Chinese lithium battery manufacturers made marked progress in their business revenues in the first half of 2022, with industry giants expanding investment in exploring upstream mineral materials to ensure security and stability of their own supply chains. Industry experts predict this year's new-energy vehicle (NEV) sales in China will reach 6 million units.

Domestic battery maker Gotion High-Tech Co, which attracted widespread attention for its recent IPO in Switzerland, released its interim financial report Friday night. The company reported 8.64 billion yuan ($1.26 billion) in business revenues for the first six months of the year, up 143.24 percent year-on-year. Its profit grew 34.15 percent year-on-year during the first six months to reach to 64.62 million yuan.

Overcoming challenges like COVID-19 outbreaks and a constrained supply of raw materials, CATL saw its business revenues jump 156.32 percent year-on-year between January and June to reach 113 billion yuan. Its profit rose 82.17 percent year-on-year to hit 8.17 billion yuan.

The rapid recovery in leading Chinese battery firms' finances highlights the overall profit improvement in the battery segment of the rapidly growing NEV sector, and the industry's gross profit margins are expected to grow further during the rest months of the year, as the battery makers are likely to reap more from a price hike scheduled in the third quarter, analysts said.

However, despite the marked growth in revenues, a couple of battery companies posted drop in profit, Mei Songlin, an auto industry analyst based in Shanghai, told the Global Times on Sunday.

"Due to surging raw material prices, along with fiercer marker competition, a few battery makers and automakers tend to see less profit or even post a loss," Mei said.

For example, Shenzhen-based lithium-ion battery company Sunwoda Electronic Co saw its revenues grew 38.49 year-on-year in the first half of the year, whereas its net income fell 39.72 percent from last year.

In contrast, lithium mining firm Youngy Co Ltd saw its net profit soar 44 times during the first half of the year, Shenzhen Chengxin Lithium Group Co's profit up 9.5 times and Sinomine Resource Group Co up 6.6 times.

