Photo: NEV

Chinese electric-vehicle maker (EV) NIO celebrated the shipment of its first battery swap station from Biatorbagy, Hungary, to Germany on Friday, produced by NIO Power Europe, the company's first overseas plant.

NIO said that the facility will support its commitment to installing 1,000 battery swap stations outside China by 2025. In the second half of this year, NIO's integrated power services and automotive products will be available in Germany, the Netherlands, Sweden and Denmark, according to a statement from NIO.

NIO's overseas factory is the epitome of Chinese enterprises' approach to the new-energy vehicle (NEV) industrial chain expanding its overseas footprint.

Analysts said that the NEV industrial chain, from upstream to downstream, can be roughly divided into four parts: batteries, including battery materials and battery manufacturing, NEV production and sales, NEV usage, including charging piles and battery swap stations, and recycling.

From all aspects, Chinese enterprises are in a leading position across the NEV industrial chain, especially EVs, and are accelerating their overseas layout, which will further secure the dominant position, a Shenzhen-based veteran industry insider surnamed Zeng told the Global Times on Sunday.

Increasing battery outputChina has already dominated the entire downstream NEV battery supply chain, namely cell components manufacturing, battery cells manufacturing and NEV manufacturing according to the International Energy Agency. China produces 75 percent of all lithium batteries and is home to 70 percent of production capacity for cathodes, and 85 percent for anodes, both key components used in batteries.

Among the world's top 10 power battery suppliers, Chinese companies account for half, with a market share of 37.3 percent. But Chinese enterprises are still accelerating their global layout to increase their capacities in mining and material processing, the upstream components of battery production.

Since lithium is an indispensable material for battery cells manufacturing, Chinese enterprises, including battery makers and carmakers, have sought to expand material exploration. This is also to secure raw material supply, said Zeng.

For example, Ganfeng Lithium, China's No.1 producer of the battery metal, started construction of the Mariana Lithium in Argentina in June. Zijin Mining Group acquired Canadian lithium miner Neo Lithium Corp in January. It is also reported that BYD was in talks to buy six lithium mines in Africa in June, with total reserves of lithium oxide at 2.5 percent grade estimated at more than 25 million tons.

While Chinese battery makers have vowed to increase raw material supply, their output of batteries continued to increase.

Major lithium battery makers in China invested over 439 billion yuan ($63.1 billion) to build new production lines in the first half in 2022, which were expected to generate a production capacity of 1,069 gigawatt-hour, according to industry data. China's lithium battery production exceeded 280 GWh in the first half of 2022, up 150 percent year-on-year.

According to customs data, in the first half of 2022, China exported 1.903 billion lithium batteries, up 36.76 percent year-on-year, with export value reaching over $20.22 billion, up 76.35 percent year-on-year.

Chinese battery makers are also building workshops overseas, which will greatly reduce the transportation cost, as lithium battery is considered as dangerous good in shipping, which requires specific package. Lithium batteries must be shipped at a state of charge not exceeding 30 percent of their rated capacity, according to Zeng.

At the same time, Chinese battery makers have continued to innovate. For example, CATL launched Qilin, a third generation of its cell-to-pack technology, in June. With a record-breaking volume utilization efficiency of 72 percent and an energy density of up to 255 Watt-hours per kilogram, Qilin achieves the highest integration level worldwide so far, capable of delivering a range of over 1,000 kilometers in a breeze.

