A LNG tanker arrives at a port of Groningen, Holland on September 4, 2022. Photo: VCG

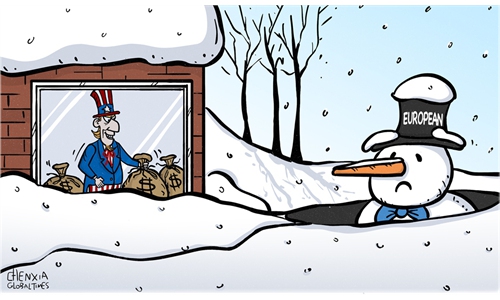

Europe's energy crisis has cooled efforts to lower the carbon intensity of liquefied natural gas (LNG) shipments, as buyers worried about a winter supply crunch prioritize securing shipments of any kind over burnishing their green credentials.

Natural gas can be certified as low- or no-carbon if its producers can prove they have reduced greenhouse gas emissions associated with getting it to market, or if they purchase carbon offsets to cut its net climate impact.

But the number of deals to ship carbon neutral LNG around the world has dropped to less than 10 so far this year, from 30 in 2021, according to energy research firm Wood Mackenzie. And demand for the greener fuel has dried up, according to Reuters interviews with nine LNG market analysts, industry officials and traders.

"Lower carbon or carbon neutral LNG cargoes have lost their appeal in the current high price environment," said Felix Booth, head of LNG at energy analytics firm Vortexa. "Energy security and affordability is front of mind for all buyers."

The decline in international demand for the so-called "greener" gas is a potential setback in the fight against climate change because it removes a financial incentive for producers to reduce their climate impacts.

The market for such fuels had taken off a few years ago with a flurry of international deals that sparked industry optimism producers would be able to reliably cover their costs for cutting emissions or buying offsets - which can run into millions of dollars per shipload.

A 2021 study by Columbia University's Center on Global Energy Policy pegged the premium on carbon-neutral LNG that year at about $1.75 million for a full cargo of around 100,000 cubic meters.

Several gas drillers, including in the world's top gas producer the United States, told Reuters they have invested in finding and plugging greenhouse gas emissions associated with production, transport and processing.

But no LNG exporters in the United States have certified their facilities, according to both the liquefaction plant owners and certification company MiQ, which had hoped to land contracts with them this year.

While gas produces fewer emissions than coal when burned, it can still contribute significantly to climate change by leaking into the atmosphere from drill pads, pipelines and other equipment. The main component of gas is methane, a greenhouse gas more powerful than carbon dioxide during its first 20 years in the atmosphere.

More than 100 countries have pledged to slash methane emissions by 2030 and are expected to detail their plans at a climate summit in Egypt next month.

Some drillers forge ahead

Despite the drop in demand for greener LNG, many drillers are tamping down their methane leaks, under pressure from regulators, investors, and big customers.

About a quarter of gas drilled in the United States is being certified to reflect its improved emissions intensity, by companies like Project Canary and MiQ, according to those firms. About a third of US supply should be certified by the end of the year.

Civitas Resources Inc, a Colorado driller, for example, said it has continued to measure emissions from its operations and certify its facilities even though it stopped seeking price premiums.

"As this market evolves, we believe there will be long-term demand for certifiably cleaner natural gas products," Civitas Chief Sustainability Officer Brian Cain said.

Drillers EQT Corp and Chesapeake Energy Corp are among the other US gas producers certifying supply.

But exporters of gas appear to be lagging.

To export gas, the fuel must be supercooled into LNG and then shipped across the sea, a process that produces substantial additional greenhouse gas emissions.

MiQ early this year said it expected to be certifying US LNG cargoes within months.

To date, however, US LNG companies have yet to certify their facilities.

Cheniere Energy Inc, the top US LNG producer, said it has provided emissions information for all cargoes shipped since June, but has not partnered with third-party certification programs.

Other US LNG suppliers, like Cove Point LNG and Cameron LNG, also told Reuters they are not certifying their cargoes.

Vincent Demoury, secretary general of the International Group of Liquefied Natural Gas Importers, said LNG exporters may be hesitating because passing on the cost of carbon offsets is difficult in a high-priced environment.

Reuters