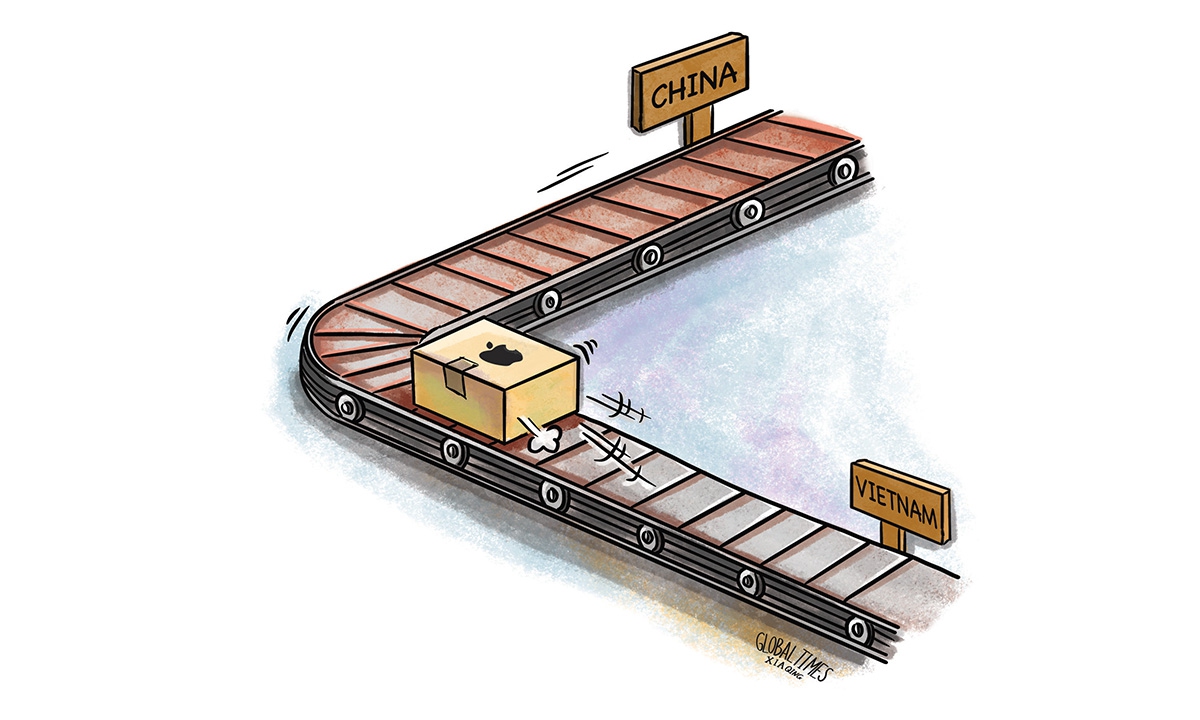

Illustration: Xia Qing/Global Times

Apple is in talks to make Apple Watches and MacBooks in Vietnam for the first time, marking a "further win for the Southeast Asian country as the US tech giant looks to diversify production away from China," Japanese media outlet Nikkei reported on Wednesday.Apple's global supply chain deployment has long been regarded as a key indicator for observing the trend of international industrial chain movement. In the current global public opinion dominated by the West's intensifying anti-China views, it is not surprise to see some foreign media using Apple's news to hype the competition between China and Vietnam. Yet, the deepening industrial chain cooperation between China and Vietnam will not be undermined by these belligerent narratives.

Looking at the bigger picture of China-Vietnam economic and trade cooperation, the relocation plan of part of the production line of Apple products certainly doesn't mean the Southeast country is stealing China's development opportunity. Instead, this reflects the complementary nature of Chinese and Vietnamese industries, which is conducive to deepening regional industrial integration. This can be an opportunity to further promote the development of China-Vietnam economic and trade relations, rather than an obstacle.

For Vietnam, while the Southeast country is under the pressure from US coercion to build an industrial chain excluding China in the Asia-Pacific region, it knows perfectly well that the ultimate goal of the US is to move factories back to the US to create more domestic jobs. Vietnam's own development interests are certainly not on the minds of US politicians.

It's no secret that the US views Asia-Pacific countries as chess pieces in its geopolitical game and has no interests to help them build up manufacturing strength. To boost economy growth, Vietnam needs to further deepen integration linked to Asia-Pacific cooperation.

China, on the other hand, has the confidence and the capabilities to tackle the US' economic aggression. Given the strength and size of its manufacturing sector, China does not need to worry about Vietnam and other Southeast Asian countries replacing it as the manufacturing hub of the world, let alone regarding Vietnam as a competitor.

Looking back to the production relocation caused by the US' arbitrary trade war and the COVID-19 pandemic, Southeast Asian countries such as Vietnam have begun to undertake some production transferring in labor-intensive fields of clothing and furniture, but not much capital and technology-intensive mechanical and electrical production moved out of China.

This trend reflects the upgrading of China's status in the international division of labor and the complementarity of China's industrial chain with other Asian economies. The advantages of China's complete industrial chain determine that it is hard for other countries to replace it.

Evidently, a close industrial chain cooperation, rather than fiercer competition, is being formed between China and Vietnam. In recent years, not only multinational companies, but also Chinese companies are accelerating their investment in ASEAN, by directly setting up factories and other means to transfer the industrial chain to some Southeast Asian countries with lower production costs such as labor. From the perspective of the relationship between the upstream and downstream of the industrial chain, the production movement reflects industrial complementarity rather than competition.

China and Vietnam enjoy mutually beneficial and win-win trade. According to Chinese customs statistics, bilateral trade between China and Vietnam exceeded $200 billion for the first time in 2021, reaching $230.2 billion, a year-on-year increase of 19.7 percent. Vietnam continues to be China's largest trading partner in ASEAN and the sixth largest trading partner overall.

From the perspective of import and export structure, Vietnam mainly imports raw materials, components and production equipment from China, South Korea and other countries. After completing assembly and processing, it exports the products to the US, the EU and other places. This structure cannot be changed in either the short or long term.

In a sense, Vietnam's manufacturing sector is following the path that China has taken, but the global environment is quite different. The rise of Made in China was carried out under globalization process, while the development of Vietnam comes amid rising geopolitical and trade tensions stirred up by the US. In this context, it may take more time and efforts for Vietnam to build up its manufacturing advantages.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn