GT Investigates: Australia urged to take practical action in easing tensions with China as coal, wine and oat grass companies look to mend frayed ties

Coal, wine, oat grass exporters aspire to sell to huge Chinese market: experts

China Australia File photo

Exporters of coal, wine, lobsters and oat grass in Australia are calling for normalized trade ties with China, their major destination market, amid growing expectations for improved bilateral relations after frequent high-level meetings between government officials, with the Chinese side stating openness for dialogue and cooperation.

There is growing hope for bilateral trade to get on normal track at the earliest time, following the disruption in most trade activities during the previous Morrison administration, which took a hostile policy toward China.

With Australian producers and traders bearing the brunt of the disruption, industry representatives and experts take a wait-and-see approach pending practical action from Canberra.

Experts said since it is the Australian side that caused relations to deteriorate in the first place, it is also up to Australia to take the initiative to bring bilateral relations back to normalcy.

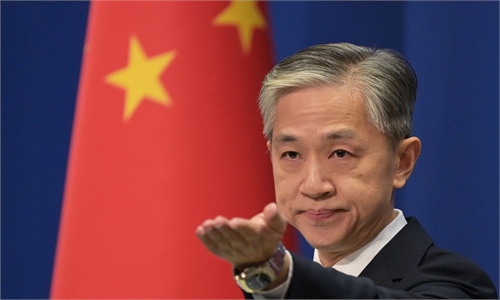

Chinese Foreign Ministry spokesperson Wang Wenbin on Monday urged Australia to seize the opportunity in bilateral relations and take concrete action to improve trade ties.

Wang said that China's position on cooperation with Australia and other countries has always been clear, and it is hoped that Australia can seize the opportunity to correct its approach to China-related issues, deal with China-Australia economic and trade relations based on mutual respect and benefits, and create favorable conditions for the healthy and stable development of China-Australia relations.

Several companies that are in bilateral trade reached by the Global Times on Tuesday and Wednesday said that they have noted a possible shift toward improved ties, but stressed they are waiting for a turning point.

Yancoal, an Australia-based coal producer and developer, is among those that suffered from the deteriorating bilateral relations.

While Yancoal has managed to diversify its customer base and re-direct cargoes to alternate buyers, China remains a potential key market, given the significant share that the Chinese market took in the company's revenue, the Global Times learned.

Previously, China generated around 17 percent of Yancoal's sales revenue, Matthew Gerber, general manager of corporate affairs of Yancoal Australia, told the Global Times on Tuesday.

Coal was Australia's third-largest export to China after iron ore and liquefied natural gas, with the average annual export value around A$13 billion ($1.60 billion), of which the average annual export value of coal to China was more than A$4 billion, accounting for one-third of the country's total, according to media reports.

Gerber said that the company is hopeful of a relaxation of Australian coal shipments to China, "but we do not anticipate any resolution to the current issues in the short term."

A senior industry insider who participated in several trade talks in cross-border coal deals told the Global Times on condition of anonymity that "some foreign media speculated about the coal trade relaxation, but that only reflects the eager mindset of the Australian side."

China went through the hardest time late last year when coal supply became inadequate, but the market supply at the moment is stable, with ramped-up production from domestic mines and increased imports from Mongolia and Russia.

"There is no rush for us to import Australian coal, especially as the thermal coal market is cooling down amid weakened global demand and China's aggressive carbon reduction efforts," the insider said.

Feng Dongbin, an analyst from China-based Fenwei consultancy, told the Global Times that chances are small for Australian coal to get into the Chinese market in the short term, since the domestic market is not short of coal now, and Australian coal is more expensive, amid shrinking global market demand.

With China buying around one-third of everything Australia exports on a value basis, producers and traders swallowed the pain from the deadlock in bilateral relations - a result of the Morrison administration's hostile approach to China.

In 2021, Australia's exports to China increased by 21 percent year-on-year to reach $133 billion, with the growth partly attributable to China's continued demand for iron ore, which reached record high prices, according to a report released by China Briefing.

But outside of growth in iron ore, many Australian exports to China declined, with goods including coal to wine, timber, seafood, beverages and even oat grass seeing the steepest decline.

Take Australian wine, for example. In 2021, Australian wine exports to China fell by about $700 million, a 97 percent drop year-on-year, following an announcement by China's Ministry of Commerce in March last year to impose anti-dumping duties.

With the winds of eased bilateral relations blowing in recent days, Australian traders in the wine business are observing the situation and not in a rush to respond.

A dealer who used to import Australian wine but has since "shifted country" amid the wine trade dispute told the Global Times that Australian wine producers are eager for normalized trade.

"I have looked at my contact lists, my partners are still there, and their wine cellars are ready. A year of disturbance has caused some damage but after assessment the damages are controllable," the dealer said. "The wine import business can be restarted if the duties are lifted."

The dealer himself is in no big hurry to take such a move as he has found other import sources.

An oat grass trader who used to be in the Australian trade business said that there is a general expectation among Australian grass farmers to be able to export to China, their major export market.