Durian boom in China only a prelude to vast opportunities for tropical fruits growers in SE Asia when the Mid-Autumn Festival approaches

Consumption fever before the Mid-Autumn Festival reflects RCEP’s benefits to fruits growers in SE Asia

Sales staff shows durian imported from Thailand. Photo: VCG

Durian from Southeast Asia has found more channels and pathways into the vast Chinese market ahead of the upcoming Mid-Autumn Festival, which falls on September 10, as companies come up with nouveau ways of serving the mooncake, the festival's signature snack.

The new trend, together with the tangible benefits brought by the Regional Comprehensive Economic Partnership (RCEP) mega trade deal, is expected to bring vast opportunities to tropical fruits growers in Southeast Asia, Chinese analysts and industry insiders said, noting that durian is only a starter.

Tmall Global, a Chinese e-commerce platform, last year debuted a mooncake containing the pulp of Malaysia's Musang King durian. The product proved popular, selling over 10,000 packages of the sweet dessert.

This year, with the joint support of the electronic World Trade Platform (eWTP) initiated by Alibaba and the Consulate General of Malaysia in Shanghai, a new Malaysian brand launched "snow-skinned" durian mooncakes in China, with the product set to arrive on Chinese people's dining tables during the coming Mid-Autumn Festival.

The platform told the Global Times that fruits from Southeast Asia, including Indonesian mangosteen, Philippine pineapple, Thai durian and Malaysian Musang King durian have all appeared on Tmall supermarkets days before the Mid-Autumn Festival this year, and noted that demand for such items were "soaring."

Alibaba's Hema, a fresh food retailer, also told the Global Times that the top ASEAN fruits sold there are Thai durian and coconut green. Vietnamese red-meat jackfruit is a potential commodity and welcomed by consumers.

Lei Xiaohua, an ASEAN expert from the Guangxi Academy of Social Sciences in South China's Guangxi Zhuang Autonomous Region, told the Global Times on Tuesday that the upcoming festival will be high-water mark for the supply and sales of tropical fruits such as mangosteen, durian, mango, honey pomelo and Dragon fruit.

Zhu Danpeng, a veteran food industry analyst, told the Global Times on Tuesday that amid a changing consumer habit in China, huge opportunities were being presented to fruit companies in Southeast Asia, as Chinese consumers seek more diversified tastes.

