IN-DEPTH / IN-DEPTH

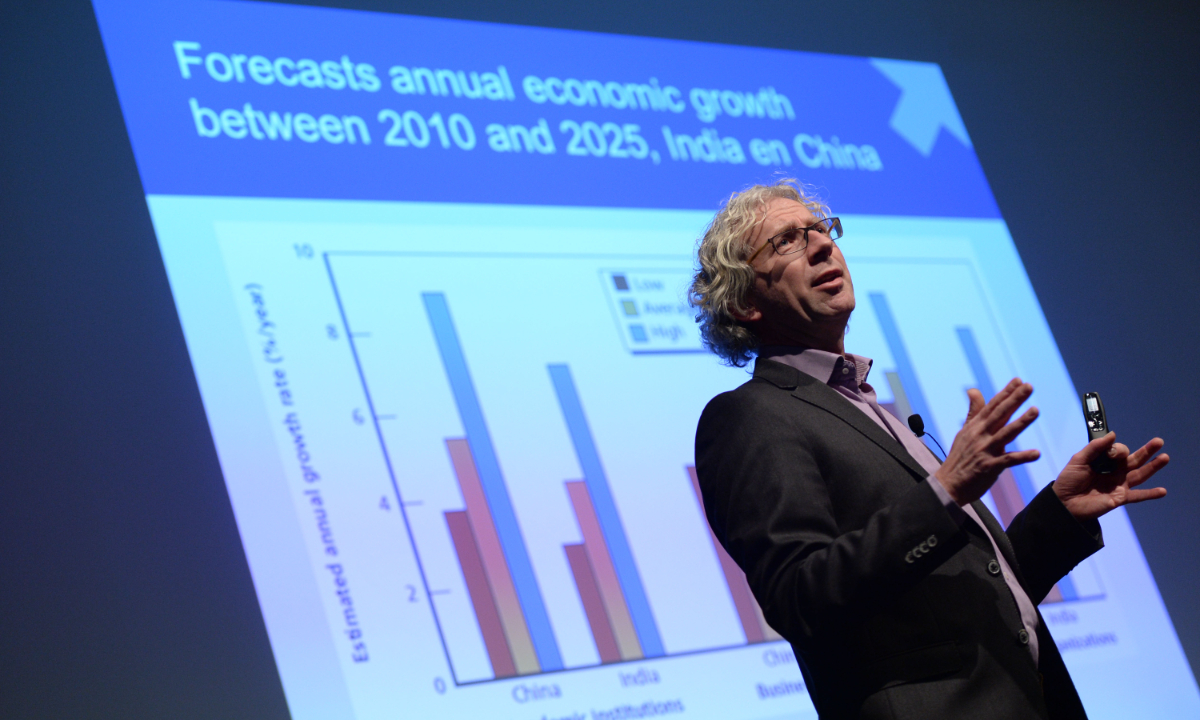

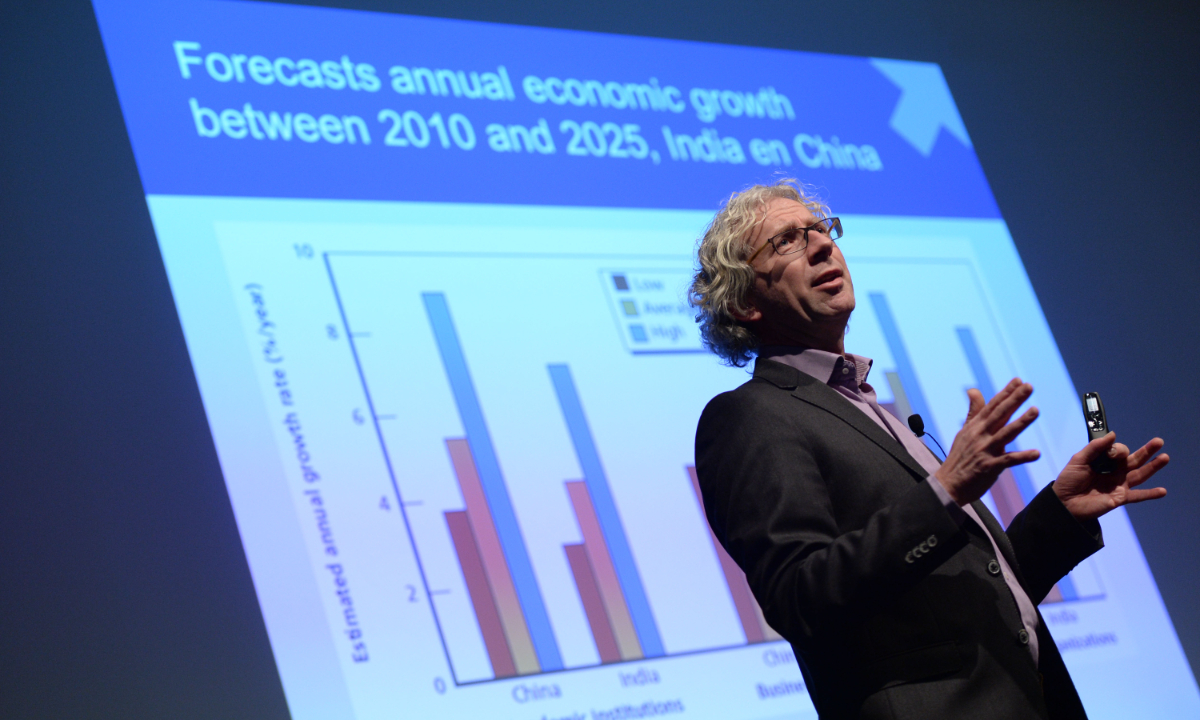

Exclusive: Emerging markets to reshape future global order as the West’s power wanes in the coming years: Dutch economic scholar

Editor's Note:

"The West must adapt to developing world's rise and learn from them." This is how Haico Ebbers, a professor of international economics at Nyenrode Business University in the Netherlands, warned the West as he believes the world is moving toward an "emerging market century." His concept of "NEP-9," a group of nine major emerging markets - China, India, Brazil, Russia, South Africa, Indonesia, Mexico, Turkey and South Korea - is increasingly gaining attention in the field of economics, as he argued that these emerging new economic powers (NEP) will translate into crucial global geopolitical power in the near future, or say, makers and shapers of the new world order.''

Ebbers had teaching experience in China and became a visiting professor at Renmin University of China in Beijing since 2010. Global Times reporters Hu Yuwei and Gu Di (GT) recently had an exclusive interview with Professor Ebbers (Ebbers) to learn more about his view on China's economic development, the West's "economic defense" against China, and the right way for Western powers to get along with the emerging markets.

GT: Why should we emphasize the impact of new economic powers? What is their future global role?

Ebbers: The world is changing in the coming decades toward the larger emerging markets. For the first time in 300 years, Western countries cannot dominate the world economy and politics as they did. This changing world can be seen in many respects: First, in 2050, eight out of the 10 largest economies will be today's emerging markets. The economic catching-up will continue, despite several short-term economic crises, the longer-term growth of these countries will be higher than long-term economic growth of Western countries. Second, in 2030, 70 percent of the global middle class will be situated in Asia.

The larger emerging markets may have large differences in economics and politics, but countries such as China, India, Turkey, Indonesia all have the viewpoint that a market also needs a government intervention to solve the market failures. It is "market and government" instead of "market versus government." They do not believe in the so-called Washington Consensus, but are moving toward the Beijing Consensus.

GT: You have said "the rise of China and other emerging markets should be seen as an unstoppable shift of power." What conflicts might this bring? Are we experiencing these conflicts right now?

Ebbers: It is clear that many countries have a choice today about the economic system they want and is best for the people. It is not only implementing the Western, IMF-driven way of economic development with more market and less government, but there is clearly an alternative economic system in which the government is more visible. This emphasis on government intervention ̶ if it is needed ̶ to reduce market failures brings China and other emerging markets in conflict with WTO because the paradigm of this organization is more liberalization in trade, services and investments.

However, the outdated dichotomy between private capitalism and neoliberalism on the one hand and state capitalism and government intervention on the other hand does not work anymore. Modern state capitalism today in countries such as South Korea and Singapore is very close to the private capitalism in countries such as the Netherlands, Sweden and Denmark. -

So, the clash in economic systems is there, but I think the differences in both systems are overstated.

The new world in which the larger emerging markets are powerful will bring tensions in the trade flows and within the WTO. But again, we should not overestimate these problems. China is in favor of the WTO, and it knows how much prosperity it brings.

At the same time, there are elements in the trade system that do not fit the emerging markets and consequently, adjustments may be needed. Of course, this gives discomfort to the West, but it is time to implement a system that works for all countries - high-income as well as emerging markets or developing states.

GT: What do you think are the advantages of China's economic development, especially considering the background that wide Western voices are advocating the collapse of the Chinese economy hit by the pandemic?

Ebbers: As you can read in my 2019 book Unravelling Modern China, I'm optimistic about China's longer-term economic development. I emphasize that the longer-term drivers behind economic development are still healthy, despite challenges such as aging, the fall in the labor force and environmental issues.

I am quite optimistic about the rise in productivity and efficiency in the coming decades and see the positive impact of focusing on inclusive development instead of the single GDP indicator. It does not say that we will not see years of low economic growth… For sure we will see that, but the underlying structural trend is positive.

GT: You started to study the overseas mergers and acquisitions of Chinese companies as early as 10 years ago. In recent years, Chinese companies have acquired a large number of European and American companies. Is this positive for globalization, as well as for China and relevant countries?

