Cooperation areas between China, Saudi Arabia now beyond oil to include new-energy sectors as firms ink flurry of deals

Multiple deals signed between Chinese, Saudi companies, broadening both scale and scope

Aerial photo shows Gulei petrochemical base in Gulei, East China’s Fujian Province. The giant industrial park is where the JV between Sinopec and Saudi Aramco will be based.

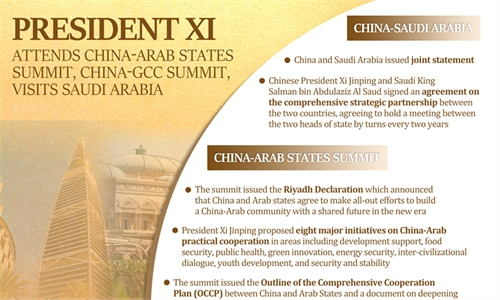

Underlining the potential of mutually beneficial bilateral trade and economic ties, Chinese and Saudi companies signed a number of cooperation deals in multiple sectors last week as the two countries jointly announced intentions to build a model of solidarity and cooperation for mutual benefits among developing countries.

In a joint statement released on Friday, the two countries emphasized strengthening energy cooperation, underlined the significance of global oil market stability and the need to deepen cooperation within the framework of the Belt and Road Initiative (BRI), and agreed to promote the development of wind energy and other renewable energy sources and projects.

Deeper partnerships on oil

The statement came as companies from the two countries announce a flurry of partnerships.

Saudi Arabia's oil giant Aramco and China's largest oil refiner Sinopec signed a deal on Saturday on the phase-II of their joint venture at Fujian Refining and Petrochemical Co, according to the Xinhua News Agency.

The deal aims to build a refinery with capacity to process 16 million tons of crude per year and an ethylene integrated cracking facility to produce 1.5 million tons of petrochemical products a year, with the earliest production date slated for 2025.

On the same day, Sinopec also signed a memorandum of understanding with Saudi Basic Industries Corporation to explore a large-sized project that can convert liquids into petrochemical products at Saudi Arabia's Yanbu Aramco Sinopec Refining Company in, a JV between Sinopec and Aramco.

Jin Lei, a professor with China University of Petroleum, told the Global Times on Sunday that China and Saudi Arabia are pushing energy cooperation to a higher level, from traditional oil and gas to new energy sources such as hydrogen and renewable energy, such as solar and wind.

"With higher-level development in mind, the cooperation in traditional petroleum refining businesses have been vastly expanded, fueling new areas of growth," Jin said.

In a separate deal with Shandong Energy Group, Aramco said it is exploring collaboration with the Chinese energy major on integrated refining and petrochemical opportunities in the Chinese market.

A MOU signed by the two companies includes a potential crude oil supply agreement and chemicals products offtake agreement, supporting Aramco's role in building a thriving downstream sector in Shandong, according to an Aramco press release sent to Global Times on Friday. The scope of the MOU extends to cooperation across technologies related to hydrogen, renewables and carbon capture and storage.

Mohammed Y. Al Qahtani, Aramco senior vice president of downstream, said through collaborations such as this in China's energy heartland, the company is creating "new pathways for growth in a country that is driving the increased integration of refining and petrochemical processes."

"I'm delighted that this spirit of cooperation is being extended across hydrogen, renewables and carbon capture and excited by the potential for further cooperation in these key areas which will shape our collective future," the Aramco executive said.

Saudi conglomerate ACWA Power, which controls a broad investment portfolio from power generation to green hydrogen plants, signed nine deals with Chinese companies last week, include Industrial and Commercial Bank of China, Power China International Group and Jinko Solar Company, on the financing, investment and construction of ACWA Power's clean and renewable energy projects in Saudi Arabia and other BRI markets.

Deals include $10billion worth of projects with investors and financiers, and an additional $33 billion with Chinese EPC contractors and suppliers, covering multiple major renewable and seawater desalination projects around the world, the company said in a press release sent to the Global Times over the weekend.

ACWA Power Chairman Mohammad Abdullah Abunayyan said the company's solid and growing relationship with major Chinese entities has contributed to its leading position in driving the global energy transition and reflects the valuable ties between the two nations.

Chinese organizations are involved in 47 projects in 12 countries within ACWA Power's portfolio.

The executive said he believes the company is in a unique position to support both the energy transition and economic transformation envisioned by Saudi Arabia's Vision 2030, as well as the China-proposed BRI.

Chinese experts said these deals have a big impact on how Saudi and Chinese companies realize their long-term goal.

For Aramco, the company aims to support China's demand for energy, petrochemicals and non-metallics as the company seeks to expand its liquids to chemicals capacity to up to 4 million barrels per day by 2030.

Mutual benefits, better growth

In recent years, Saudi Arabia has vigorously promoted economic diversification and transformation under its Vision 2030 framework.

Experts said the synergies created through these agreements between Chinese and Saudi companies have allowed them to drive the energy transition with cost-competitive methods.

China's nuclear power giant China General Nuclear Power Corp inked a deal with Saudi conglomerate AlJomaih to develop solar, wind and thermal energy projects with a total capacity of 10 million kiloWatts in Saudi Arabia, the Laos, Bangladesh and Azerbaijan.

Chinese and Saudi companies signed 34 investment agreements in the fields of green energy, green hydrogen, photovoltaic energy, information technology, cloud services, transportation, logistics, medical industries, housing and construction factories, according to a report by Saudi Press Agency on Thursday.

In the first 10 months of this year, bilateral trade between China and Saudi Arabia soared up 37.4 percent to $97.26 billion, according to customs data.

Jin noted that in the process of energy transactions, the status of the Chinese yuan is becoming more prominent, not just for Saudi Arabia but also for Arab countries as a whole and predicted a sizable increase in yuan-denominated transactions between China and its oil-producing countries in the near future.