China’s polysilicon price likely to drop in 2023 as annual production capacity expected to reach 2.2m tons

China consolidates status as world’s largest supplier for key solar power material

Solar panels in Bijie, Southwest China's Guizhou Province Photo: VCG

The record-high polysilicon price in China is expected to see an apparent drop in 2023 amid increased production capacity and a crackdown on speculation and monopolistic behavior, a combination which is likely to consolidate China's role as the world's largest supplier for the key raw materials needed for solar power amid a global energy crisis and climate challenges, experts said on Tuesday.

Chinese manufacturer of power transformers and other electrical equipment TBEA Co said on Monday at a press conference that the company's output of polysilicon is expected to reach 110,000-120,000 tons this year, and will likely hit 240,000-250,000 tons in 2023. Polysilicon is a necessary input across the solar photovoltaic and electronics industry.

The second phase of the company's 100,000-ton polysilicon fab in North China's Inner Mongolia Autonomous Region has obtained approval for production, while the construction of a first phase of 100,000-ton polysilicon fab in Zhundong, Northwest China's Xinjiang Uygur Autonomous Region is already underway and is expected to enter into production in the first half of next year, according to the company.

In the meantime, GCL Technology, one of China's largest producers of raw materials for solar panels, said on August 25 that it will work together with TCL to set up a production base in Hohhot, Inner Mongolia that will produce 10,000 tons of polysilicon and 100,000 tons of granular silicon.

"Amid expansion in production capacity, domestic polysilicon price will likely go down for the rest of the year but may still stay above 200,000 yuan ($28,900) per ton," Xu Aihua, deputy head of the Silicon Industry of China Nonferrous Metals Industry Association, told the Global Times on Tuesday.

The price of the raw materials will slightly drop in the first half of 2023, and an apparent price decline is expected in the second half, Xu said.

The comment came as Chinese polysilicon companies race to expand production as the price of polysilicon hit a 10-year high on surging solar panel demand as well as the US' ban on solar panels made in China's Xinjiang region under its so-called Uyghur Forced Labor Prevention Act.

According to open data, the growth rate of domestic polysilicon price slowed last week, with the price of the raw material hovering at around 305,000 yuan per ton.

It's worth noting that the price of polysilicon was about 80,000 yuan per ton at the beginning of 2021, and the extremely high price has dealt a blow to the healthy development of the industry, leading to a pause in new investment for downstream large-scale photovoltaic power stations.

On August 24, China's industry ministry together with energy and market supervision regulators issued a notice, calling for promoting and optimizing the development of photovoltaic industry, warning against price gouging and hoarding.

The notice requires all localities to coordinate development and security, guide the expansion pace of upstream and downstream participants, and optimize the industrial regional layout to avoid industrial convergence, unhealthy competition and monopolistic behavior, according to the notice posted on the Ministry of Industry and Information Technology website.

"Stronger regulation is timely and needed for the quickly expanding market," Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University, told the Global Times on Tuesday.

"As raw materials are keys to the photovoltaic industry, it may lead to raw materials being preempted and thus lead to monopolies," Lin said, noting that concrete market standards may be followed to define such illegal activities.