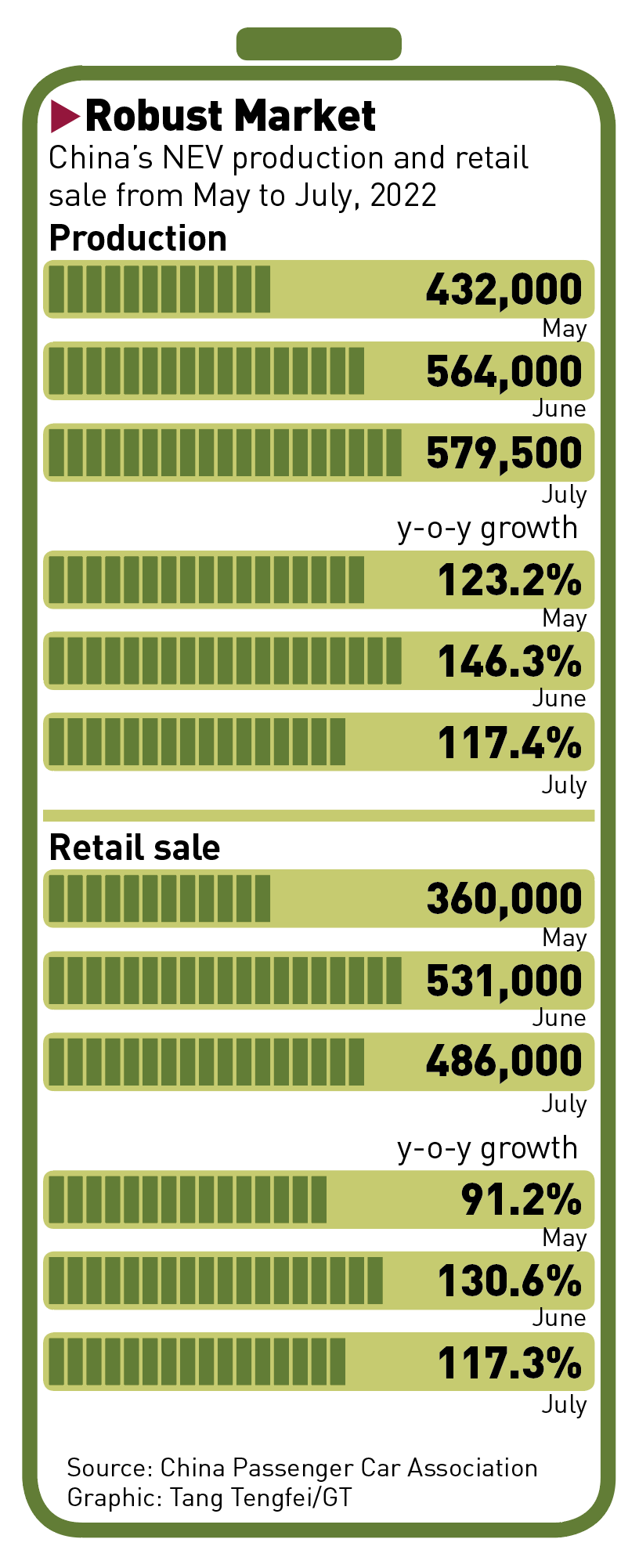

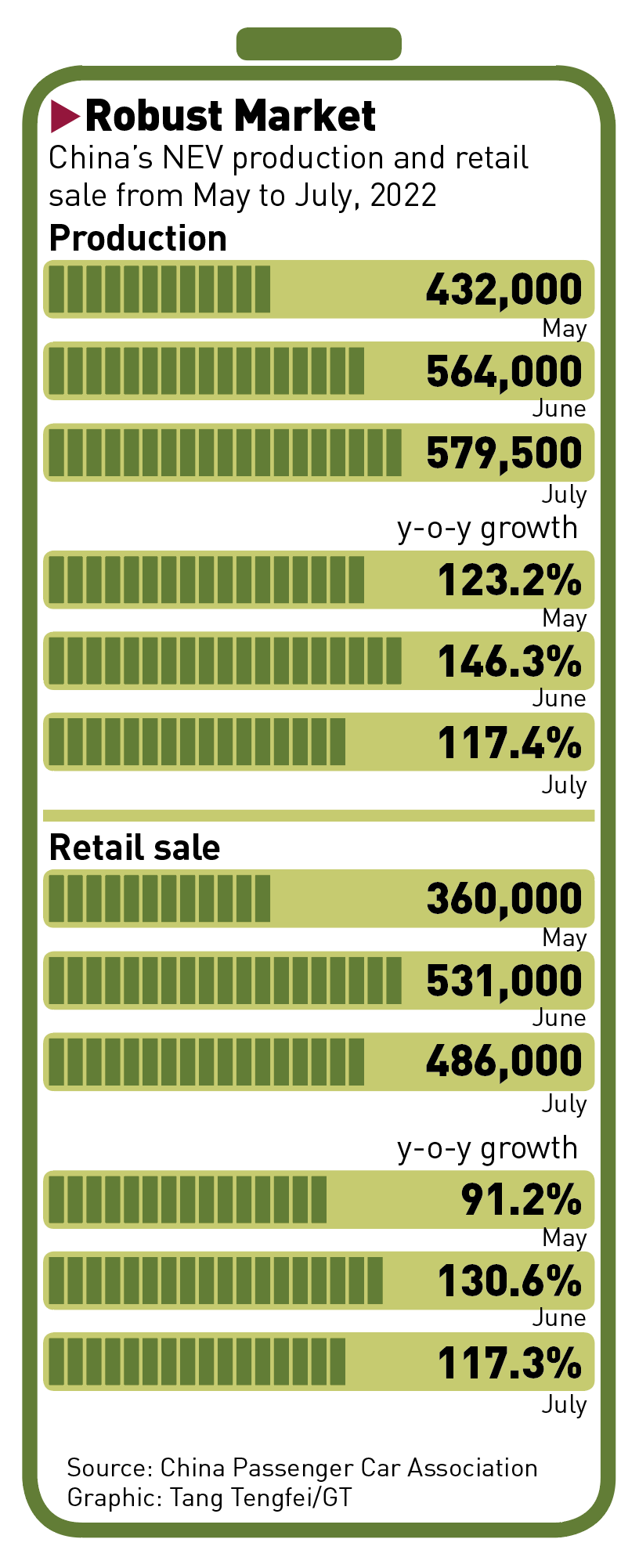

Graphic: Tang Tengfei/GT

Upstream expansionIn order to contain the fluctuations in raw material prices and ensure the stability of the supply chain, leading Chinese battery makers and automakers are expanding their presence in the upstream sector.

The giant CATL has signed an agreement with PT Aneka Tambang and PT Industri Baterai Indonesia on a nearly $6 billion project that spans from nickel mining to battery materials and recycling in Indonesia, according to the company's latest financial report.

Meanwhile, the company said it is boosting the development and construction of a lithium clay project in Yichun, East China's Jiangxi Province and phosphate mining and phosphorus projects in Southwest China's Guizhou Province and Yichang, Central China's Hubei Province, among other investments. Meanwhile, Gotion High-Tech plans to build a 30-GWh battery base in two phases in Yichun.

Following CATL and Gotion High-Tech, Shenzhen-based NEV giant BYD will be the third industrial giant in the country to build a production base with investment worth 28.5 billion yuan ($4.2 billion) in Yichun, Jiangxi Province, local government officials said on August 15.

BYD's facilities in Yichun plans to have a capacity to produce 30 gigawatt-hours and 100,000 tons of battery-grade lithium carbonate and ceramic clay a year.

Soaring skyrocketing lithium prices over the past two years has increased pressure on downstream battery manufacturers and car-makers, according to Cui Dongshu, secretary general of the China Passenger Car Association (CPCA).

According to statistics from industry consultancy Mysteel, the price of lithium carbonate used for batteries stood at 491,000 yuan per ton on Friday, up nearly 77 percent from the beginning of the year.

This is mainly due to faster expansion on the demand side than the supply of lithium resources, as lithium mining requires various approvals and certificates from the regulators, and there will be more uncertainties if the mines are located overseas, Cui told the Global Times.

"The elevated lithium price doesn't reflect real market supply and demand, as businesses often trade it via long-term contracts," Cui said, noting that there is sufficient lithium supply and the sales of NEV will continue to rise during the coming months.

The sales of NEVs surged to 2.6 million units in China in the first half of the year, an increase of 120 percent year-on-year, according to data released by the China Association of Automobile Manufacturers.

As part of a package of government policies to boost domestic consumption, the State Council, the cabinet, has extended a tax exemption policy for NEV purchases.

Amid the strong growth momentum in NEV production and sales, the CPCA recently raised its prediction for the while-year NEV sale in the country to reach a record of 6 million units, from its previous estimate of 5.5 million.