China Germany Photo:VCG

Despite some German politicians and media outlets that hype an industrial "decoupling" from China, German enterprises have been continuously investing in China, attracted by the enormous size of the Chinese market.

The latest example is Kreditanstalt für Wiederaufbau (KfW), a German state-owned investment and development bank, which will lend 69.52 million euros ($67.75 million) for a railway project linking North China's Tianjin city and Beijing Daxing International Airport. The loan term is 15 years, including a 5-year grace period, China's Ministry of Finance (MOF) said on Sunday.

The total investment in the project amounts to 11.65 billion yuan ($1.64 billion), MOF said.

If a project is financed by German banks, chances are large that it is also a "sweet pastry" for the global capital markets, Chen Jia, an independent research fellow on international strategy, told the Global Times on Sunday.

Chen pointed out that Germany has been attaching great importance to China's infrastructure sector when it comes to investment, because China's infrastructure projects are well known for stable, long-term investment returns.

In the first half of 2022, German companies' direct investment in China hit a record high, surpassing the level of tens of billions of euros, according to a report by the German Institute for Economic Research, more commonly known as DIW Berlin, which was released in August.

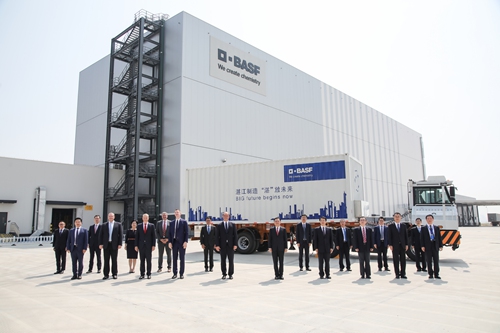

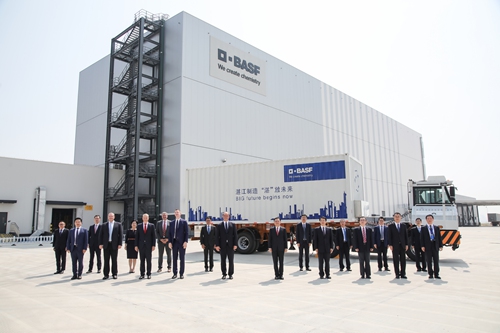

This is proved by intensive investments by German enterprises in China. For example, BASF inaugurated the first plant of its Zhanjiang Verbund site on September 6 in South China's Guangdong Province.

The group photo taken in front of the BASF Zhanjiang Verbund site Automated Smart Warehouse on September 6, 2022 in Zhanjiang, South China's Guangdong Province. Photo: Courtesy of BASF

The project will be the company's largest investment to date, with a pledged investment of 10 billion euros by 2030, according to a statement sent from BASF to the Global Times. An expansion phase covering further downstream plants for diversification is expected to be operational by 2028, said BASF.

The BASF Zhanjiang Verbund site in Zhanjiang, South China's Guangdong Province Photo: Courtesy of BASF

German auto parts manufacturer Hella announced in July that it will expand capacity in China and open a new lighting plant in Changzhou, East China's Jiangsu Province.

A new lighting plant of German auto part manufacturer Hella in Changzhou, East China's Jiangsu Province on July 25, 2022 Photo: Courtesy of Hella

This expansion was among 10 China-Germany cooperation projects signed in Changzhou in July, with a total investment of nearly 200 million euros, covering areas such as electric vehicles, new medicine, equipment manufacturing and new materials, according to the Changzhou municipal government.

Robert Bosch Venture Capital GmbH, a subsidiary of Bosch Group, announced in June that it will set up a new fund of 250 million euros for start-ups in China, particularly in the areas and value chains of electrification and automation, smart manufacturing, artificial intelligence and semiconductors.

"China and Germany have a long-term partnership in manufacturing cooperation, especially in sectors like industrial equipment, parts and material high-precision processing. Abrupt 'decoupling' will only benefits the competitors in other regions of the world," said Chen.

Analysts noted that it's very unrealistic and irrational to seek 'decoupling' between China and Germany from the perspective of German companies.

"Given a deepening energy crisis, high inflation and anemic economic growth in the EU, decoupling would bring nothing but harm to Europe," Chen noted.

Tian Yun, a veteran economic observer, also said that the voices pushing the German government to launch the so-called 'decoupling' from China always existed after China-US relations turned chilly a couple of years ago. But official data showed that cooperation between China and Germany, or the EU, hasn't dropped.

"Even in the past one or two years, while China-US tensions rose, we can still see that there's a big difference between the voices of German businesspeople and a few German politicians, as German companies have largely chosen to continue to cooperate with their Chinese counterparts," Tian told the Global Times.

According to statistics from China's Ministry of Commerce, the growth rate of German investment in China rose 30.3 percent in the first eight months of 2022.

According to Tian, Germans understand clearly that China is their most reliable business partner.

"China insists on deepening opening-up and inclusive development in the face of the US government's reckless trade and technology squeeze, which strengthens global investors' confidence in the Chinese market," said Chen.

China is Germany's largest trade partner. This means that if Germany really chooses to decouple from the Chinese economy, the odds that Germany will slip into a painful economic recession will significantly rise, analysts said.