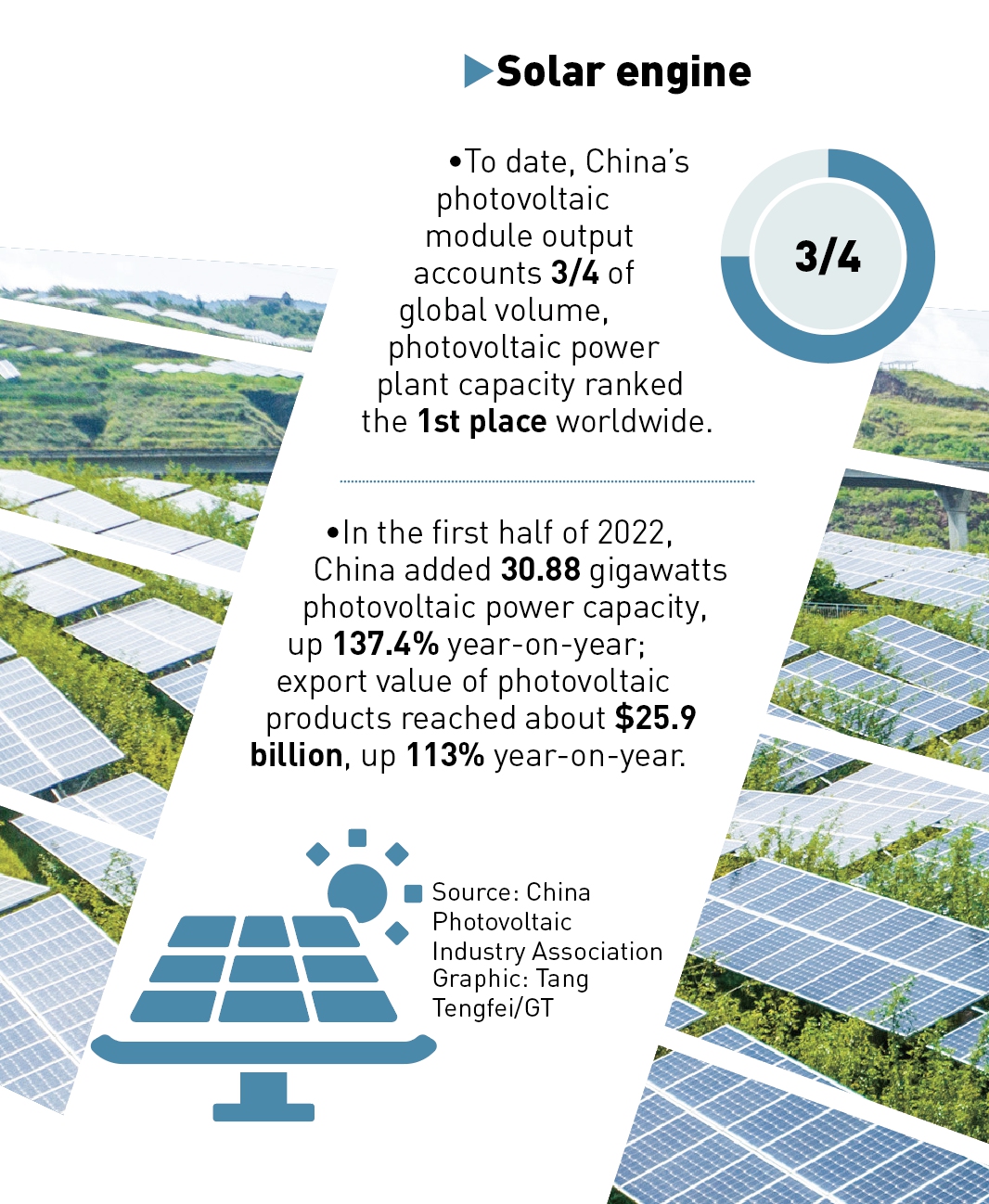

Graphic: Tang Tengfei/GT

Top player

Amid major economies embracing clean and sustainable energy amid an energy crisis and climate challenges, global demand for photovoltaic-related products made in China will accordingly increase, Xu said.

"The supply shortage of polysilicon will only be temporary, and China's supply will be adequate to meet long-term demand," she noted.

She estimated that the polysilicon production capacity in China is expected to reach more than 1.1 million tons this year, 2.2 million tons in 2023, and more than 3 million tons in 2024.

According to a recent report by the International Energy Agency (IEA), global manufacturing capacity for solar panels has increasingly moved out of Europe, Japan and the US over the last decade and into China, which has taken the lead in investment and innovation.

China's share in all the key manufacturing stages for solar panels as of today exceeds 80 percent, according to the IEA report, and the share for key elements, including polysilicon and wafers, is set to rise to more than 95 percent in the coming years.

While remaining optimistic about strong momentum of global demand for polysilicon from China, Lin also expressed concern that the US' agenda driven bill will disrupt the global supply chain for solar panels, as Xinjiang produces almost half the world's supply of a crucial component in solar panels.

An industry expert told the Global Times in a recent interview that upstream polysilicon companies in China have been making changes by adding production capacity in other parts, which, along with the production of raw materials, will continue to ensure China is the leading supplier of solar products to the EU as well as the US.