Timing of Samsung heir’s pardon in focus amid US’ effort to lure S. Korean chip firms

A pedestrian walks past a Samsung Electronics billboard in Seoul, South Korea, Aug. 24, 2012. (Xinhua/Park Jin-hee)

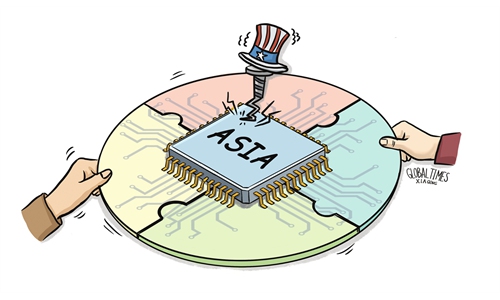

South Korea as well as South Korean chipmakers are under intense pressure from Washington in making a choice between China and the US. While how the pardon for the Samsung heir affects the major chipmaker’s decision about investing in the US remains unclear, Chinese analysts said that Washington is definitely pulling all strings to lure Samsung in its chip campaign.

South Korea’s President Yoon Suk-yeol pardoned Lee, with the country’s Justice Ministry saying that the decision was made based on the “urgent needs to overcome the national economic crisis,” Reuters reported.

Lee was among many well-known South Korean business leaders who were pardoned, but his pardon attracted the most attention globally, given Samsung’s status as a global leader in the chip sector and the timing as the US is pressuring South Korea and South Korean chipmakers to join its chip alliance.

The announcement came just days after US President Joe Biden signed into law the so-called CHIPS and Science Act, which provides about $52 billion in subsidies for chip manufacturing and research under the condition that the companies don't expand advanced chip manufacturing in China for 10 years. This US is also pressuring allies, including South Korea, to form a so-called chip alliance.

The pardon on Friday would pave the way for Lee to take over Samsung, according to several media reports, which makes Lee a crucial figure for Washington to target in its effort to entice Samsung to abandon China and invest in the US, Chinese analysts noted.

Xiang Ligang, a veteran tech analyst, told the Global Times on Friday that the US government may be pulling all kinds of strings, including "political operations," to try to lure South Korean chipmakers including Samsung to abandon China and set up plants in the US.

In fact, the US has long been pressuring South Korea to pardon Lee, according to media reports. In May 2021, the American Chamber of Commerce in Korea asked the South Korean government to pardon Lee, as Samsung continues to consider a $17 billion investment in the US, Korea JoongAng Daily reported at the time.

In a high-profile appearance in May, Lee welcomed US President Joe Biden at a Samsung plant in South Korea, during which Biden thanked Lee for his welcome and the company for “the incredible $17 billion investment,” according to a transcript of Biden’s remarks on the White House’s website.

In November, Lee visited the US to finalize the site selection for Samsung’s new $17 billion chip foundry plant in the US, according to the Korea Herald.

While it remains unclear whether Lee will accelerate the plan or announce new plans in the US under pressure, US’ pressure will likely intensify on not just Samsung but other South Korean chip companies, analysts noted.

That appears to be happening already. Reuters reported on Friday that South Korean chip giant SK Hynix plans to set up an advanced chip packaging plant in a US city next year. Chinese analysts noted that behind the reported move is the US "pulling strings" and playing all kinds of tricks to entice more South Korean chip firms to invest in the US and abandon China.

However, South Korean chipmakers have massive interests in the Chinese market and therefore they cannot afford to abandon the Chinese market, they added.

South Korean companies have so far shown an inclination to sit on the fence, clinging to the Chinese mainland market while cooperating with US policies, analysts noted.

According to a report by guancha.cn recently, SK Hynix has previously announced plans to set up a new semiconductor fabrication plant in Dalian, Northeast China's Liaoning Province, while increasing production at some of its other plants in China. Samsung also has considerable production in China.

Given their presence in the Chinese market, experts noted that there's no way for the US government to succeed in letting overseas chip giants entirely forsake the Chinese market.

According to Xiang, South Korean companies can cut costs by setting up plants in China, and they're also closer to their end customers, something that's absolutely in line with their business interests.

"China welcomes overseas chip companies that sincerely want to cooperate with domestic semiconductor supply chains, but its policy direction is very clear - China will count on its own capabilities to make breakthroughs in core chip technologies, and external disruption would not reverse the trend of rapid development in the country's semiconductor industries," he said.

If South Korean firms abandon the Chinese market to appease the US, they will lose the fruits of a lot of investments they made in China, and they might also lose the world's largest semiconductor market to a large extent, Chen Jia, a research fellow at the International Monetary Institute of the Renmin University of China, told the Global Times on Friday.