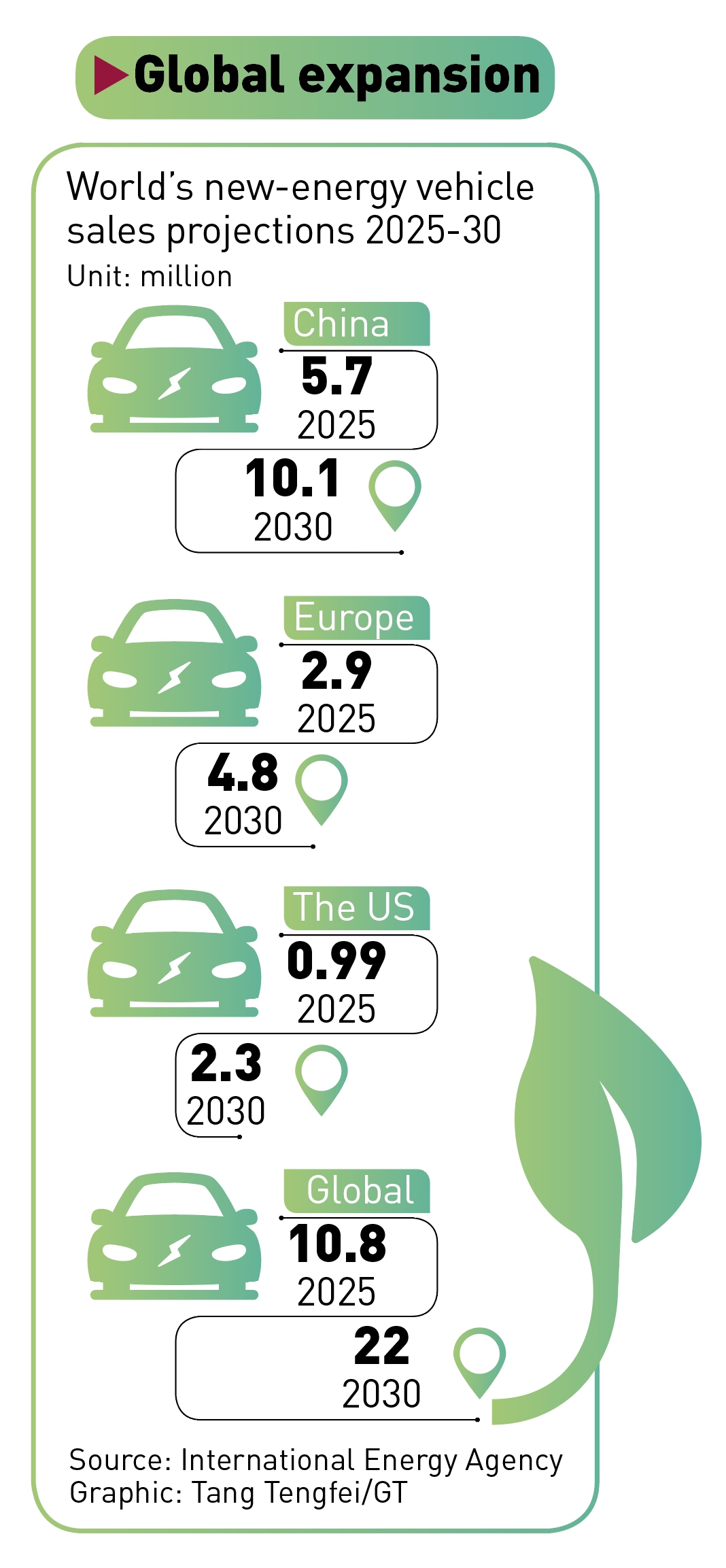

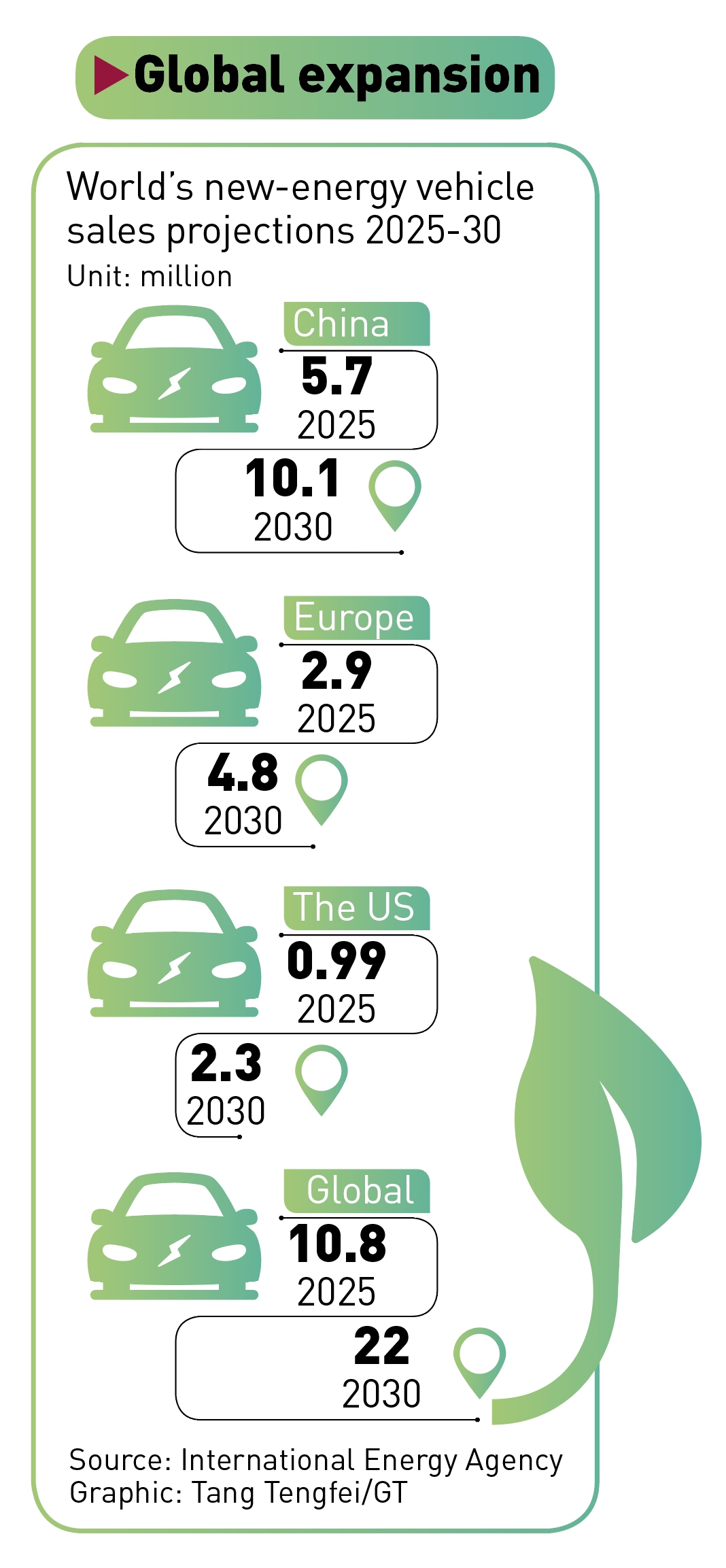

Graphic: Tang Tengfei/GT

NEV manufacture and salesWithin the downstream industrial chain, China's NEV production and sales have ranked first in the world for seven consecutive years. And Chinese NEV sales increased 270 times between 2012 and 2021. According to China Passenger Car Association, it is estimated that some 6.5 million NEVs will be sold in China this year, up more than 80 percent from 2021.

Meanwhile, China's NEV exports have continued to grow. From January to August this year, 341,000 NEVs were exported, contributing 26.7 percent to China's automobile exports, according to the latest data from the China Association of Automobile Manufacturers.

At the same time, Chinese carmakers are also actively building vehicle production plants overseas to expand capacity and reduce transportation cost. BYD, for example, said on September 8 that it will build its first overseas passenger car plant in Thailand, wholly invested by the company.

BYD's Thailand factory will use the most advanced right-rudder vehicle technology and is expected to start operations in 2024, with an annual capacity of about 150,000 vehicles. The production of cars will initially supply the Thai market, before spreading out to neighboring ASEAN members and other regions, according to a statement sent by BYD to the Global Times.

BYD also has canvassed initial plans to build an assembly plant in India in the future.

Growing intelligence

As a high-end terminal on the NEV industrial chain, intelligent vehicles and Internet of Vehicles are key areas for the whole industry. Intelligent NEVs will be part of the construction of smart cities.

"China's autonomous driving technology is now in full swing in the freight industry. In addition, the realization of autonomous driving needs the foundation of smart transportation and smart city construction, and China already has the basic development conditions," Zheng Lei, chief economist of Samoyed Cloud Technology Group, told the Global Times.