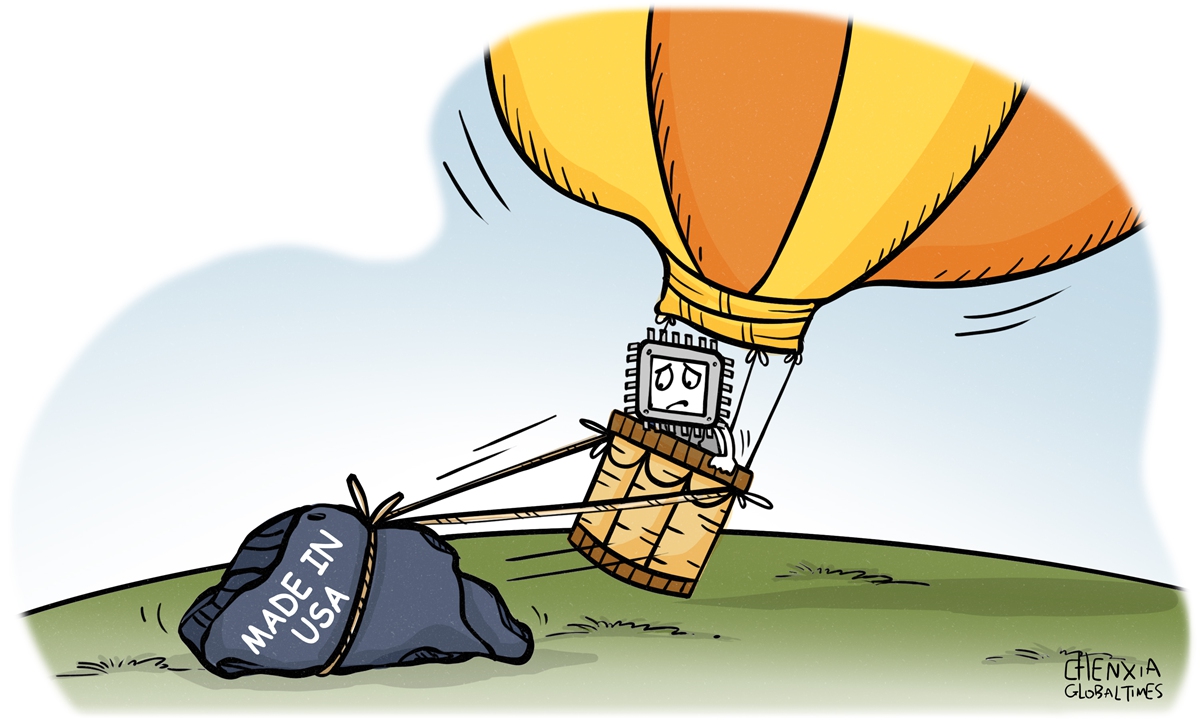

Illustration: Chen Xia/Global Times

Apple Inc is preparing to begin sourcing chips for its devices from a plant under construction in the US state of Arizona, Bloomberg reported on Wednesday, claiming the move is aimed at reducing the company's reliance on Asian production.Apple chief executive officer Tim Cook was quoted as saying that the company has already made a decision to start buying out of a plant in Arizona, and this plant will start up in 2024. According to the Bloomberg report, Cook is likely referring to an Arizona factory that will be run by Taiwan Semiconductor Manufacturing Co (TSMC), Apple's so-called exclusive chip-manufacturing partner.

The reported remarks by Cook came at a time when the US government is pulling out all the stops to boost domestic semiconductor manufacturing and flexing all policy muscles available to give US-based semiconductor producers an unfair advantage over competitors in Asia, especially China.

Currently, US politicians are desperately in need of one example to show that they are able to revive the domestic semiconductor industry, and that's why Cook's reported remarks attracted broad attention on Wednesday and Thursday. However, it's no secret some long-term political considerations are involved in Apple's superficial enthusiasm toward made-in-US chips, so such acts have perhaps more symbolic than practical meanings.

The US semiconductor sector faces a serious hollowing-out problem when it comes to manufacturing in recent years. The share of modern semiconductor manufacturing capacity located in the US has eroded from 37 percent in 1990 to 12 percent this year, according to data from the Semiconductor Industry Association of the US.

The decline can be the result of multiple factors, and one thing is clear: this is a market choice. If the US government cannot help the economy build up competitiveness of its manufacturing sector by improving infrastructure and reducing business costs, then the US will find it impossible to revive the domestic semiconductor industry.

The US government in August sign into law the CHIPS and Science Act of 2022, which the White House said will strengthen US manufacturing to keep the country the leader in the industries of tomorrow. Even as the legislation includes $52 billion for manufacturing incentives, research and development and workforce training, now there are reports that the US chip industry is facing serious headwinds.

A recent earnings report paints a grim picture across the US' chip sector. Intel reported an 85 percent year-on-year plunge in net income for the third quarter on a 20 percent drop in sales, Nikkei Asia reported last month. This year more than $1.5 trillion has been wiped from the combined market value of American-listed chip businesses, according to the Economist.

As the US chip giants have lowered their sales expectations amid weakened demand, the effectiveness of the US chip industry policy is still questionable. At a time when the global chip supply chain has been severely disrupted by US political interference and the supply-demand balance is in disarray, Apple's plan to use made-in-US chips is expected to face many challenges.

In February, Nikkei Asia said in another report that construction of TSMC's first advanced chip plant in the US is three to six months behind schedule, partly due to labor crunch. It's hard to guarantee that it won't happen again.

The long-term competitiveness of US manufacturing is at risk. In most US manufacturing sectors, productivity growth is substantially below that in Asian countries. Even though some US enterprises can be persuaded to use made-in-US chips under mounting pressure from Washington, high procurement cost will inevitably cause economic losses to those companies.

Efforts to revive the domestic semiconductor industry through non-market means are doomed to fail in today's world economy. There is a high probability that iPhones featuring chips made in the US will be more like just a political stunt in the coming years. At the very least, Apple's industrial chain will continue to be concentrated in Asian countries, including China.

Although the West has been hyping Apple's "reduced dependence" on China's industry chain, the indisputable fact is that China's resilient supply chain and strong manufacturing capacity have provided strong supports for Apple in the past decade. Of Apple's top 200 suppliers in 2020, 51 were based in China, according to a Nikkei Asia analysis of the Apple supplier list last year. Economic "decoupling" is not realistic in the short term.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn