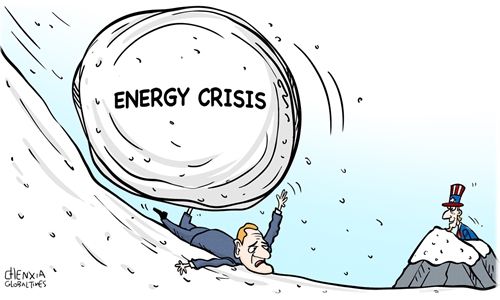

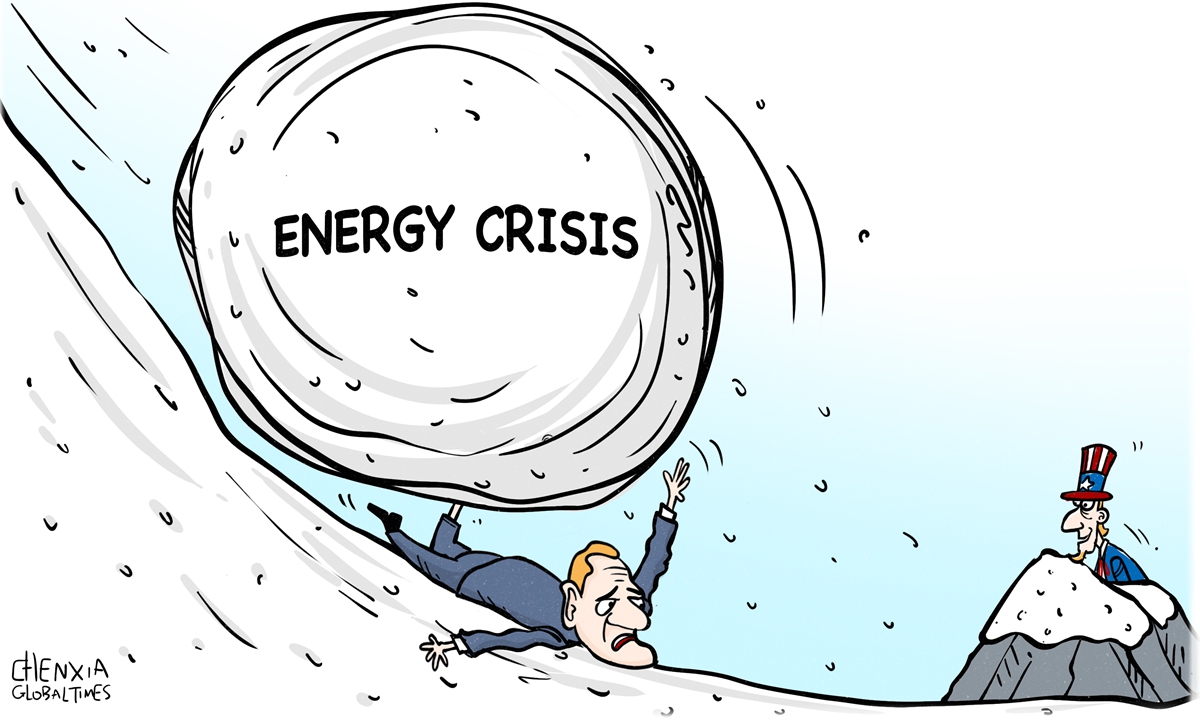

Illustration: Chen Xia/Global Times

Affected by the crude price cap on Russian seaborne oil imposed by G7 countries and worries that the US Federal Reserve could continue its aggressive monetary tightening policy, global oil prices saw sharp fluctuations on Monday. Brent crude futures were down $2.57, or 3 percent, at $83 a barrel after touching $88 during trading.

On Friday, the G7 agreed to cap the price of Russian oil at $60 a barrel to ramp up economic and diplomatic pressure on Russia and President Putin. In response, Moscow has said it will not abide by the measure even if it has to cut oil production. Meanwhile, oil producers' group Opec+ said over the weekend it would stick to its policy of reducing output.

Russia had made preparations for G7's price cap. It "will not accept" a price cap on its oil and is analyzing how to respond, Kremlin spokesman Dmitry Peskov said in comments the Russian state news agency TASS reported on Saturday.

Russia's uncompromising stance is understandable as oil pricing power is one of the core contents of its economic sovereignty. Russia, albeit under pressure of the act's fallout on its economy, is unlikely to give in to the West-imposed price ceiling. In fact, Moscow has said European countries championing the price cap could face a suspension of oil supplies, local media reported over the weekend.

Since the military conflict between Russia and Ukraine broke out, cutting off or at least restricting the energy exports on which the Russian economy is dependent has become a tool for the US and its Western allies to suppress and sanction Russia. The cap of $60 per barrel is also aimed at further restricting Russia's government revenues.

However, some analysts say that the impact on Russia is limited. Instead, it will have a largely negative impact on the stability of the international oil market and may possibly further drag down the global economy. This will impact the world's major economies.

The price cap of the G7 and Russia's potential reaction will further add more uncertainties to disrupt global energy supply order, by worsening global oil market turmoil.

Daniel Ahn, a former chief economist at the US State Department, said the Western countries sanctioning Russia have overestimated their control of the global oil trade, according to Reuters. UBS estimates that once the G7 price cap is officially implemented and provoked reaction from Russia, the price of Brent crude oil futures will reach $125 per barrel.

It is plain to see the G7's price cap on Russian oil will only intensify the conflict between Russia and Europe. Oil prices will face further turmoil, and the energy crisis will intensify. This would seriously disrupt the functioning of the global oil market. The global oil price may exceed $100 amid the introduction of the EU's $60 price cap for Russian oil and possible reduction of Russia's oil exports, TASS reported in a report on Saturday, citing Kirill Melnikov, head of the Russian Energy Development Center.

Expected oil price turmoil would inevitably add to woes over a worsening inflation across the world, and the EU that's being haunted by surging price levels and energy supply shortage in decades will bear the brunt of the clampdown. The stability of the global oil market is of great significance for not only a few Western countries, but the global economy. All economies should work together to maintain the stable operation of the global oil market and make constructive efforts in securing global energy supply.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn