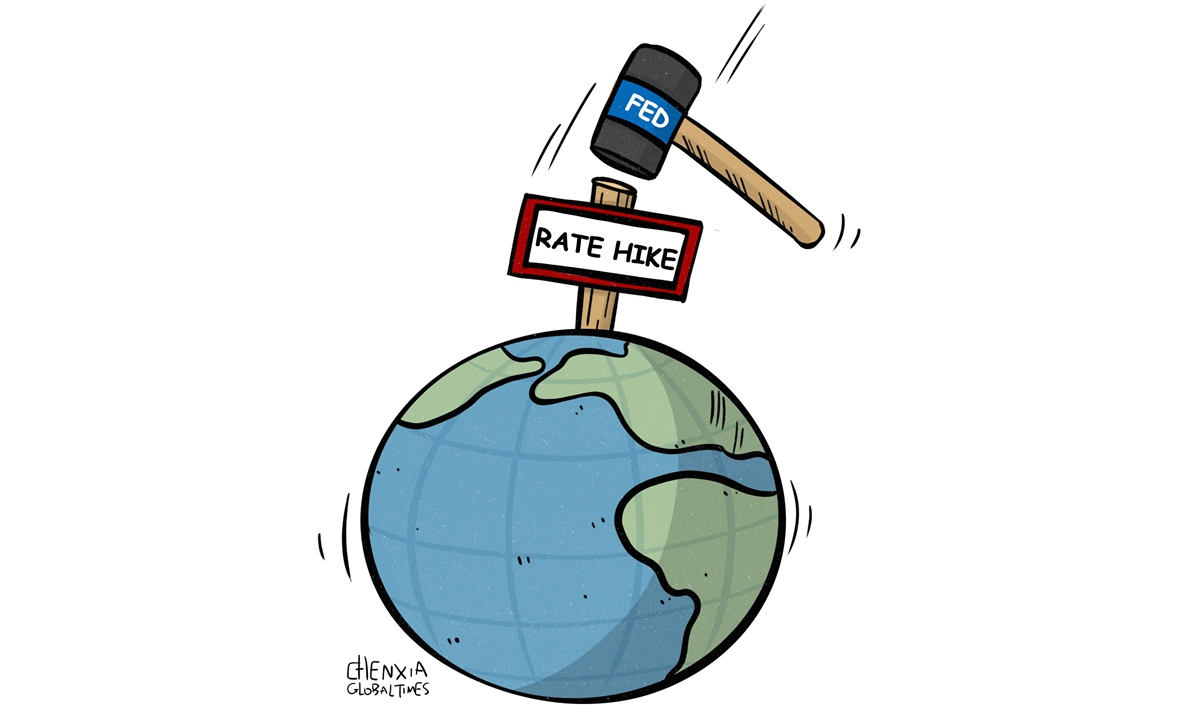

Illustration: Chen Xia/Global Times

US Senate Banking Committee Chair Sherrod Brown in a letter on Tuesday urged Federal Reserve Chair Jerome Powell to be cautious when it comes to tightening monetary policy that may risk costing the jobs of millions of Americans already plagued by high inflation, Reuters reported.Brown's letter comes as the Fed is widely expected to deliver a fourth straight supersized interest rate hike during the Federal Open Market Committee meeting next week.

While the letter only called for caution and did not explicitly ask the Fed to stop or slow down its interest rate hikes, it certainly reflects the anxiety over the economic costs and ineffectiveness of the Fed's increasingly reckless policy aimed at bringing inflation down.

Despite the previous rounds of the Fed's aggressive interest rate increases, which have exacerbated fears of a recession, US inflation remains at high levels. US consumer inflation rose 8.2 percent over a year earlier in September, marking the seventh consecutive month that saw the consumer price index jumping above 8 percent.

Against this backdrop, voices of skepticism toward the policy are inevitable. Is the US' tightening policy the right answer to its inflation problem? The answer remains unclear. What is clear is that the Fed's moves are causing serious problems for many economies around the world and the international community is increasingly losing confidence in the US economy as well as the Fed itself, which has even attracted widespread resentment.

It is important to note that the high inflation in the US is not caused by the US' trade with other countries, but a result of a series of domestic problems, including the Fed's previous money-printing policy, its failure against COVID-19 and inherent issues within the US economy. These problems are very complicated and intertwined with each other, meaning that the current high inflation in the US is not something the Fed can address by simply raising interest rates. To a certain extent, there is growing awareness that the Fed's policy tools are limited as is its ability to address the problems facing the US economy.

What's worse, the US' current financial and trade policies have been hijacked by Washington's geopolitical considerations and domestic political turmoil, including the US' containment strategy against China, the US-initiated tech "decoupling" from China, and the US-led comprehensive economic sanctions against Russia. These policy choices have, directly or indirectly, led to the problems in the US economy, which then creates problems for the global economy.

After inflicting great pains on the world economy, the US has showed no willingness or interest to rectify its mistakes. Instead, what the Fed has been doing indicates that it wants to take advantage of the dollar hegemony to export inflation and other crises to the world, while addressing its own economic problems alone. How irresponsible is that?

The Fed doesn't have the right policy tools at its disposal to alleviate the US' current problems. Moreover, it is impossible to expect a policy shift by the Fed that would help ease pressure on the global economy. The US is unlikely to change its selfish nature for the sake of the global economy. Nonetheless, the Fed cannot ignore rising criticism of its malign policy forever.

And many countries, including US allies, are suffering. Take Japan for example. Japan may have spent a record 5.5 trillion yen ($37 billion) to tame sharp yen falls in suspected intervention over the past days, according to Nikkei, but the yen remains relatively weak against the dollar, standing close to the important mark of 150 per dollar. Now many worry that Japan's economic woes, caused by the US, could affect economic development in Asia.

For many economies in Asia and around the world that prioritize economic development, the difficulties facing Japan are also a reminder that it is time to considers ways to build a fire-resistant barrier to protect themselves from the US abuse of monetary policy.