China's forex reserves rise in July, helped by accelerating exports, foreign direct investment

Photo: VCG

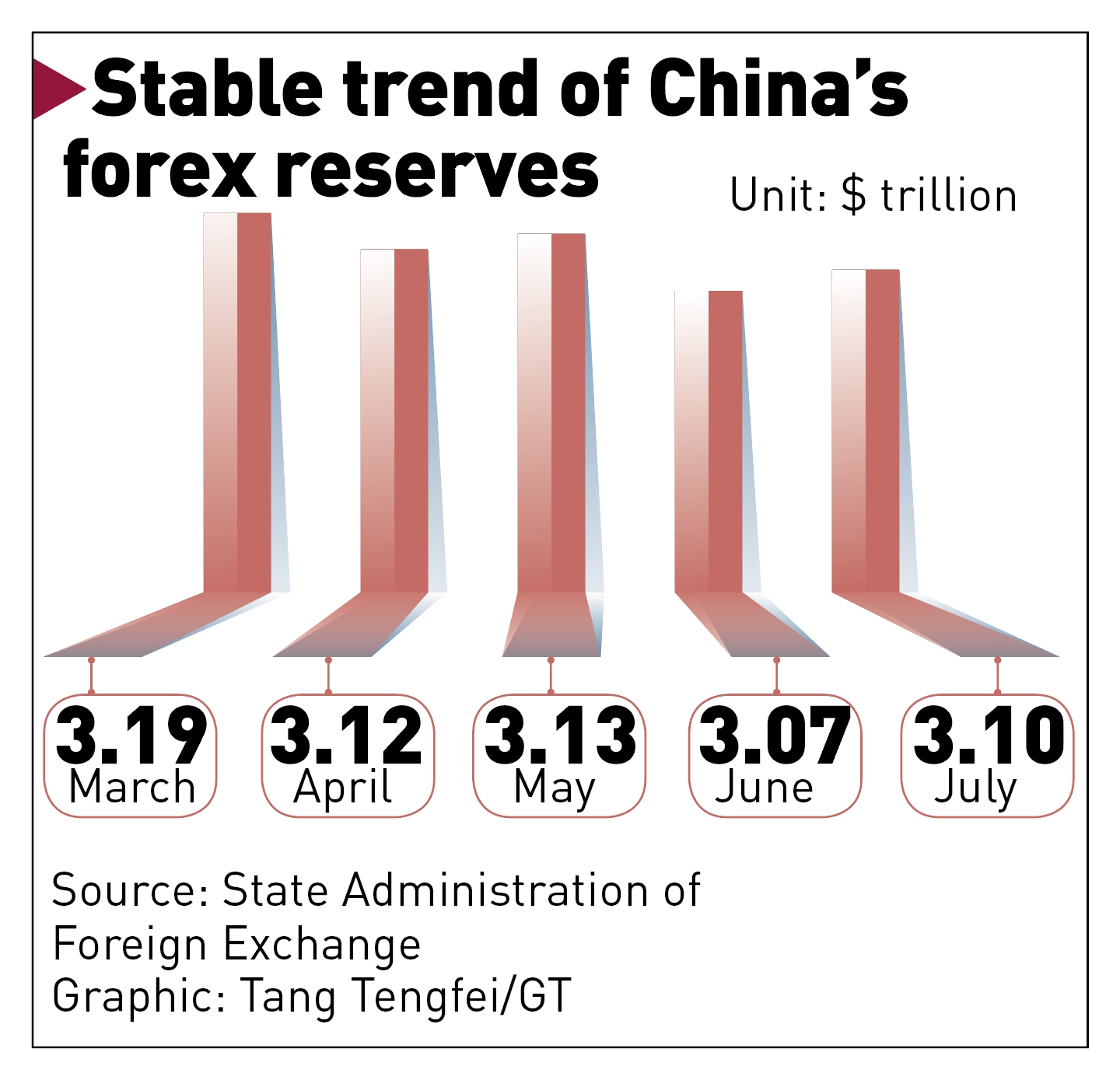

China's foreign exchange reserves in July remained stable, up 1.07 percent from June, remaining above a commonly accepted benchmark of $3 trillion, the official reserve asset data for July released by the State Administration of Foreign Exchange (SAFE) on Sunday showed, despite complex external factors including global inflation, US monetary policy tightening, rising geopolitical conflicts and other factors.

