Prefabricated food popular among Chinese urbanities, but sector faces bubble concerns

Sector has long value chain, needs attentive management: industry analyst

A consumer checks prefabricated food in a supermarket. Photo: VCG

As the once-in-a-century COVID-19 pandemic has badly pummeled the catering industry, the prefabricated food market segment has witnessed a booming window with capital pouring into the sector, bringing about both growth potential and bubble concerns.

"I filled up one of my cabinets with prefabricated food in late April when my living compound was locked down due to the coronavirus outbreak," a Beijing-based resident surnamed Yu told the Global Times on Wednesday.

"It is when I realized there have emerged so many different kinds of prefabricated food, including instant hotpot and instant roast fish," she said, "all you need to do is put some water into the heating package and a fair meal would be ready in minutes."

"I bought some too, but mainly as a reserve in case some restriction measures to be rolled out in my living compound. With two young children in the house, I prefer to cook with fresh ingredients," Wang Min, a resident from Central China's Anhui Province, told the Global Times.

Prefabricated food has become increasingly popular over the last two years, with plenty of companies entering the business and different kinds of productions keep hitting shelves.

Chinese food producer Shandong Longda Meishi Co saw its total revenue fall 19 percent year-on-year in 2021, yet the company reported 1.18 billion yuan revenues selling prefabricated food products in 2021, rising 4.75 percent year-on-year, according to the firm's annual financial report.

Longda's revenue generated by prefabricated food accounted for 6.06 percent of its total revenue in 2021, which increased 29.49 percent from the previous year.

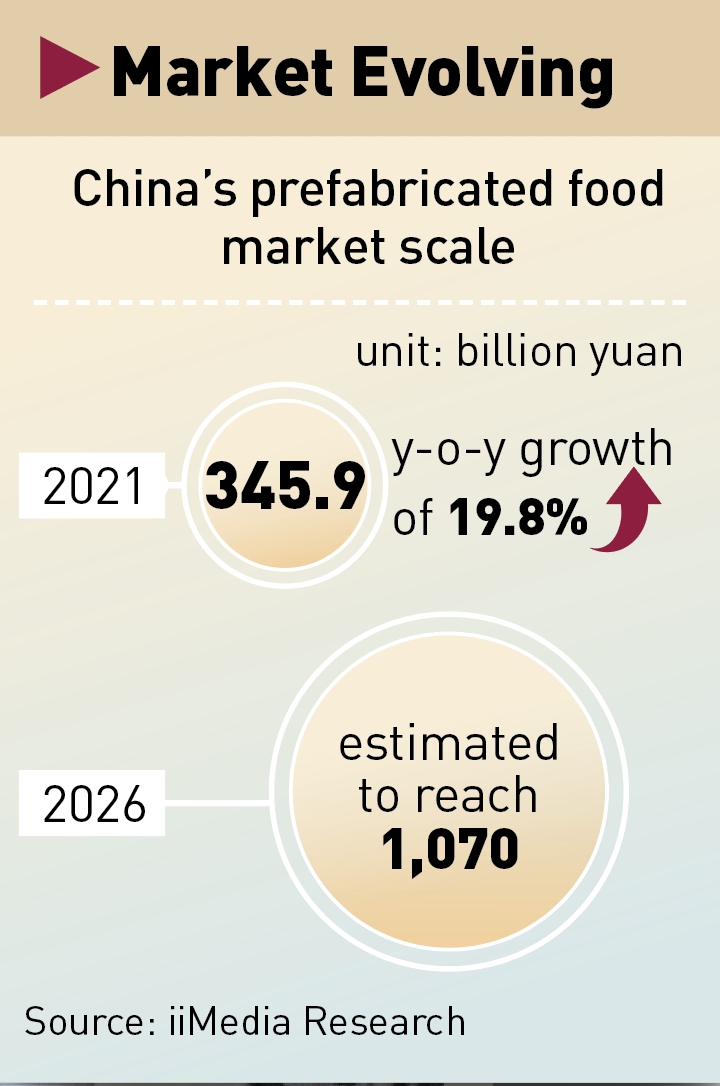

The total market scale for prefabricated food reached 345.9 billion yuan in 2021, surging 19.8 percent year-on-year, which is deemed fast growth, according to an industrial report sent to the Global Times by iiMedia Research on Wednesday.

It is expected that China's prefabricated food market will maintain a high growth rate into the near future, with a market scale estimated to reach 1.07 trillion yuan in 2026..

Besides the coronavirus factor which has boosted the growth of the industry, one other major factor is that related production and storage capacity has become mature for prefabricated food, Zhang Yi, CEO of iiMedia Research Institute, told the Global Times.

And, the expansion of the sector could drive the development of a series of industries, from agriculture, manufacturing to logistics and services, Zhang said.

Bubble concerns

With capital sniffing out new opportunities across the prefabricated food sector, many investors have started to pour money into new innovations. Even household appliances producer Midea and real estate developer Country Garden have reportedly jumped onto the bandwagon.

From 2013 to 2021, a total of 71 investment and financing rounds were conducted in the prefabricated food sector, and the total amount of financing hit more than 1 billion yuan, involving 42 projects, media reports said, citing an industrial report.

Meanwhile, the capital enthusiasm has raised concerns of a potential bubble and disorderly competition in the sector.

The latest controversial case is Qudian Inc which recently launched eye-catching sales promotion activities on a live-stream platform, such as "buying one fish dish for only 0.01 yuan" to attract consumers.

Besides low-price promotion, the company recently announced moves to offer one-year interest-free loan to people who join its business chain and open offline stores. It has sparked wide controversy among consumers as the company was once focusing on campus loan business which is strongly restricted by regulators now.

Graphic: Chen He/GT

Healthy growth

While it is understandable that capital would not want to miss the lucrative business, there are problems linked to the growth of the industry.

For instance, the prefabricated food industry constitutes a relatively long value chain from production, cold-chain logistics to delivery, which requires companies to ensure resilience of every part to realize smooth operation, Zhang said.

Chinese food e-commerce platform MissFresh recently changed its "30-minute delivery service" to "overnight delivery service" which is viewed by industrial experts as a move to ease possible cash flow crisis. It showed that management loopholes are one of the crucial problems that these companies need to address to pursue a sustainable growth, according to Zhang.

In addition, the sector's product quality issues have also come under spotlight, becoming one of the frequently complaints by consumers, according to an analysis released by China Consumer Association (CCA) on Tuesday.

There are prefabricated food products with not detailed labels and many restaurants do not inform customers when offering them prefabricated food, CCA's analysis said.

CCA stressed that with the rapid development of prefabricated food market, relevant regulations need to be rolled out to promote the standardized development of the industry, to guide the industry's healthy growth.