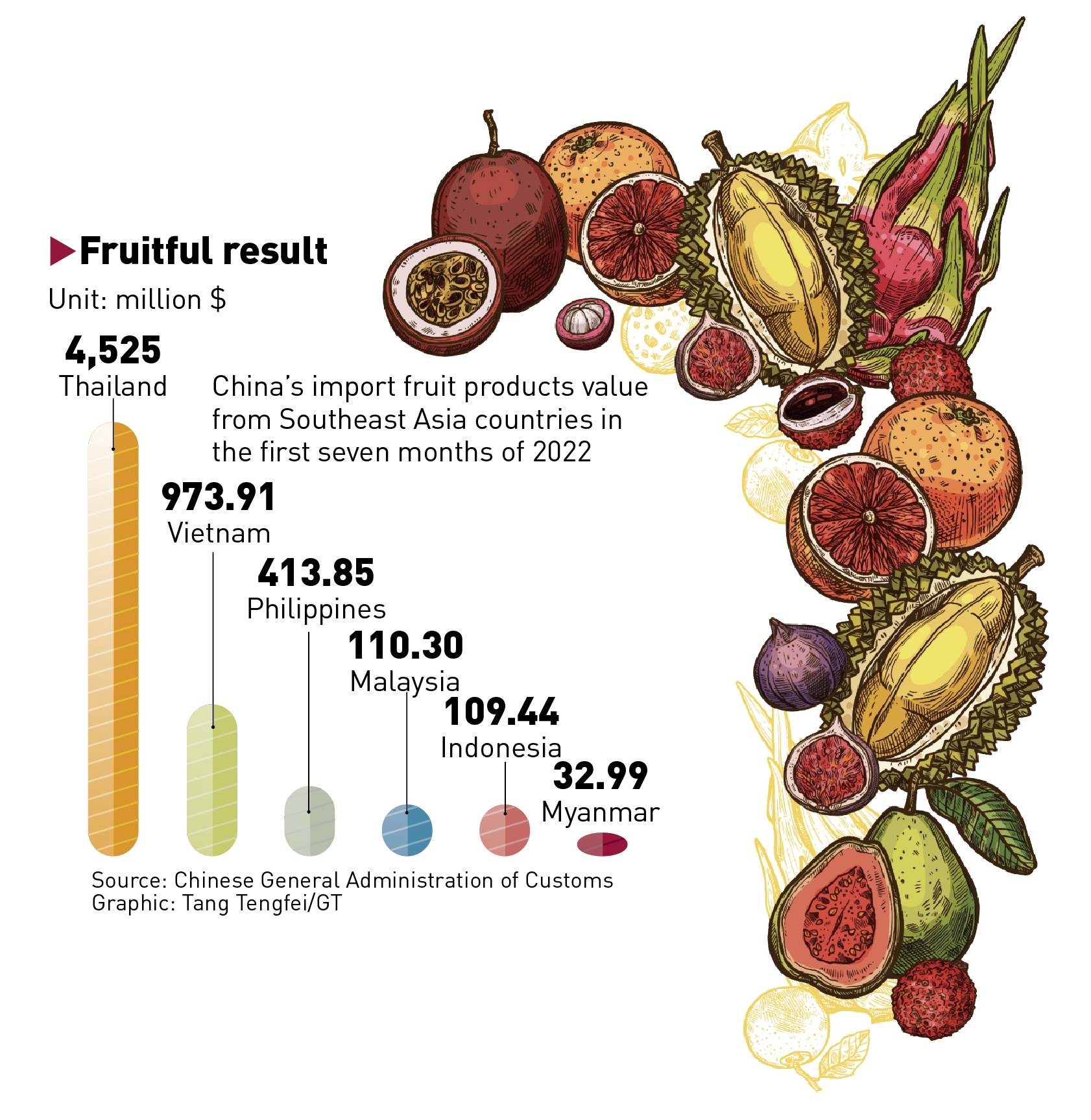

Graphic: Tang Tengfei/GT

Diversified appetite

More ASEAN members are actually exploring opportunities centered around durian exports to China.

In April, Thailand for the first time sent its durians via the 1,035-kilometer-long China-Laos Railway.

A total of 500 tons of durians were sent from Vientiane, Laos to Kunming, Southwest China's Yunnan Province, and from there connected to China's sprawling high-speed railway network to other Chinese cities including Shanghai.

After four years of negotiations, China and Vietnam signed a protocol on phytosanitary requirements for Vietnamese durian exported to China on July 11, according to the Vietnam news agency VNA. The progress is an important condition for Vietnamese durian to have a sustainable import market, the news agency said.

China is already the largest importer of Vietnamese durian, which has an estimated output of 600,000 tons, although the fruit is mainly exported to China via border gates.

Cambodia, too, is negotiating with China's agricultural authorities over quarantine issues for its pepper, bird's nest and durian, the Phnom Penh Post reported in July.

The country's TKY Farm, a Monthong durian growing and exporting company in Preah Vihear Province, shipped over 120 tons of frozen durians to the Chinese market via Thailand, in a first for Cambodia.

The report said the company, "seeing how China is a big market for durian," made the shipment through a local partner and is planning to expand exports to 500 tons by 2023.

Zhu said as Chinese consumers' pursuit for high-quality tropical fruits continues, there will be more durian farms across Southeast Asia with produce destined for the Chinese market because of the massive demand.

"More companies will become key partners with China, and such a relation will benefit from as well as contribute to the amiable relationship between China and ASEAN," Zhu said.

China is aiming to import $150 billion worth of agricultural products in total from ASEAN during the period from 2022-26, according to media reports.

As of end of July, nine ASEAN members, with the exception of Singapore, have had fresh fruits approved for market access to China, according to Lei.

Thailand has 22 types of tropical fruits cleared for the Chinese market, while Vietnam has 11, Lei noted. In 2022, banana crops from Myanmar, longan and mango from Cambodia, as well as durian, mangosteen and passion fruit from Vietnam all received green lights to the Chinese market after the inking of bilateral phytosanitary protocol.

In addition to China, ASEAN members are also promoting tropical fruit sales to the Japanese and South Korean markets to tap RCEP benefits.

From Thai durian to Vietnamese coffee to Indonesian waffles, an increasing variety of agricultural products, leisure items and industrial supplies from ASEAN have gained easier access to the Chinese market and consumers since the RCEP came into force at the beginning of the year.

Trade volume between China and RCEP member countries increased by 7.5 percent year-on-year in the first seven months of this year, data from the General Administration of Customs showed.

China's trade value in July with the other RCEP members hit 1.17 trillion yuan ($168.13 billion), up 18.8 percent year-on-year, adding 5.6 percentage points to the nation's overall trade growth in that month.

The China-Laos Railway has transported more than 10 billion yuan worth of international freight over its first nine months of operation since last December.