European companies lean toward Chinese market as demand for sustainable shipments grow amid global turbulences

Huge market, stable supply appeal amid global turmoil

Visitors view a new energy vehicle during the 2022 Chongqing International Auto Exhibition in southwest China's Chongqing Municipality, June 25, 2022.

Photo: GT

Companies doing cross-continental businesses are shifting the focus of their supply chains from Europe to China due to cost rise and energy shortage in Europe.

Due to geopolitical factors, many European companies are now transferring orders from local factories to Chinese suppliers, or simply building their own factories in China, which has been resilient despite global turbulences, industry insiders said.

Some Chinese businesspeople said the orders from European clients jumped by 20 percent this month.

The trend is particularly evident in energy-intensive and high-tech sectors such as organic chemicals, electronic and mechanical equipment and auto parts, according to media reports, which industry insiders said may boost China's role as the world's manufacturing hub.

Tommy Tan, president of Shanghai EPU Supply Chain Management Co, an agent for China-EU freight train service, confirmed the new trend to the Global Times on Tuesday.Tan has been participating closely in supply chain management for new-energy vehicles (NEV) for the European market, providing products for European clients such as BMW and Volvo via China-Europe freight trains.

"Demand from Europe is indeed increasing. There are no official data yet, but I estimate demand grew more than 20 percent in September year-on-year - mainly NEVs and lithium batteries," Tan said.

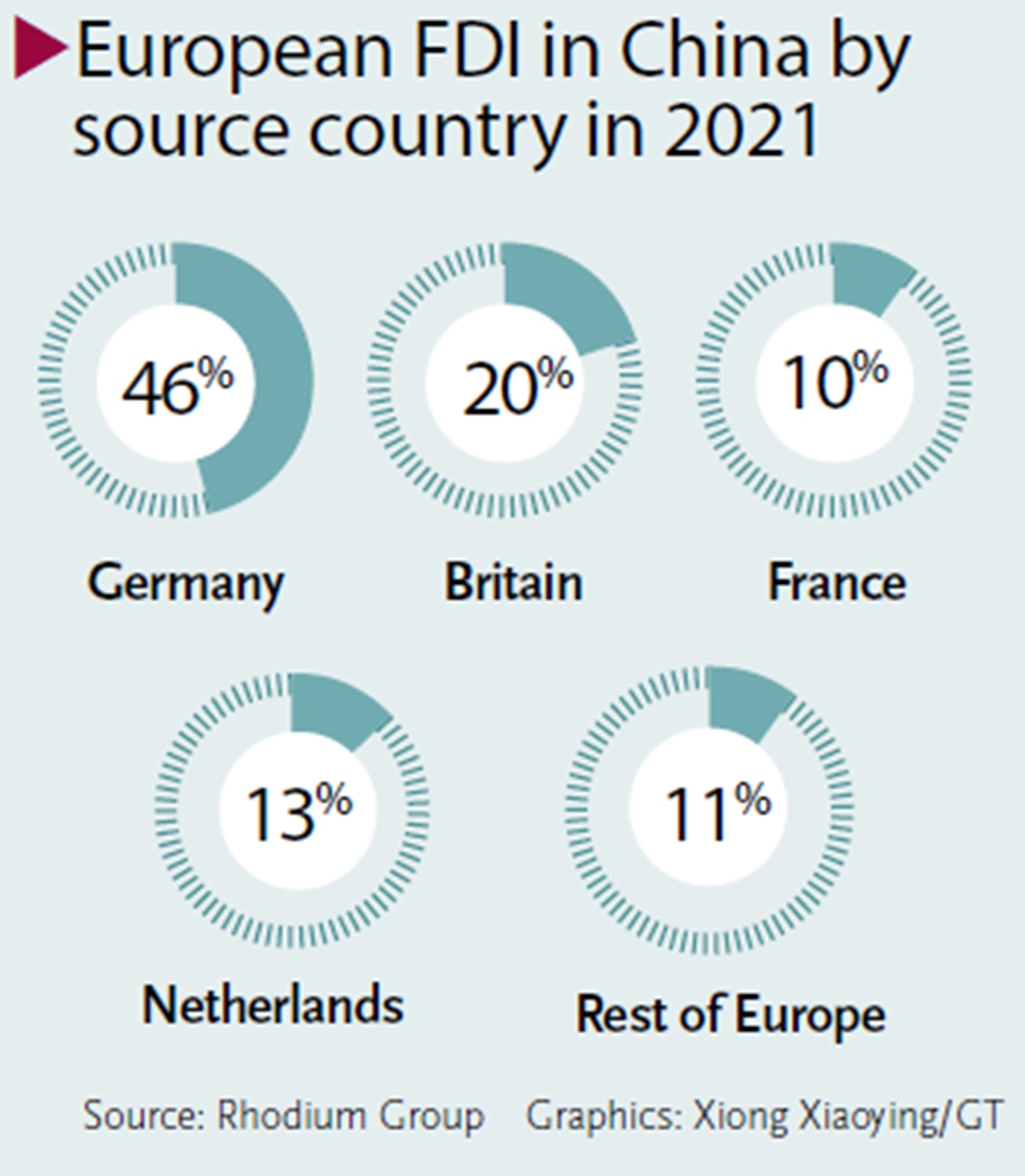

Foreign direct investment from EU members has been increasing this year, despite the Western media keeping badmouthing the Chinese economy and market.

A recent study by Institut der deutschen Wirtschaft found that German investment in China amounted to 10 billion euros ($10.09 billion) in the first half of 2022, far exceeding the previous half-year peak since the turn of the millennium of 6.2 billion euros, Reuters reported.

Earlier this month, German chemical group BASF launched a giant chemicals project in South China's Zhanjiang, and Merck announced in early September that China's first OLED material production base was completed and put into operation in Shanghai - examples of the rising focus of major European companies shifting toward the Chinese market and supply chain, experts said.

German carmakers such as BMW have borne the brunt of the energy crunch, raw material shortage and supply chain disruptions, largely due to the Russia-Ukraine conflict, which makes Chinese market more attractive to them, Sun Xiaohong, secretary-general of the automobile branch of the China Chamber of Commerce for Import and Export of Machinery and Electronic Products (CCCME), told the Global Times on Tuesday.

It's not just a shift in where orders come, it's also about investment and new project construction, a trend that reflects confidence in China, Sun said.

CCCME showed that China accounts for 76 percent of the global production of automotive power batteries, while Europe accounts for only 7 percent.

"With a complete and stable industrial chain, it is more secure to develop new auto models in China," Sun said.

There has been some discord in the German ruling coalition, often reminding German companies that they should not "rely too much" on China and pursue a diversified supply chain, German companies have given Berlin the answer, Sun said.

Chinese Ministry of Commerce data shows that German investments in China increased by 23.5 percent year-on-year in the first seven months this year.

Moreover, five industries - auto-making, food processing, pharmaceuticals, chemicals and consumer goods - now account for nearly 70 percent of all European direct investment in China, up from 65 percent in previous years.

"There is speculation that Europe will enter an era of elevated energy cost, and some companies with high energy consumption will need to move their operation overseas, and China's energy supply is definitely more stable than Europe's, and for those companies, production in China is also closer to their target market," Cui Hongjian, director of the Department of European Studies at the China Institute of International Studies, told the Global Times on Tuesday.

Experts said that European companies will increasingly embrace the Chinese production hub and the huge market, which cannot be found elsewhere.

In the past four years, the top 10 European business giants that have invested the most in China such as Volkswagen and BMW accounted for nearly 80 percent of all European direct investment in China.