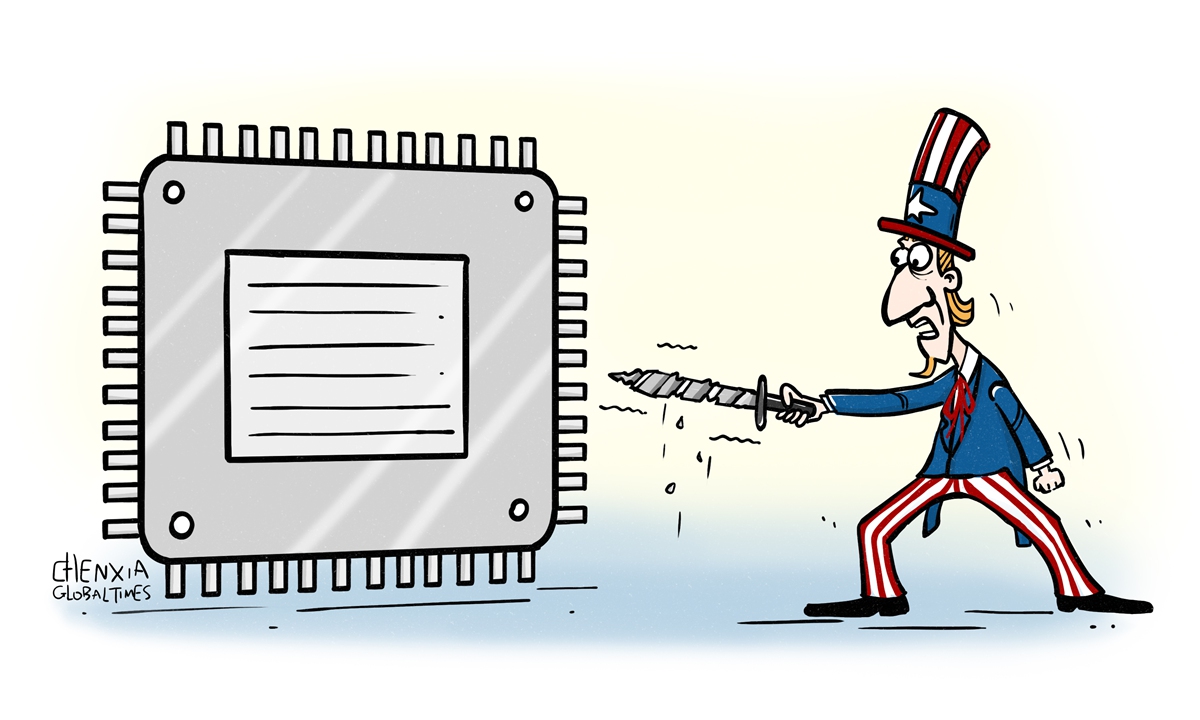

Illustration: Chen Xia/Global Times

The US government has been exerting pressure on Asian countries and regions, especially China's Taiwan region, to hobble the Chinese mainland's chip industries after the US' efforts to lure Asian chip companies away from Chinese mainland markets had proved unsuccessful. In particular, the US is eyeing Taiwan island as a "sally port" to meet its ends, and some Taiwan politicians have showed an inclination to comply with US orders under the latter's pressure.

Chinese experts warned on Sunday that a forced "decoupling" from the mainland will not bring any benefits to Taiwan companies, and the conservatism in the US is undermining existing global chip industries, which could trigger "butterfly effects" that the US might not be able to control.

The island of Taiwan's economy authority said in a statement issued on Saturday that Taiwan's semiconductor industry has long served global customers and "attaches great importance to compliance with laws."

The statement noted that Taiwan authorities will cooperate with the needs of international customers who place orders and the rules back in customers' home countries.

The statement is deemed as a response to new rules on technology export controls rolled out by the Biden administration on Friday, including what is said to be the "harshest" ban on shipments to China of certain semiconductor chips made anywhere in the world with US equipment, further intensifying its so-called tech decoupling push and threatening to wreak havoc in the highly globalized chip supply chain.

The US' pressure on Taiwan and the latter's yielding attitude have aroused controversies and opposition from locally based observers. Yiin Chii-ming, former head of Taiwan's economic affairs authority, published a commentary in Taiwan-based media on Friday entitled "How can Taiwan swallow America's poison pill," saying that the US has extended bilateral relations, like those between China and the US, into "third-party relations" to meet its objective of cornering the Chinese mainland at the cost of other nations' industries.

According to Yiin, there are many factors that could influence the development of the global semiconductor industry in the future, but undoubtedly the most critical factor is the fact that the US government is intent on establishing an all-round confrontation against the Chinese mainland.

"On the surface, the US wants to protect the security of semiconductor supply chain by revitalizing local semiconductor manufacturing and preventing the rise of the mainland. But its policy measures are nothing more than undermining the stability of global semiconductor supply chains," the commentary read.

Ma Jihua, a veteran telecom observer, told the Global Times on Sunday that it is more difficult for leading Taiwan semiconductor firms like Taiwan Semiconductor Manufacturing Co (TSMC) to stand up against US pressure, considering that US companies and institutions are major stakeholders in TSMC.

Not a good choice

The Taiwan region's main market is still in the Chinese mainland, and it is not a good choice for the island authorities to lean to Washington, Wang Jianmin, a senior cross-Straits expert at Minnan Normal University in Fujian Province, told the Global Times on Sunday.

Taiwan's semiconductor manufacturing industry has its advantages, but this is not enough to fully occupy a more secure position in the industry, as major equipment and raw materials are still in the hands of the US and Japan, Wang said.

"Without control over raw materials, exports are a top issue for Taiwan's semiconductor industry," Wang said. "The US has a limited market compared to the [Chinese] mainland, and it will no doubt put more effort into nurturing its own companies."

According to research and statistics provided by Li Yingbo, an associate professor at the Institute of Taiwan Studies under Tsinghua University, TSMC's net revenue in the mainland market in 2021 was about 11 billion yuan ($155 million).

According to what Yiin said in his article, about 38 percent of Taiwan region's exports was semiconductor integrated circuit exports in the first eight months of 2022, and about 58 percent of those products were exported to Hong Kong and the Chinese mainland.

Experts described the Taiwan authorities' collusion with the US on chips as a decision that will "boomerang" on the Democratic Progressive Party (DPP) itself.

"If TSMC gives up mature chip manufacturing for mainland customers, it means it is giving a chance for its competitors to replace it in this business area, as other companies fell behind TSMC in this sector not on technology, but on production scale," Ma Jihua said.

Besides, chip companies like TSMC still rely on scale production instead of high-end products for follow-up development like research and capital sources. Losing mainland orders for mature chip manufacturing process means that Taiwan companies' mass production will dwindle by a lot, Ma said.

For example, South Korea and Japan, which took a relatively restrained attitude over the Biden administration's new rules, have close ties with Chinese mainland market and have been competing with Taiwan region in the semiconductor industry supply chain. If TSMC is forced to be estranged from Chinese mainland, it may provide a larger mainland market for South Korea's chip industry.

The more strongly the US inhibits the Chinese mainland, the more it will promote the Chinese mainland semiconductor companies and give them more space. In a few years, the semiconductor industry in the Chinese mainland will definitely rise, experts said.

Politicized chips

Experts said it is almost impossible that the Taiwan authorities and manufacturers are unaware of the disadvantages of cooperating with the US in containing the Chinese mainland. However, political manipulation of "decoupling" from the Chinese mainland and relying on US for secessionist aims overwhelms all.

The chip industry has been completely politicized by the DPP authorities and the US. The behavior of Taiwan authorities is not an act in line with international economic investment law and market operations, it is a political kidnapping of enterprises, Li said.

The DPP authorities are actually sending a signal indicating they hope Taiwan island will be deeply embedded in an industrial chain led by the US, which Taiwan secessionists believe would provide a sense of security, Li said.

According to Li, the patent cooperation between major industrial research and development departments in Taiwan region and the US is very close. "The DPP authorities may think that the hesitation in showing their loyalty in time would affect its role in the US-led supply chain."

As for the US, experts believe that its influence in the global technology industry chain is waning. However, Washington may believe that mastering the chip industry of Taiwan would be very helpful to maintain its hegemony, as well as cause damage to the stability of cross-Taiwan Straits economic and trade exchanges.

Politicization of chips is becoming a new normal in the global politics… It is a bad example for the US to set off a wave of chip protectionism around the world, bringing down the current industrial chain pattern and reshuffling the deck in its own interests, Li said.

The worry is that the future global chip industry chain may abandon integration and return to a fragmented structure, Li noted.

Telecom observer Ma Jihua said that the US' pressure on Taiwan chip companies will also exert great pressure and disruption on global semiconductor supply chains by further accelerating chip price hikes and driving up global inflation.

"The US is adding to the imbalance of global chip industries by triggering 'butterfly effects' that it might not be able to control," Ma said.