With the strong support from Chinese government policies and firm determination to stabilize Chinese economy and trade, the newest reading of foreign exchange reserves reflect that China's foreign exchange market is operating normally and domestic foreign exchange supply and demand are basically balanced, experts said.

At the same time, foreign exchange reserves will remain at around the 3-trillion-dollar level as experts predicted, given the fact that the rise of the US dollar index will bring continuous challenges to future economic development amid changing factors such as the US monetary policies, sluggish global economic growth prospects and high inflation of major countries.

As of the end of July, the scale of China's foreign exchange reserves reached above $3.10 trillion, an increase of $32.8 billion or 1.07 percent from the previous month, according to the SAFE.

In response to the latest changes in foreign exchange reserves, Wang Chunying, deputy head of the SAFE, suggested that China's foreign exchange market has remained stable as domestic supply and demand keep in balance, noting that changes in global exchange rates and assets prices have helped the country's foreign exchange reserves to grow.

Stable trend of China's forex reserves Photo: GT

Upward trendThe increase on the foreign exchange reserves came as the reserves stood at $3.07 trillion in June, hitting a low point since April 2020 amid the sharp appreciation of the US dollar.

Experts said that July's reading reflects that the general trend of China's foreign exchange reserves remain positive, despite a string of external uncertainties.

"The high foreign exchange reserves show that China's foreign trade situation continues to be good, reflecting its strong ability to earn foreign exchange through exploring exports," Dong Dengxin, director of the Finance and Securities Institute of Wuhan University of Science and Technology, told the Global Times on Sunday.

"The income of foreign capital in China continues to be stable, regardless of whether it is through capital or through investment channels," Dong noted, which are the two main sources of foreign currency reserves.

The General Administration of Customs announced on Sunday that in the first seven months of this year, the value of China's foreign trade imports and exports reached 23.6 trillion yuan, recording a year-on-year increase of 10.4 percent.

Among them, exports came in at 13.37 trillion yuan, a year-on-year increase of 14.7 percent, demonstrating a bounce back of economic activity following COVID-19 flare-ups in the Yangze River Delta, one of the nation's manufacturing and trade hubs.

With the continuous recovery of Chinese domestic economy, the pace of foreign investment in China is seen accelerating, a strong guarantee for foreign exchange reserves.

In the first half of this year, the actual use of foreign capital nationwide came to 723.31 billion yuan ($106.9 billion), rising 17.4 percent, data published by the Ministry of Commerce revealed earlier.

"At present, our foreign exchange reserves are stable at around the 3-trillion-dollar benchmark, and this level has been maintained for more than a decade, which can also be seen that our central bank determination to stabilize foreign exchange reserves," Dong said, noting that China's foreign trade imports and exports are growing rapidly, and it needs to maintain current foreign currency reserve scale to guarantee trade sustainability.

Resilient to external risks

In the midst of growing external uncertainties, maintaining reserves at this high level is an appropriate response to deal with risks, Dong said.

Since the second half of last year, the US dollar index has shown a strong upward trend, posing unprecedented challenges to the global economic uncertainties, together with inflation, the geopolitical conflicts and weak economic rebound.

Data show that from the beginning of this year to July 21, the US dollar index has risen by nearly 13 percent, hitting a 20-year high, according to media reports.

Despite the complex external challenges and uncertainties, the Chinese foreign exchange market has remained resilient, and both yuan exchange rate and cross-border capital flows are kept stable.

So far this year, the yuan has weakened by about 6 percent against the US dollar, but experts said it would likely remain stable at a balanced level over the second half of the year.

Moreover, as of the end of June, the balance of domestic foreign exchange loans of Chinese enterprises stood at $351 billion, basically the same as the end of 2021, another reflection of the resilient domestic foreign exchange market, media reported.

The continuous growth of foreign exchange derivatives trading scale has also helped maintain the country's economic efficiency and reduced risks.

China has effectively coordinated coronavirus prevention and control and economic and social development, and its economy is resilient, with great potential and vitality to keep growing, Wang said, noting that the country's long-term positive fundamentals will not change, which will continue to support stability of its foreign exchange reserves.