Illustration: Chen Xia/Global Times

Former US Federal Reserve chairman Ben Bernanke, who was awarded the 2022 Nobel Prize in Economics on Monday for his research in the financial crisis, urged policy makers to watch for any worsening of financial conditions around the world as pressures from geopolitical conflicts and currency fluctuations squeeze economies, Bloomberg reported."Even if financial problems don't begin an episode, over time, if the episode makes financial conditions worse, they can add to the problem and intensify it, so that's something I think that we really have to pay close attention to," Bernanke warned on Monday during a press briefing at the Brookings Institution in Washington, according to the report.

The reason why current US policy makers should still listen to Bernanke's warning is partly because he was well recognized for his research on the role of bank failures in the Great Depression in the 1930s, in addition to his pioneering policy decisions in dealing with the financial crisis of 2008-09. People across the world increasingly fear that another financial crisis may be in the making and the spillover impacts of the Fed's radical interest rate hikes are triggering the crisis.

While nodding to global risks, Lael Brainard, vice chair of the Federal Reserve, said in a speech on Monday that "monetary policy will be restrictive for some time" to wrestle inflation back down, The New York Times reported. This indicates that the US central bank's monetary policy will still focus on controlling inflation, regardless of its impact on global financial stability.

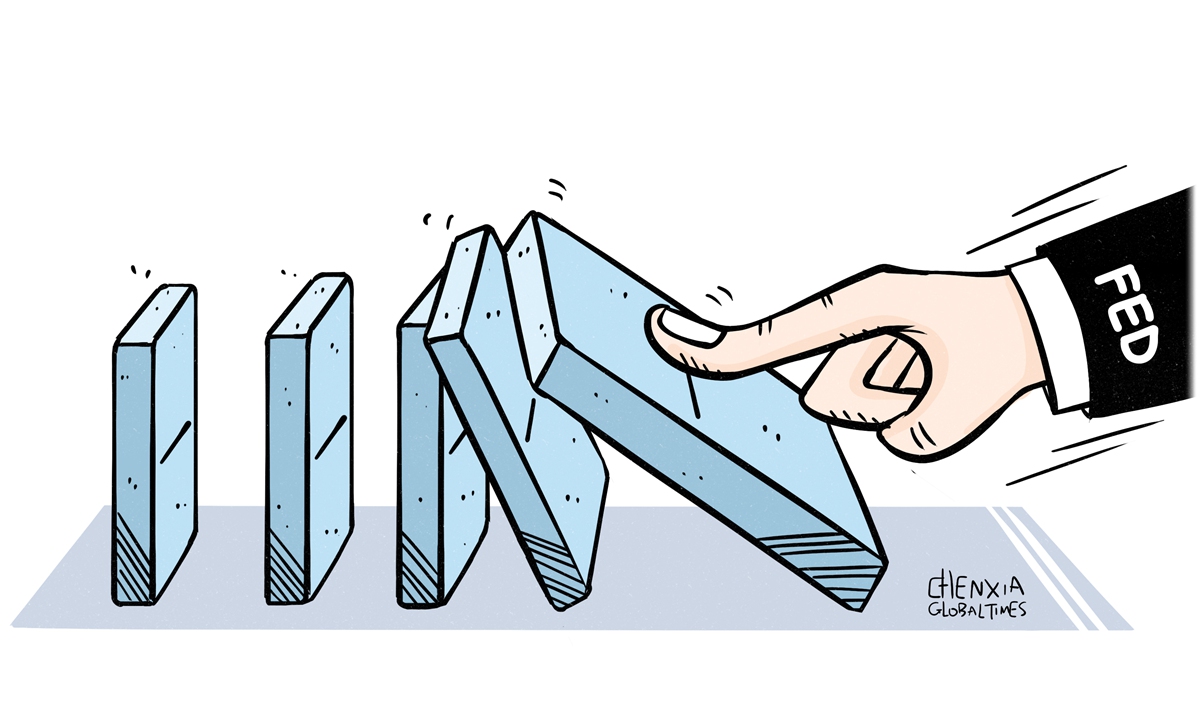

In order to tame the fastest inflation in four decades, the Fed has raised interest rates five times this year, exporting risks to global market and worsening financial conditions of economies that are already in a debt crunch. There are a rising number of economists pushing back against the Fed's recklessness and irresponsibility in raising rate so steeply and warning of a higher risk of a global recession, and markets have become more vulnerable to turmoil.

In fact, since the global financial crisis triggered by the US in 2008, the Fed's monetary policy has been centered on the US' own interests and triggered controversy. Although Bernanke's quantitative easing (QE) policy was widely regarded as an effective response to the aftermath of the 2008-09 financial crisis at the time, there are still disputes whether the size of the monetary loosening was appropriate and the sequelae it brought to the US economy and global markets.

What is certain is that much of the liquidity the US injected into the financial system did not end up flowing into the real economy. The liquidity has more flown into the stock market, pushing up asset bubbles and attracting the inflow of international capital to the US, which worsened the financial conditions of other economies. It not only caused serious sequelae to the US economy, but also caused serious spillover effects to the global financial market, easily evolving US financial crisis into a global financial turmoil.

At present, the Fed's hawkish tightening moves once again impacted global market, taming the surging inflation in the US at the cost of destabilizing the global financial market. In this sense, it is the same as Bernanke using QE to save the market. If the Fed continues with its irresponsible monetary policy, it may be a step-by-step damage to the financial hegemony of the US.

Extreme changes in US monetary policy, from excessive QE to aggressive quantities tapering (QT), have eroded global confidence in the US dollar and US assets. Even for maintaining the status of the dollar, the US should have a long-term vision and coordinate with other countries to maintain the stability of the international monetary system, which necessarily helps to maintain the global role of dollar.

As the whole international economy is facing the common problem of high debt, if the US blindly adopts irresponsible policies and triggers the collapse of the debts of other countries, it will also be harmful to the US economy, considering the US financial institutions are very important creditors in emerging countries. Therefore, the US should work jointly with other countries and maintain global financial and economic stability, to find a solution to the problem of global debt.

The author is a non-resident senior research fellow at the Center for International Security and Strategy at Tsinghua University. bizopinion@globaltimes.com.cn