Financial Street Forum, a bellwether of China’s financial reform, highlights robustness, openness

The China Banking and Insurance Regulatory Commission at Beijing Financial Street. Photo: IC

China's vibrant financial sector, a solid underpinning of the economic prowess and a crucial part of the country's reform and opening-up, is set to anchor the world's second-largest economy toward higher-quality growth and amplify its role as a stabilizer of the global markets amid varied uncertainties, senior officials and prominent domestic and foreign industry leaders told an influential financial forum in Beijing on Monday.The Financial Street Forum 2022, an annual event widely viewed as the bellwether of China's financial reform and opening-up, opened in the capital city on Monday and will run through Wednesday.

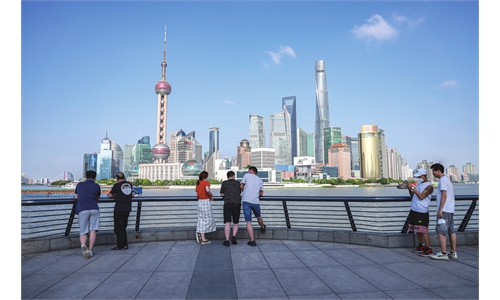

Coming shortly after the successful conclusion of the 20th National Congress of the Communist Party of China (CPC), which stressed high-quality growth and continued opening-up, this year's event, also marking the 30th anniversary of the construction and development of the capital's Financial Street, further cements Beijing's indispensable role of China's financial sophistication and innovation as well as the nation's leading role in championing a more open global economy, analysts said.

Rising prominence

The Beijing Financial Street's rising to prominence in the country's financial landscape that has earned it the name of the national financial management hub is seen epitomizing the country's financial reform and innovation at large.

In a speech at the forum on Monday, Yi Gang, governor of the People's Bank of China (PBC), the country's central bank, praised the great achievements in the construction and development of Beijing Financial Street over the past three decades.

"The Financial Street adheres to the road of financial development with Chinese characteristics, and has played an important role in serving the country's economic construction and social development," Yi said, adding that the PBC will put into practice the spirit of the 20th CPC National Congress to build a modern central banking system, implement prudent monetary policies, serve the real economy, prevent financial risks and deepen financial reforms.

Home to the country's financial regulators and a rising number of domestic and foreign financial institutions, Beijing has made great progress and contributed a lot to China's financial industry in recent years. Beijing's financial sector saw its added value amount to about 287 billion yuan ($40 billion) in 2021, up 160.6 percent compared with 10 years prior.

In particular, the Beijing Financial Street located in Xicheng district, dubbed as the "brain" of China's finance and sometimes referred to as China's Wall Street, has contributed nearly 40 percent of the city's financial added value since 2012.

It hosts the central bank, the securities, banking and insurance regulatory commissions, as well as headquarters of large domestic and foreign financial institutions. Known as the national financial management center, the street serves as a confluence of financial policymaking, supervision and asset management, among other aspects of the capital's financial functionalities.

There have been a series of major developments in the rise of the Beijing Financial Street in recent years. For example, the Beijing Stock Exchange, which officially opened in November 2021 to support small and medium-sized enterprises, is also located at the block of Financial Street.

In a major move, the Beijing Stock Exchange (BSE) on Monday officially launched a benchmark index - the BSE 50, which rose by 2.55 percent on its first day, highlighting investors' confidence in the performance of the capital's stock bourse.

The capital where the famed financial street is located is reputed to become an important part of the country's financial reforms.

"I think it is already [an important part] by many aspects because many decisions are taken in Beijing and those decisions quite often are financial decisions," Hugues de la Marnierre, Group Country Head for French bank Societe Generale in China, told the Global Times on the sidelines of the forum on Monday.

The country has done a lot in opening its financial sector to overseas institutions and "the trend is good," he said.

"Precisely the topic we had today was to exchange ideas between us and brainstorm. And I think that's very good. It's why I'm delighted to be here because it also gives an international flavor to the discussions."

Unwavering opening

Apart from the feat of the Beijing Financial Street over the past decades, the forum on Monday, which also marks its 10th anniversary and drew nearly 400 industry heavyweights from around the world, was also focused on China's financial opening, amid turmoil in global markets.

China has committed to opening wider at a high standard and said it will not change its commitment to an economic globalization that is more open, inclusive, balanced and beneficial for all, Chinese officials said.

As part of the unwavering opening push, China will deepen reforms and innovation of the over-the-counter market, known as the New Third Board, as well as push high-quality expansion of Beijing Stock Exchange, Yi Huiman, head of the China Securities Regulatory Commission (CSRC), said at the forum on Monday.

In the process of opening to the world, China has coordinated opening-up with security, strengthened risk monitoring on cross-border funds to make it visible and manageable, the CSRC head noted.

As one of the latest moves of the country's unswerving effort to expand all-around opening-up, China on Friday unveiled cash management rules for overseas institutional investors looking to the country's bond market. From June, qualified overseas institutional investors were allowed to invest in the exchange bond market either directly or through the connectivity.

China has basically put in place a management system of pre-establishment national treatment together with a negative list in the financial sector. It has completely lifted restrictions on foreign ownership in the banking, securities, fund, futures and life insurance sectors. The country has promoted the connectivity of cross-border securities markets and improved the qualified institutional investor system.

The promulgation and implementation of a series of measures have fulfilled the commitment to a greater financial opening-up.

Despite sluggish global investment sentiment, China remained a strong magnet for foreign companies backed by these endeavors. In the first 10 months of 2022, China saw an increase of 17.4 percent year-on-year in actualized foreign direct investment, totaling $168.34 billion, official data showed.

A global stabilizer

Guided by the 20th CPC National Congress, the 2022 Financial Street Forum will discuss how finance will serve the real economy, industrial chain, green development, digital infrastructure, the country's development and revitalization, energy security, as well as international cooperation and financial globalization.

On the premise of ensuring energy security, the orderly promotion of green and low-carbon transformation will become an important growth point for high-quality development, and bring unprecedented huge opportunities to the financial sector, so as to realize a virtuous circle between the financial sector and the real economy, according to the forum.

According to the report delivered to the 20th CPC National Congress, China must continue to focus on the real economy in pursuing economic growth.

China's financial industry has made great contributions to helping real economy transform to higher quality, while supporting the growth of many companies through fundraising.

Analysts also noted that the global economic recovery is fragile and faces serious challenges from high inflation, supply chain disruptions, and energy and food crises. With steady economic growth, wider opening-up of the financial sector and a vibrant market, China has become a rare factor of certainty in the current international environment.

While global financial volatility is increasing, China's financial market remains dynamic and stable. China has made substantial progress in financial opening-up and integration into the global market, and such a strong momentum is expected to continue in the future, they said.

Besides, China's rapid and healthy development of the financial industry is also making great contributions to the world's financial stability, at a time when market volatility is increasing globally as a result of geo-political tensions and irresponsible monetary policies launched by certain countries, experts noted.

This year's annual conference of the Financial Street Forum focuses on fintech, which is generally based on how the financial sector will serve the real economy, Pan Helin, co-director of the Research Center for Digital Economics and Financial Innovation at Zhejiang University, told the Global Times on Monday.

"The 2022 forum is more pragmatic, touching upon financial innovation, the difficulties and pain points in the practice of financial sector, and discussing feasibility and offering more diversified solutions. In addition, this year's annual conference also put more emphasis on the collaboration of cross-border financial innovation," said Pan.