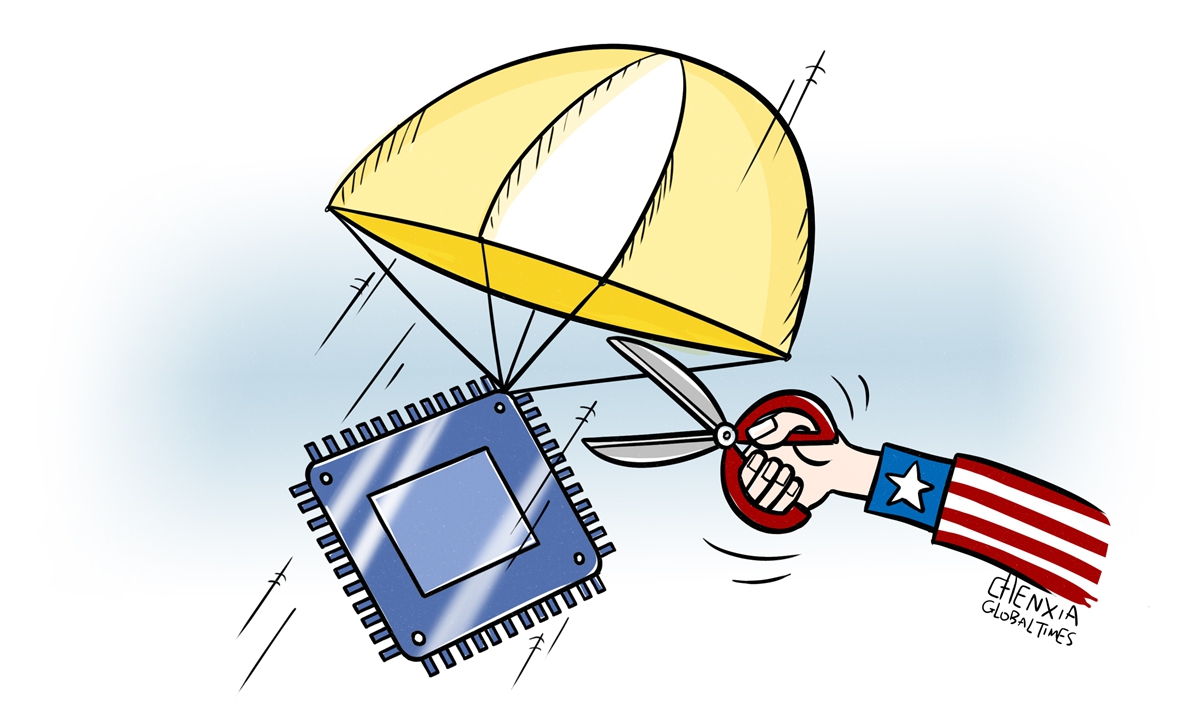

Illustration: Chen Xia/Global Times

The US is urging its allies including Japan to align with its lead on restricting exports of advanced semiconductors and related technology to China, the Chinese version of VOA reported on Tuesday.

"I think you will see Japan and the Netherlands follow our lead," US Commerce Secretary Gina Raimondo was quoted as saying.

It is unclear whether Raimondo's judgment is accurate or not, and what decision the Japanese government will be, but one thing is almost certain: the Biden administration appears ready to pressure Japan even more to join Washington's efforts to block the flow of advanced chips and technology to China. If Tokyo succumbs to US pressure, Japanese semiconductor-related industries will likely suffer huge economic losses.

Japan was once a global leader in semiconductor manufacturing, providing more than half of the world's supply of microchips, but according to a report published in January by the US International Trade Administration, Japan has now only a 15.8-percent share in terms of the world's monthly wafer capacity, as globalization helped push semiconductor companies in wealthy countries to contract out production abroad.

In recent years, the strategic importance of the chips industry and supply chain issues have driven policymakers to take action. In a bid to expand domestic production capacity, the Japanese government is reportedly investing billions of dollars in the country's chip industry and providing considerable subsidies for joint ventures with overseas chip companies from countries and regions such as the US.

It should be pointed out that the once global semiconductor leader is currently facing great pressure to find solutions to revive Japan's stalled semiconductor sector, and incentivize foreign chipmakers to build localized plants.

Some observers believe Japan is still attractive to global semiconductor players because the country still leads the market in manufacturing equipment, devices, or materials that are essential to semiconductor manufacturing, including specialty chemicals and silicon. But unfortunately, the US' push for tech decoupling from China has cast a shadow over Japan's efforts to revive its microchip industry.

The US government last month released a broad set of technology export controls, including the "harshest" ban on the shipment of advanced semiconductor chips that are made with US equipment and technology to China, intensifying Washington's so-called decoupling push.

If Tokyo succumbs to US pressure and align with Washington's lead on export restrictions to China, a major semiconductor market in the world, it will not only hurt the interest of semiconductor enterprises currently doing business in Japan, but also weaken the attractiveness of the industry for global investors.

In 2021, the size of China's semiconductor market was about $186.5 billion, of which $31.2 billion worth of chips were manufactured in China, the Diplomat reported in August. A gap between chip consumption and chip manufacturing provides a big market for international manufacturers.

If Japan succumbs to US pressure on export restrictions and give up the Chinese market, international investors may lose interest in Japan and stop their planned investment or even pull their capital out of the country.

The world's semiconductor competition is accelerating. Against the backdrop, Tokyo's possible compromise under the coercion of Washington will cede development opportunities to other players in the global semiconductor supply chain, such as the US and South Korea.

Biden in August sign into law the CHIPS and Science Act of 2022, which the White House said will strengthen US manufacturing to keep the country the leader in the industries of tomorrow. The act is designed to boost chip manufacturing in the US and bring good-paying manufacturing jobs back to the US from countries including Japan.

Some Japanese observers may hope US-Japan cooperation can help expand production capacity and revive the country's stalled semiconductor industry, but those people are going to be deeply disappointed. The disadvantages will outweigh the benefits if Tokyo succumbs to the US pressure.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn