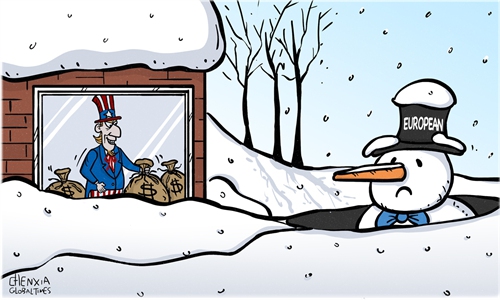

Illustration: Chen Xia/Global Times

The European Central Bank (ECB) is under pressure to raise interest rates to counter rising inflation. ECB President Christine Lagarde said that her bank must keep raising interest rates, even if the probability of a eurozone recession has increased, Reuters reported on Tuesday.The latest data indicate the eurozone may soon be teetering on the edge of an economic recession. Against this background, the ECB's interest rate hike cycle is likely to further stunt the weak economy. But unfortunately, the central bank seems to have little choice but to stick to the path of fighting inflation and suppressing growth.

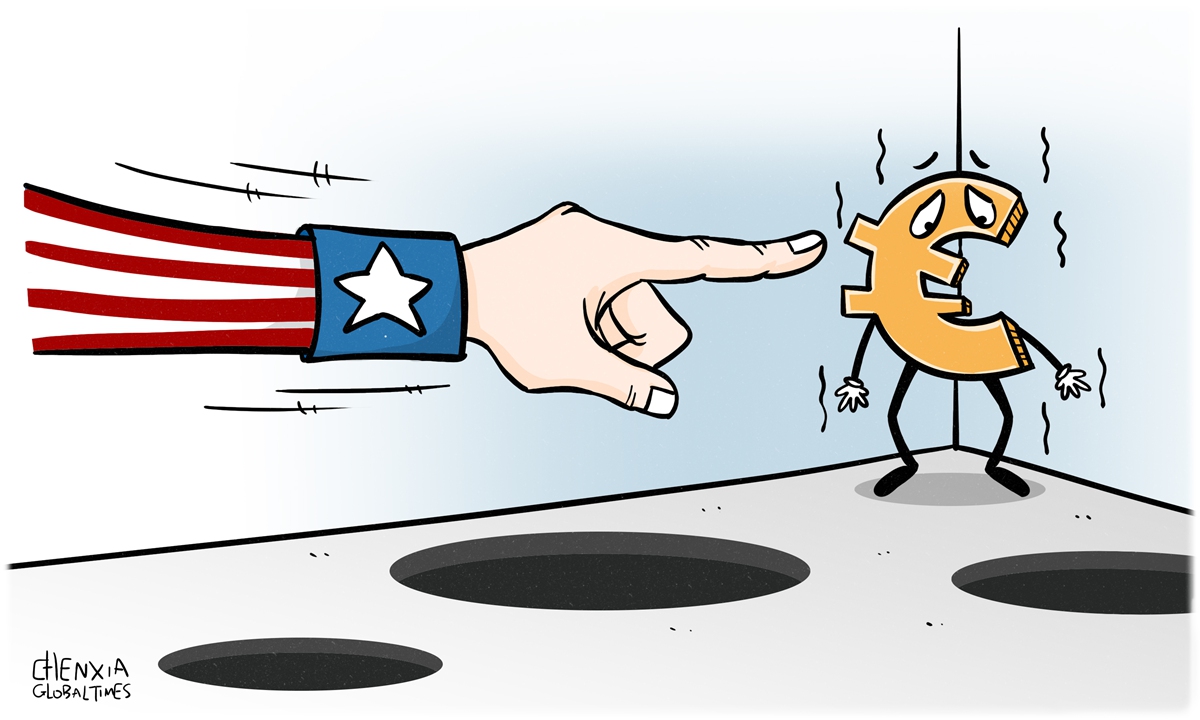

The US is playing an important role behind the ECB's dilemma.

First, the US created an atmosphere of criticizing and sanctioning Russia within Western social and political ecology and it agitated anti-Russia sentiment which resulted in a looming energy crisis and stubborn inflation. Inflation in the eurozone is anticipated to have reached a new record high of 10.7 percent in October, highlighting the severity of the cost-of-living crisis in the region and forcing the ECB to take more aggressive action.

Second, the US Federal Reserve's rate hikes put ECB in a no-win situation: Fight inflation and slow growth, or allow prices to continue surging. It seems the eurozone has chosen the former. The Fed raised its benchmark interest rate in September by 75 basis points for the third consecutive time and signaled a high likelihood of at least one more move of that size this year. If the Fed continues to raise interest rates, which results in a stronger dollar, it will add more pressure on ECB to follow such steps to help support the euro, although ECB's rate hike will hurt the EU economy.

Europe is facing stiff headwinds that are darkening its economic outlook and constitute potentially a stagflation shock severer than that of the US. In the third quarter of 2022, seasonally adjusted GDP increased by 0.2 percent in both the eurozone and the EU, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the EU. Analysts said that in the face of inflation and energy crisis, ECB' rate hike will add pressure to the European economy and push it to the brink of recession.

Europe's current passive position is related to its strategic dependence on the US. Facing continued economic headwinds, European policymakers should maintain strategic sobriety in the current complex situation of internal and external challenges.

The most urgent task right now is to encourage growth, investment, exports and jobs to support rather than further harm the EU economy. Currently, the path to restoring the economy is the biggest issue facing European policymakers. European politics should reach a rough consensus over the issue.

A simple and quick solution to EU's economic dilemma would be to avoid politicizing economic and trade issues, and make an objective and rational choice on its relations with economic partners. Trade protectionism is a blind alley while the creation of an open, free and fair trading environment is the right path toward an economic recovery.

China and Europe are important trading and economic partners with high economic complementarity. In 2021, China was the EU's largest trading partner, largest source of imports, and third largest export market. The EU is China's second largest trading partner, second largest source of imports and second largest export market. In 2021, the bilateral trade exceeded $800 billion for the first time, which shows that extensive shared interests and similar strategic goals in bilateral cooperation have strong resilience and potential.

As German Chancellor Olaf Scholz is scheduled to visit China later this week, a large group of senior German business leaders have reportedly formed a delegation to visit China with Scholz. It will be the largest trade delegation visiting China since the start of the COVID-19 pandemic.

The pragmatism shown by German businesses will likely be rewarded in the Chinese market with reciprocal trade and investment cooperation, and hopefully this pragmatic spirit will be accepted by more European investors and policymakers. Pragmatic economic cooperation can bring positive economic growth and partly offset the negative effects of tightening monetary policy.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn