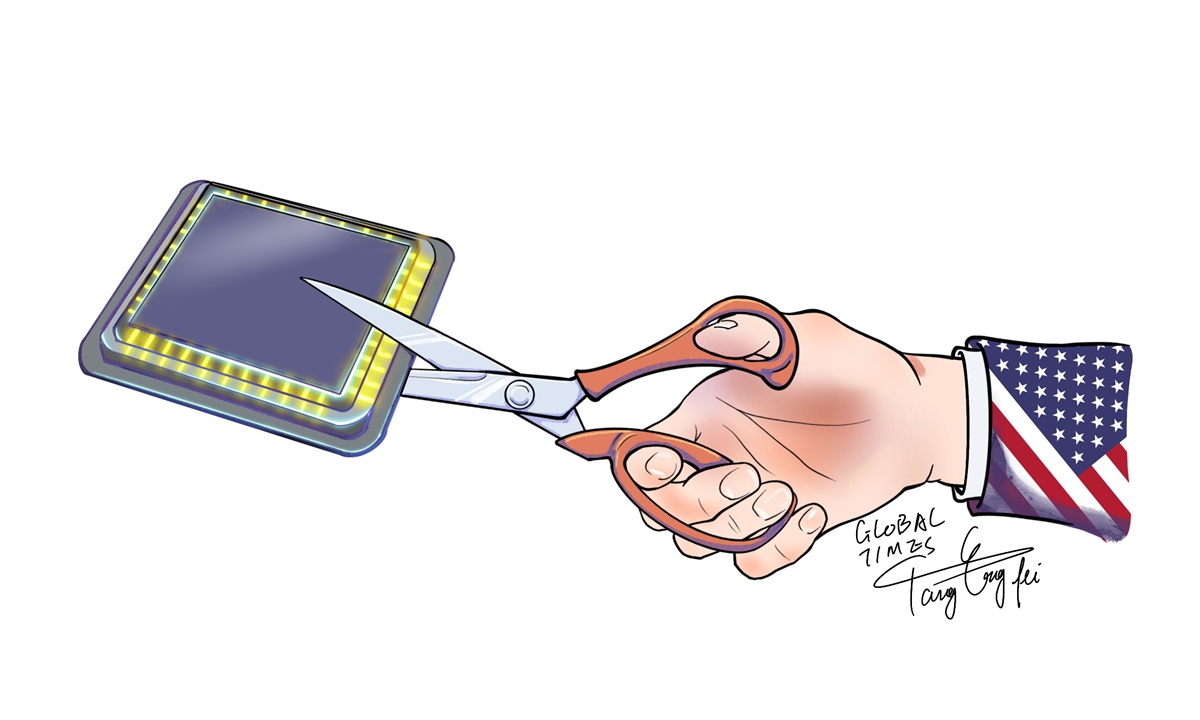

Illustration: Tang Tengfei/Global Times

Lorenzo Flores, vice-chair of Japanese chipmaker Kioxia, said that his company was analyzing the influence of the most recent US export controls on semiconductor, adding that decoupling global supply chains shall be "very complicated, expensive and time-consuming," the Financial Times reported on Sunday.The warning by the Japanese chipmaker executive came as the US has intensified its arbitrary moves to disrupt and split Asian semiconductor industrial chain. Flores' comments reflect the real hazard resulting from the US' export controls and deserve attention from policymakers in Japan and other effected countries and regions.

The US government on October 7 released a broad set of technology export controls, including what is said to be the harshest ban on shipment to China of certain semiconductor chips made anywhere in the world with US equipment. If the new measures are strictly implemented, it could put as much as 30 percent of some US and global chip industry giants' total revenue at risk, according to analysts.

In order to maintain its dominant position in the global semiconductor sector, the US government has also been trying to coerce Japan, South Korea, and China's Taiwan island to build a chip alliance - the so-called Chip 4 alliance. However, the plan which is based on geopolitical calculation has caused controversy among chipmakers in related regions.

From imposing semiconductor export controls to coming up with "Chip 4" alliance plan, the US' purpose is to maintain its own dominant position in the global semiconductor sector, contain China's progress in semiconductors and exclude the Chinese mainland from the industrial and supply chain. In this sense, the US will never sincerely help other economies to develop the chip industry, and it will not hesitate to sacrifice the interests of its allies when it deems necessary.

The US semiconductor sector is now facing a serious hollowing-out problem when it comes to manufacturing. In recent years, US chip manufacturing has declined sharply, and its domestically manufactured chips account for only 12 percent of the world's total. To reverse this trend, the US CHIPS bill vows to provide $52.7 billion in subsidies to attract chip manufacturers to set up factories and carry out research in the US.

Companies from Japan, South Korea and China's Taiwan island have long been worrying that the US-initiated "Chip4" and its subsidies could help the US semiconductor companies such as Intel and Micron gain the upper hand in competition with Asian companies.

Moreover, the US also interfere Japanese and South Korean companies' decisions to set up factories and expand production in China. Last year, South Korea's SK Hynix's chip factory's renovation plans in Wuxi, East China's Jiangsu Province were in jeopardy because US officials do not want advanced equipment used in the process to cross into China. After the US' recent export bans, the company reportedly worries about more difficulties, and it is preparing for all potential scenarios.

However, the importance of the Chinese market to Asian chipmakers is simply self-evident. China has a lot of key components and raw materials. Chipmakers from regional economies are inseparable from the Chinese market and the Chinese supply chain. The US' "decoupling" moves to push these companies to take sides are against the interests of these companies and have actually caused a strong backlash.

For instance, shortly after the US brought up the so-called Chip 4, Samsung's NAND flash plant in Xi'an, Northwest China's Shaanxi Province, Samsung's only overseas memory semiconductor plant, completed the expansion of its second plant and started its full-scale production, Business Korea reported in April.

If the US continues to adopt discriminatory measures against China and push "decoupling," the global semiconductor supply chain will be violently shaken. The US cannot rely solely on chip hegemony to shape the global semiconductor industry chain at will, otherwise it will only be backfired and isolated.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn