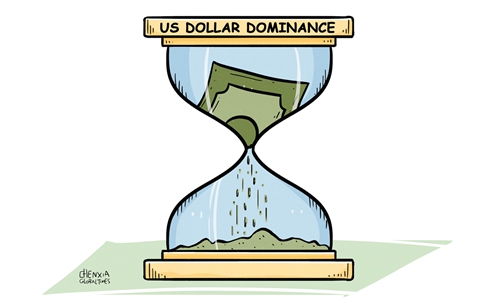

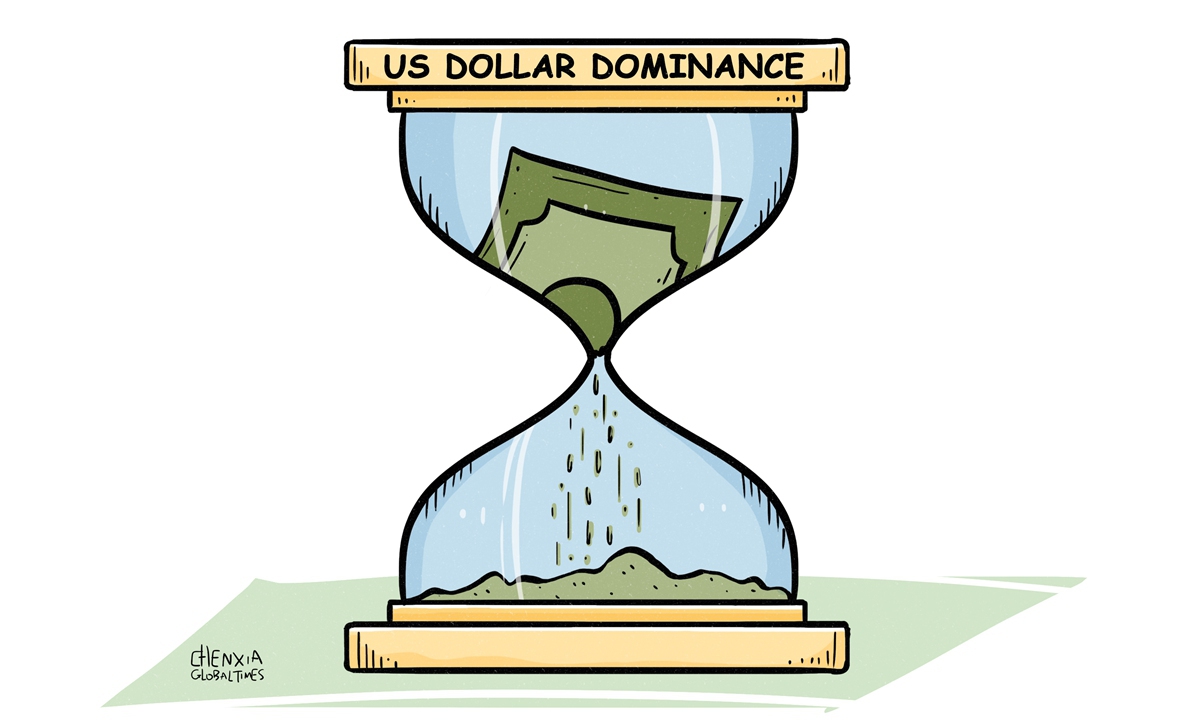

Illustration: Chen Xia/Global Times

US Federal Reserve Chairman Jerome Powell delivered a stark message on Friday: The Fed will use its tools "forcefully" to deal with inflation that is still running near its highest level in more than 40 years, which means US interest rates will likely keep rising."We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2 percent," Powell was quoted by US media as saying, adding that restoring price stability will likely require maintaining a restrictive policy stance "for some time." Following Powell's words that has indicated his determination to fight inflation, some economists expect the Fed could be more aggressive than the market had originally anticipated.

The result will be a stronger exchange rate in favor of the US dollar. Interest rate increases announced by the Fed have already driven the US dollar to its highest level in many years, and it seems with further rate hikes the US dollar's appreciation trend will continue and spiral up.

There is no need to deny that a strengthening dollar prompts global investors to buy dollar-denominated assets. Although the US economy faces a number of headwinds, the US dollar is still an important safe-haven currency globally. This tends to bode ill for emerging market economies as a strong US dollar leads to increased capital outflow from those countries.

Dollar dominance has seemingly gained more support from increased market demand for dollar-denominated assets, but in fact, a strong US dollar may produce the opposite effect.

A strong dollar means it can buy more of a foreign currency than before and naturally devalues other currencies. Emerging market economies across the world, already weakened by factors such as the COVID-19 pandemic, are facing huge devaluation pressure of their currencies. Central banks around the world are tapping into their stockpiles of US dollar to bolster their weakening currencies against the dollar.

The Wall Street Journal reported on Wednesday that emerging market economies are "burning through their stockpiles at the fastest rate" since 2008, raising the risk of a wave of debt defaults across the world's most fragile economies.

A "competitive devaluation" of some major currencies has seriously disrupted international trade, forcing exporters and importers to take the risk of exchange rate fluctuations. When currency exchange rates fluctuate, businesses rush to prevent potential losses, and some of them have begun to think about how to promote foreign trade settlements denominated in non-US dollar currencies, in a bid to avoid the risk of exchange rate volatility caused by the appreciation of the US dollar.

Some central banks in emerging market economies have announced plans that will facilitate businesses to settle international trade in local currencies, a move which will expand trade with the countries short of US dollar reserves.

Following the establishment of the Bretton Woods Agreement in 1944, the US dollar has dominated world trade and global financial markets. Although dollar-denominated assets are still attractive in financial markets as investors look for safe-haven assets, a de-dollarization movement may already have begun in the world. In search of a solution for exchange rate fluctuations, more businesses are likely to seek de-dollarized trade settlement and shift to local currencies for settlement.

Statistics showed China had surpassed the US to become the largest trading nation in the world from 2013. The US has lost its leadership role in international trade, and now the motivation of avoiding the risk of exchange rate fluctuations is likely to be the catalyst of de-dollarization in the world. In light of the US' irresponsible monetary policy, a de-dollarization push will likely be the beginning of the disintegration of Washington's dollar hegemony.