A view of the PBC building in Beijing on August 22, 2022 Photo: VCG

The People's Bank of China (PBC), the country's central bank, on Monday revealed an extension of its local currency swap agreement with the European Central Bank (ECB) for another three years, in a fresh sign of closer ties between the two major currencies amid mounting pressure from a strong US dollar.

By conducting currency swaps, the two sides' trade or financial transactions could have lower costs, as companies don't need to resort to a third-party currency, usually the US dollar, to complete the deals, market watchers said. It could also lower the risks of foreign exchange reserve shortages, as well as help promote the yuan's internationalization, they noted, reckoning the move will shore up China-EU trade.

The PBC recently extended for three years a bilateral currency swap with the ECB worth 350 billion yuan or 45 billion euros ($49 billion), according to a statement issued by the PBC on Monday.

The scale of the currency swap is unchanged from the previous rounds, the statement noted, saying that the deal will help deepen financial cooperation between China and Europe, boost the two sides' trade and investment, and maintain the stability of the financial market.

A currency swap is an agreement between two central banks to exchange currencies. It allows a central bank to obtain foreign currency liquidity from the central bank that issues it, usually because it needs to provide this to domestic commercial banks.

Local swaps mainly exist to solve the settlement needs between two major trading partners, including cross-border trade settlement and investment, Dong Dengxin, director of the Finance and Securities Institute of the Wuhan University of Science and Technology, told the Global Times on Monday.

The settlement in local currency between the two major economic camps is of great significance, as it can reduce the costs and risks of exchange rate fluctuations, especially when the yuan is a relatively stable currency, Dong said.

The renewed swap pact between two of the world's most influential central banks is seen as providing stability in the global financial market, which has been roiled by the super strong US dollar. The unruly dollar strength in the wake of the US Federal Reserve's drastic rate hikes has jolted global equity markets and non-dollar currencies.

A weaker yuan against the dollar still leaves the Chinese currency much stronger than its global peers. The euro, among the hardest-hit, has fallen below parity with the dollar.

In another move to reinforce the role of the yuan as a stabilizer to global foreign exchange markets, the PBC vowed in an article on Sunday to explore possibilities of local currency settlements with ASEAN members and neighboring countries.

The Chinese central bank revealed plans to push for the yuan's direct transactions with other currencies and support overseas economies in the development of local yuan foreign exchange facilities.

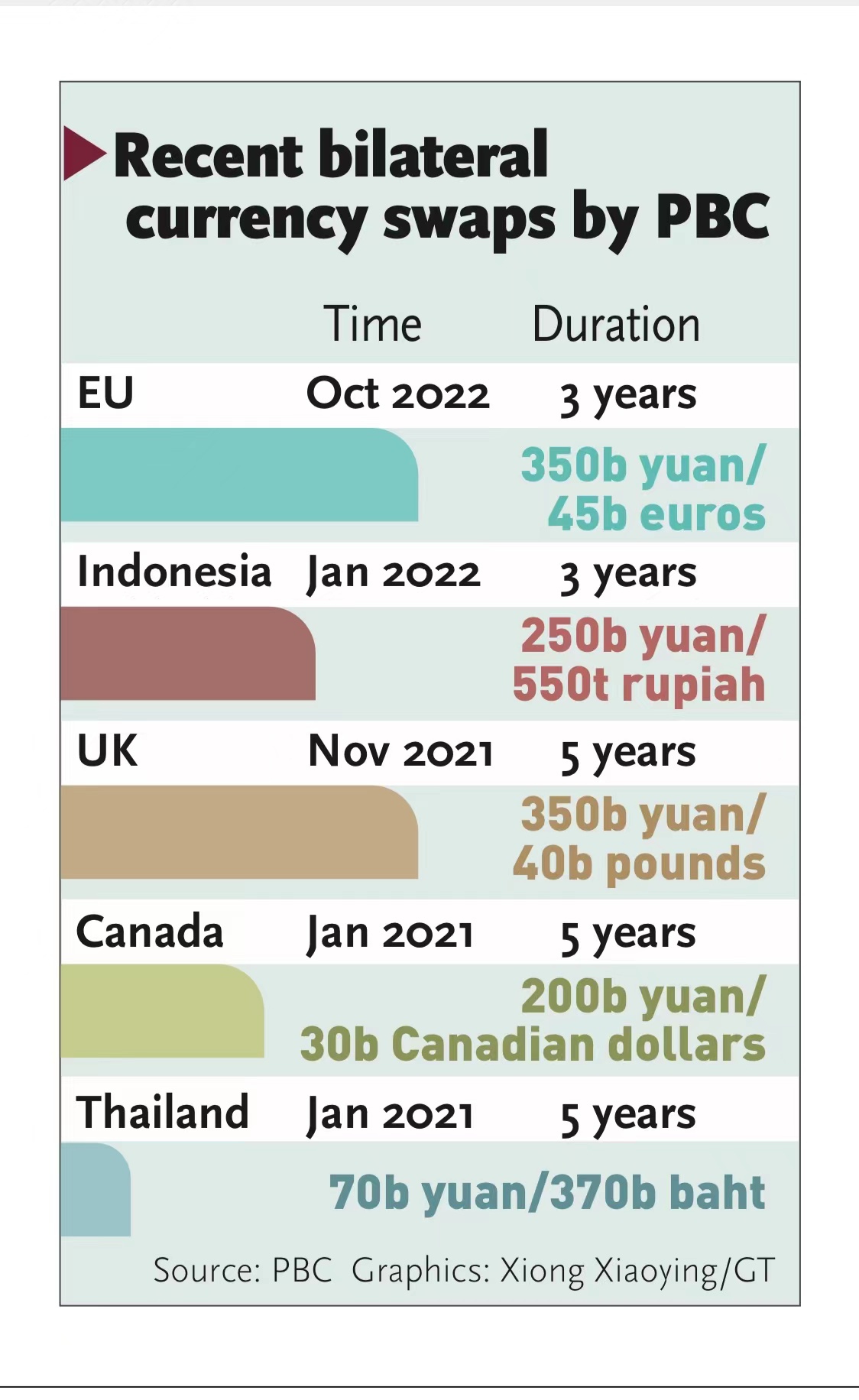

The PBC has carried out currency swaps with counterparts in several countries, including Japan, the UK, Canada, Russia and Singapore.

China's latest extension of the currency swap with the ECB reflects the deep business interactions between China and Europe, as bilateral economic links are strengthening despite some calls among European politicians to seek a so-called "decoupling" from the Chinese economy, experts said.

Dong said that certain voices of decoupling in Europe are in line with the US, and they cater to the demands of the US, which is just a slogan on the surface. This ignores the basic fact that China and Europe are more complementary economically, and their stronger and closer economic and trade ties will be of actual benefit for the people of the two sides, he said.

"China and Europe have formed a huge development area via Central Asia. The area, which is home to more than half of the world's population, has enormous potential for consumption," Luo Pan, a veteran financial observer, told the Global Times, saying that he saw little chance of decoupling between the two economies.

In terms of finance, Europe, as one of the world's financial hubs, has a large amount of funds that seek overseas investment opportunities. Meanwhile, China offers relatively good development opportunities compared with many other economies, providing good investment opportunities for European investors that can hardly be found elsewhere.

"Europe could climb China's development ladder to achieve bigger development for itself," Luo said.

According to China's Ministry of Finance, Kreditanstalt für Wiederaufbau (KfW), a German state-owned investment and development bank, has agreed to lend 69.52 million euros for a railway project linking North China's Tianjin and the Beijing Daxing International Airport. The loan term is 15 years, including a five-year grace period.

China is Europe's largest trading partner, and the investment extension of the Belt and Road Initiative (BRI) is constantly interconnecting with Europe. Whether from the perspective of trade or cross-border investment, the equivalent exchange of local currencies between China and Europe is still of great significance, reflected in growing yuan settlements with countries and regions along the BRI, Dong said.

According to the PBC, China's yuan settlements with such economies reached 5.42 trillion yuan in 2021, up 19.6 percent year-on-year, the Xinhua News Agency reported on October 5.

As of end-2021, China had signed bilateral currency swap agreements with 22 economies along the BRI, and it had established yuan clearing arrangements with eight, the report said.