Chinese car enterprises explore vessel cooperation as booming exports boost shipping demand

Firms explore transport options

A ro-ro ship berths at a port in Lianyungang, East China's Jiangsu Province to prepare for loading cars on September 19, 2022. Photo: VCG

China's domestic car brands have achieved a major comprehensive breakthrough in entering the global market, which has driven demand for cargo shipping as a means for Chinese car manufacturers to cope with the rapid expansion of overseas transport demand.

In September, China's automobile enterprises exported 301,000 vehicles with 2.12 million units being exported in the first nine months of the year, a year-on-year increase of 73.9 percent and 55.5 percent respectively, data from China Association of Automobile Manufacturers showed on Tuesday.

The figure marks China's monthly car exports exceeding the 300,000-unit mark for the first time, while the nation's car export volume has surpassed Germany and ranked second internationally following Japan, stcn.com reported.

Driven by surging overseas demand, Chinese car manufacturers have been expanding their strategic investment in purchasing and producing vessels on their own in order to transport vehicles.

Industry insiders and experts noted that the strong momentum of China's car exports will continue to last while further promoting the exploration of reshaping the maritime supply chain during the post-epidemic era.

Booming shipping demand

SAIC Motor has signed an agreement with China State Shipbuilding Corporation (CSSC) on January 17, with CSSC Jiangnan Shipyard to build two LNG dual fuel and low carbon ro-ro (rolling-on/rolling off) vessels for SAIC Anji Logistics Co, a wholly-owned subsidiary of SAIC Motor specializing in automotive logistics business, according to a statement sent to the Global Times by SAIC Motor on Wednesday.

The statement noted that the construction of the two vessels would actively meet the company's growing export needs. Currently, SAIC Anji Logistics Co has established the largest self-operated fleet among China's automobile enterprises with a total of 31 various carriers.

The boom in car exports will supercharge marine transportation especially following the steady increase of annual export volume from roughly one million units previously to the fast expansion with an expected scale of three million units now, Cui Dongshu, secretary general of the China Passenger Car Association (CPCA), told the Global Times on Wednesday.

The export of passenger cars with Chinese brands reached 250,000 units in September with the total number of exported cars topping 1.59 million units in the first nine months, up 85 percent and 60 percent respectively, reaffirming the trend that China has achieved a major comprehensive breakthrough with domestic brands entering the international market, CPCA data showed.

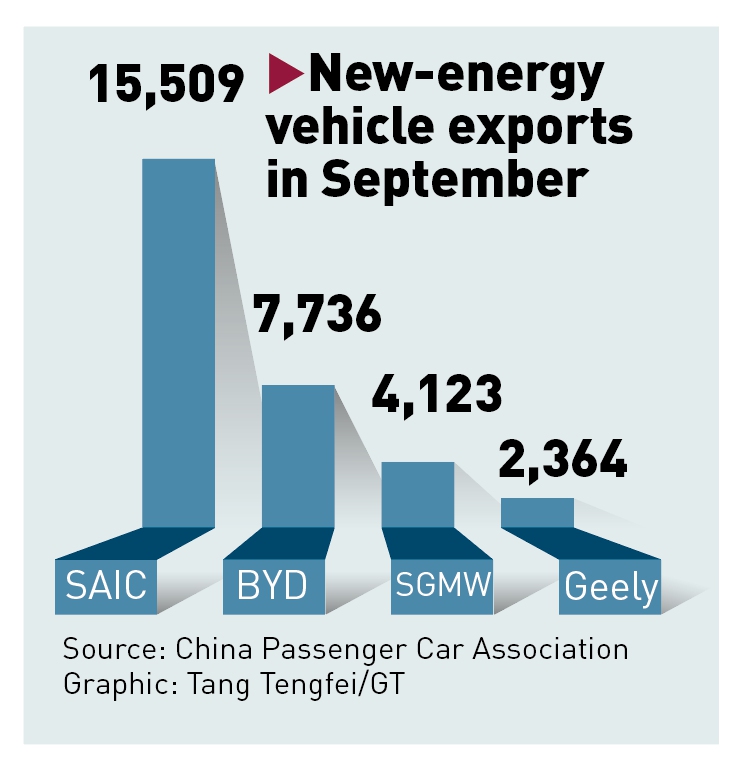

New-energy vehicle exports in September Graphic: Tang Tengfei/GT

Meanwhile, leading Chinese carmaker BYD reportedly booked up to eight 7700 CEU dual fuel LNG Pure Car Truck Carrier (PCTC) with advanced talks being held with three domestic shipyards, China Shipping Gazette reported in July, which noted that the price for the vessel might be set at $84 million each, adding that the similar type of vessel is currently priced about $100 million on the Chinese market. However, the price might be added up depending on the rise in building cost.

The report also noted that BYD had also been in talks with Chinese shipping enterprises to explore potential partnerships.

In addition to the delivery of vehicles, car manufacturers have also been expanding their strategic layout in shipbuilding and shipping in an early stage, opting to order and build ships instead of chartering existing vessels, according to a report from guancha.cn.

The report noted that car enterprises therefore can deepen their understanding of cargo transportation while even paving the way for integrating marine transportation into their own industrial chain and further enhance their competitiveness and advantages.

Meanwhile, Chinese enterprises have also been establishing close ties with domestic shipping companies through mutual investment as a new means of partnership.

China COSCO Shipping Corporation and SAIC Motor have signed separated agreements on October 9, under which China COSCO Shipping Corporation will transfer 5 percent of its shares to SAIC Motor by free transfer, while SAIC Motor will transfer 5.82 percent of its shares to China COSCO Shipping Corporation,

Cooperation between China COSCO Shipping Corporation and SAIC Motor represents the upstream and downstream industrial chains have set up even closer cooperation, especially as industrial chains have been facing disintegration affected by the COVID-19 pandemic, Wu Minghua, an independent shipping industry analyst from Shanghai told the Global Times, adding that such cooperation sends a strong signal, which can improve efficiency and reduce costs.

Optimistic yet challenging

Wu also noted that as Chinese car producers are optimistic about the long-term future of the market, working closely with shipping companies by carrying out extended contracts and other in-depth cooperation will be condusive for the stability of the entire automotive industrial chain.

Both Cui and Wu expected that booming Chinese car exports will continuously promote the demand and development of the country's marine transportation, while the experience will be beneficial for similar industries requiring sea transportation.

However, the journey for the exploration just began. Wu reminded that car manufacturers without reaching sufficient operating scale or maintaining stable export volumes may face disadvantages or challenges by directly diving into shipbuilding.

It will take a while and process for Chinese enterprises to expand abroad, especially as the construction cycle of ro-ro vessels is relatively long which generally takes two to three years, according to the guancha.cn report, citing Wang Zemin, the manager of SAIC Anji Logistics Co, adding that challenges still remain including negotiating with different terminals across the globe.