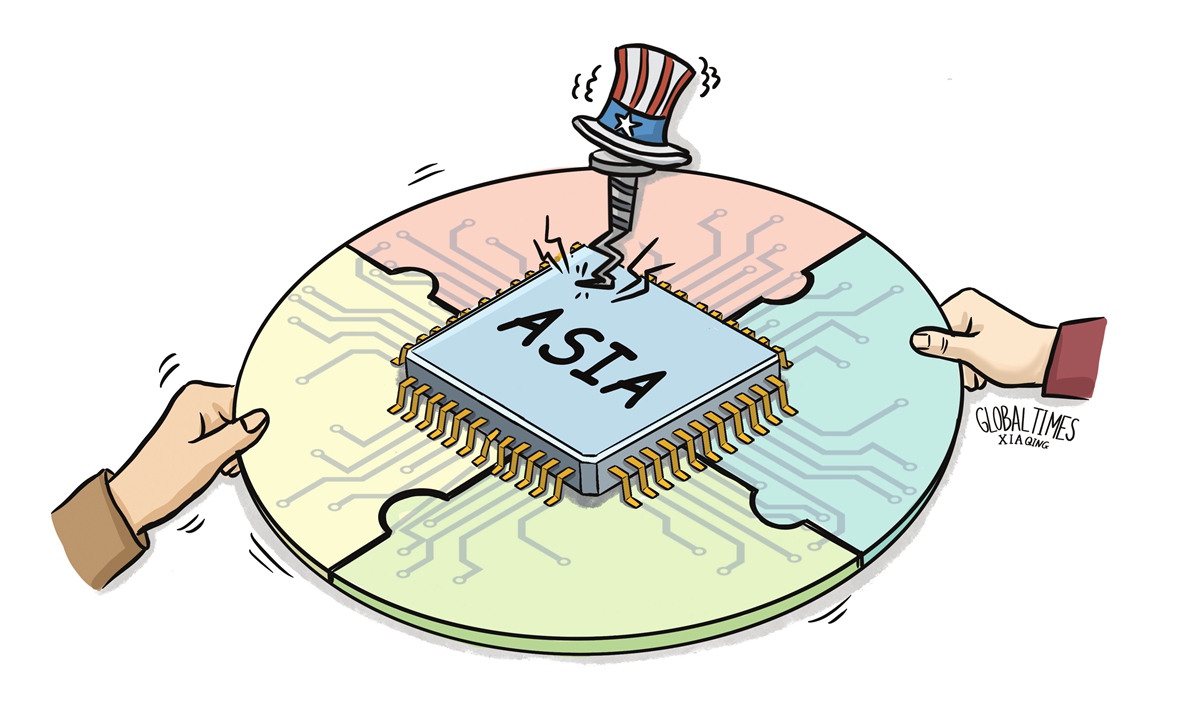

Illustration: Xia Qing/Global Times

The South Korean government is facing a strategic dilemma, several South Korean media outlets reported, as it finds increasingly hard to resist growing US pressure from compromising its semiconductor sector.The US government asked South Korea to inform it by the end of August whether it would participate in the so-called "Chip 4," Yonhap said, citing anonymous sources in Washington.

The chip industry alliance was first proposed by the US in March to chip manufacturing powerhouses in the Asia-Pacific region - South Korea, Japan, and the island of Taiwan. While the industrial alliance is ostensibly aimed at strengthening cooperation throughout the chip-making production chain, it sent a signal that no one could get it wrong: the US intends to step up pressure on China in terms of the global semiconductor supply chain.

While it is unclear what reply the South Korean government will ultimately give under the political pressure from the US, it is clear that this could cause more harm than good if South Korea succumbs to US pressure.

There is no denying that the US is an absolute leader in the semiconductor industry, with its chip manufacturing technology remaining the most advanced in the world, while Japan is taking the lead in supply key components and raw materials. If South Korea chooses not to join the "Chip 4," its domestic semiconductor sector may risk being held back due to limited access to upstream side.

But the tricky part behind the South Korean government's reluctance to make the choice lies in the fact that South Korea's major semiconductor companies are heavily dependent on the Chinese market. China accounted for 48 percent of South Korea's $69 billion memory chip exports in 2021, Reuters reported, citing data from the Korea International Trade Association.

South Korea is well aware that the so-called "Chip 4" is a small political circle aimed at creating division in the global semiconductor industry, which will bring little benefit to its own industrial chain.

To a certain extent, this would put South Korea in a very awkward position in terms of semiconductor supply chains. If China, as the largest market for semiconductor applications, views South Korea's semiconductor supply chain as unreliable and unpredictable, it would generate direct impact on its market share in China, because it means pressing needs for China to make its own chips.

This impact may be easily digested in other markets during a period of chip shortage. Yet, with the world showing signs of a chip glut, the impact could be more serious. For instance, South Korea's chip stockpiles jumped 53.4 percent in May from a year earlier, marking the biggest increase more than four years and suggesting a slowdown in demand for memory chips used in electronics worldwide, Bloomberg reported.

The trend is not that surprising given the policies various countries have rolled out to support their own semiconductor industries over the past two years. For instance, voting in US Senate on a bill to boost the US semiconductor industry and improve competitiveness with China could begin as early as Tuesday, Reuters reported.

Since no country is poised to benefit from the industrial chain decoupling in the region, it is time for regional economies to think more about cooperation rather than following the US decoupling strategy.