Illustration: Chen Xia/Global Times

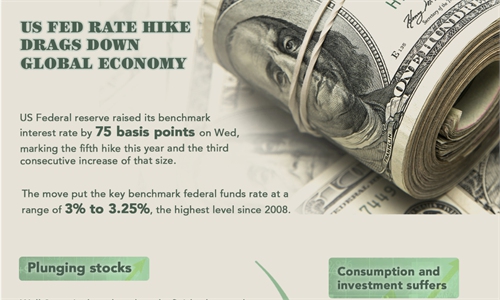

As predicted, the US Federal Reserve made another large interest rate hike on Wednesday, adding further pressure to global equities markets and sending the Dow Jones Industrial Average below 29,600 points at the end of Friday trading. If compared with the index's all-time high of more than 36,000 points in late 2021, hundreds of billions of dollars of investors' and pensioners' savings have evaporated.To make things worse, the US central bank remains stubbornly aggressive and hawkish, indicating more rate hikes are likely before the end of this year. The Fed is now raising rates at one of the fastest paces in its modern history. The 75 basis points rate hike on Wednesday - the fifth in a row - lifts the rate the Fed charges banks to borrow from near zero at the beginning of 2022 to a current minimum of 3 percent.

By 2023, the Fed could raise rates to as high as 4.5 percent, according to the US central bank's announced plan, which will undoubtedly take the wind of the sails of the world's largest economy, if not sending it into negative growth. The Fed predicts the US economy will crawl along at 0.2 percent this year. And in 2023 it seems that the US economy can hardly escape recession.

US Fed chairman Jerome Powell admitted that higher interest rates inevitably mean growing pain for American businesses and households - middle-class couples paying off a mortgage in particular. But the Fed is determined to quash elevated inflation that is seeping through the country's economy, with the most recent data showing inflation remaining stubbornly elevated at 8.3 percent in August, with large price rises in shelter, food, health care and education.

"We have got to get inflation behind us," Powell said on Wednesday. "I wish there were a painless way to do that. But there isn't."

As a matter of fact, the Federal Reserve's commitment to tamp down inflation to reach the bank's stated 2 percent target through drastically raising interest rates in a short span of 12 months is too radical, if not unrealistic.

By increasing the rate to 4.5 percent or even higher over a short period, the Fed will not only dampen the US' own economy and hurt a vast number of American companies and households, the move will also send shockwaves through the world's other major economies, causing a worldwide economic earthquake. To prevent dollar-denominated assets from being drawn back to the US by the Fed's streak of aggressive rate hikes, other economies will be forced to raise their interest rates too, which is likely to cause a global recession, with hundreds of millions of people losing their jobs.

No wonder that there are a rising number of economists pushing back against the Fed's recklessness and irresponsibility in raising rate so steeply. For instance, the depreciation of the world's major currencies, including the euro, the British pound, the Japanese yen, the Indian rupee and the Chinese yuan, against the US dollar hastened following the Fed's rate hike on Wednesday.

For instance, Japan's central bank, for the first time in 24 years, was forced to intervene in the foreign-exchange market by buying back yen last week to buttress yen's value, because Tokyo cannot deal with its battered currency from falling past 145 yen to the dollar. Meanwhile, the euro has dropped nearly 15 percent this year against the dollar and is trading below parity. The yuan was also hit by the fallout of the Fed's policy tightening, with the Chinese currency reaching a 26-month low of 7.08 yuan per dollar last week.

And, at a time when the Ukraine crisis is becoming increasingly complicated, adding to the uncertainty that may further disrupt global energy and food supply, the Fed's aggressive rate hikes may further darken the global economic outlook. There is a real chance that another financial storm or system-wide meltdown could be coming down the pipeline.

Facing the aftermath of the 2008-09 financial crisis, the Fed resorted to a lengthy round of monetary loosening, called quantitative easing (QE), by parachuting printed dollars to American businesses and families to spend. Prior to 2008, the size of the Fed's balance sheet was less than $1 trillion, and by 2015 it rose to $4.5 trillion. At the end of 2021, it surged to nearly $9 trillion.

And, to keep the US economy afloat following the COVID-19 pandemic assault, both the Trump and Biden administrations resorted to very generous fiscal stimulus spending plans, one after another. It was these splurges by the Fed and the White House that triggered and fed the runaway inflation in the US.

To curb persistent inflation, which is now entrenched in many economies, central banks around the world are all raising rates, which will suffocate economic growth. Almost all global and regional research institutions have significantly lowered their growth forecasts for the world economy in 2022, with many extending to 2024. Some economies are unlikely to see a pick-up in growth until 2025, and this gloomy scenario is distressing many people in the world.

Is the US concerned about other countries' deepening economic woes that are proportionately caused by erratic American monetary and fiscal policies? Only Powell can answer this question.

When asked about international policy coordination at his press conference on Wednesday, Powell said: "We regularly discuss what we're seeing in terms of our own economy and international spill-overs, but it's hard to talk about policy collaboration in a world where people have very different levels of interest rates."

It seems the Fed doesn't care about other economies and their exchange rates at all, including many US allies. Japan won't be the only country in the world to intervene in the market and buy back yen. More economies will follow and some will have to seek outside support including from the IMF.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn