Shanghai shines as intl financial center in past decade, eyes greater roles in China's new devt phase

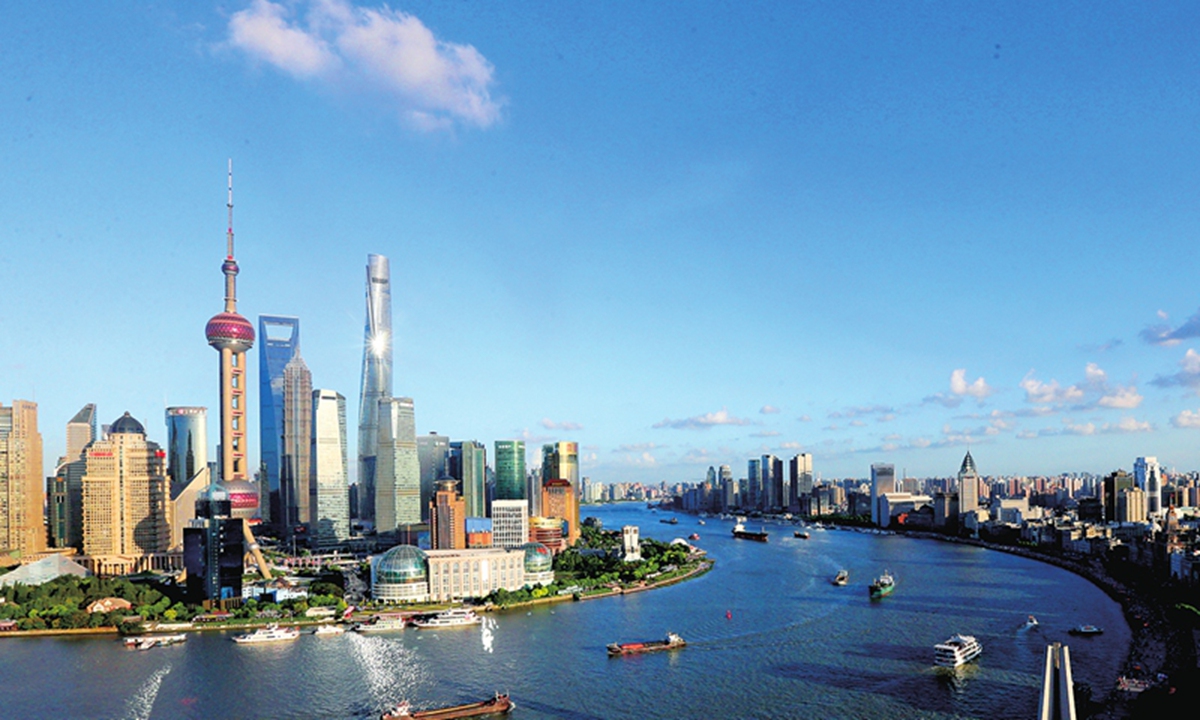

File photo shows a view of the Lujiazui area in Shanghai.Photo:Xinhua

From attracting global financial institutions to surging financial transaction volumes and the expansion of the nation's financial infrastructure, Shanghai has proved itself as a global financial center, officials said at a press conference on Tuesday afternoon about Shanghai's financial development over the past decade.Officials also stressed that Shanghai should shoulder new responsibilities as global financial center at "a new starting point," such as accelerating the construction of a yuan-based financial market and participating in global financial cooperation and competition.

"Shanghai has achieved significant progress in the construction of a global financial center... as of 2020, Shanghai had basically built a global financial center in conformity with China's economic strength and the yuan's international status," Xin Yadong, secretary of the Shanghai Financial Work Commission, said at the conference.

At the press conference, officials listed the progress Shanghai has made in constructing a global financial center in the past 10 years since the 18th National Congress of the Communist Party of China in 2012.

First, the scale and value of Shanghai's financial markets have burgeoned and now account for an increasingly larger part of the local economy.

According to data provided by Xin, Shanghai's total financial market turnover rose from about 528 trillion yuan ($73.6 trillion) in 2012 to 2.5 quadrillion yuan in 2021. The market's direct financing value in 2021 was nearly five times that of 2012.

Shanghai's cross-border yuan settlements surged about 47 percent on an average annual basis over the past ten years, while the city's stock market turnover nearly doubled, officials said.

As a result, the financial industry has taken an increasingly important role in boosting the local economy in the past decade. In 2021, financial added value accounted for 18 percent of Shanghai's GDP, compared with 11 percent in 2012, according to Sun Hui, deputy director of the Shanghai branch of the People's Bank of China.

Moreover, Shanghai's appeal to global financial institutions and talent rose. According to Xin, the global influence of many Shanghai bulk commodity prices like gold and cooper is increasing rapidly. The city is also becoming a hub for major domestic and overseas fintech enterprises.

The city's financial institutions that hold licenses increased from 1,227 at end-2012 to 1,719 at end-June 2022, of which about 30 percent were foreign financial institutions, officials noted.

The variety and scale of the city's financial products and mechanisms also saw rapid growth. For example, Shanghai launched the Science and Technology Innovation Board as a reform. By the end of this September, 473 companies had raised a total of 718 billion yuan on the board.

Experts attributed Shanghai's remarkable achievements to favorable policies in the China (Shanghai) Pilot Free Trade Zone, accelerated two-way opening-up in bonds, foreign exchange and currency trading, and breakthroughs in stock exchange connect programs.

"Compared with other international financial centers, the characteristics of Shanghai lie in its close connection with the Yangtze River Delta region, one of the country's manufacturing hubs, and accordingly it grows with a variety of industries," Cao Heping, an economist at Peking University, told the Global Times on Tuesday.

Experts said that Shanghai should shoulder new responsibilities, as China is ushering in a new development phase.

According to Cao, Shanghai should actively integrate finance and technologies to seize opportunities in areas such as the digital economy and green finance to build new advantages and future competitiveness.

"Shanghai should also actively promote high-level institutional opening-up in the financial sector, while improving the financial market system, product system and infrastructure system to continuously enhance the global financial hub's influence," Cao said.

Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China, told the Global Times that Shanghai should continue to improve its business environment and make it more convenient to use the yuan to attract more overseas financial institutions and provide more innovative services.

Yan Xu, a Shanghai financial official, said that Shanghai should undertake new missions at a new starting point, such as speeding up the construction of the yuan financial market, further improving the institutional system that conforms to international rules, as well as making up for "development weakness" to enhance the internationalization level of the financial center.