Ebbers: This development of international mergers and acquisitions (M&As) is logical if an economy and its domestic companies are growing. This international M&A is also part of today's globalization.

M&A means taking over control of local management and this may generate some discomfort in the West. A Chinese company becomes the owner of an iconic domestic company and it is obvious that it will create discussions.

Furthermore, if the Chinese company is a private company, Western policymakers may easily accept the takeover, but if the investment is made by a Chinese state-owned company, Western policymakers become nervous, in particular if the investment is in a strategic important sector such as logistics, energy or high tech.

Interestingly, people in these Western economies are losing faith in globalization. Changes, particularly rapid ones, create discomfort and a perceived lack of control. So we see their defensive reactions.

Again, this is not new. When American companies took over many European companies in the 1960s and 1970s, there were voices in Europe against this process.

We may see the same in China. If a Western company wants to take over a Chinese firm, also the government may step in to discuss this transaction beforehand or even block the takeover. What is needed is to understand each other's motive and to achieve reciprocity as much as possible. This reciprocity is not 100 percent possible due to the fact that China's economic development differs from that of Western countries, but moving to this reciprocity is needed.

GT: Some Western scholars have touted China as a superpower. But China is clearly not, and does not want to be, a hegemon on the international stage. What do you think of these Western perceptions?

Ebbers: The size of the Chinese economy in purchasing power parity is already larger than that of the US and this trend will continue. In 2050, China's economy in purchasing power will be 40 percent larger than US'.

Also, in market exchange rates, China is second worldwide in 2022 and will become larger than the US in the mid-2030s. This economic size is transferred into soft power, geopolitical power, military power, negotiation power and so on… This is the perception in the West.

However, at the same time China's GDP per capita is much lower compared to the US and the Western countries. So, from this perspective, China is a middle-income country or an economy in transition. It has several developing country challenges, and many sectors in the economy are not mature.

Therefore, in the WTO, China sees itself as a developing country while the Western nations are asking China to change its status from a developing toward a developed nation. Both parties are partly correct. What is needed is to set a more concrete timeline about changing this status in the WTO. This needs flexibility from both parties.

GT: Why do you include those nine countries in your NEP-9 concept? What do they have in common?

Ebbers: The growing importance of the largest emerging markets is striking in many respects: demographically, economically, geopolitically, culturally, technologically and environmentally.

Demographics have shifted and will continue to move toward emerging markets. If the phrase "people are our greatest asset" is true, then emerg¬ing markets are rich indeed. In 2021, the population of emerging markets accounted for more than 87 percent of the world's population. In the top 10 countries with the highest population in 2021, nine are emerging mar¬kets. The only Western country on that list is the US. This development will continue in the coming decades

My book on the concept The Rise of the New Economic Powers and the Changing Global Landscape can help understand shifts in the political, economic and soci¬etal landscape of these countries and recognize the choices these countries are making, as they will affect you as a consumer, worker, policymaker, marketeer, strategist, global citizen or voter. Their growing impact on the world stage is visible everywhere.

The global center of gravity for research and technology is rapidly shifting toward emerging markets. Look at the ranking of emerging markets in the annual Global Innovation Index and the Global Competitiveness Report. Countries such as China, India, Brazil, and Russia were in the top 10 in terms of expenditures on Research & Development in 2019.

In 2003, I was working on the previously men¬tioned globalization book. Back then, the consensus view was that under¬developed educational systems and a lack of regulations aimed at stimulating creative thinking and innovative behavior were seriously hampering innovation in emerging markets. However, over the last decades, several emerging markets have been striving to develop skills and talent through educational policies.

Another reason we need to understand the new role of the largest emerging markets is that their rise and development will continue throughout the coming decades. Unfortunately, we will likely see short-term economic crises and social unrest, but the consensus view is that a different world will have emerged by 2050. We are moving toward an emerging market century.

GT: What kind of challenges and difficulties does NEP-9 face in getting more involved in global governance?

Ebbers: The NEP-9 countries face a dilemma in their orientation toward global governance. On the one hand, these countries are increasingly dependent on the existing institutional frameworks. On the other, their interventionist policies put them into tension with the doctrines of global institutions.

There are two views on this issue. The first view emphasizes confrontation. In this confrontation view, the NEP-9 threatens the current rules-based world order. This idea is supported by the more aggressive bargaining, coalition building, and growing regional initiatives, resulting in a standstill in the WTO discussions.

The second view accentuates coop¬eration. This is what I call the collaboration view and is, in my opinion, the correct way to look at the present situation. From this perspective, the NEP-9 uses the existing global governance order. Although they will seek incremental adaptations of the current rules and institutions, they do not want to change the system fundamentally because they have been the chief beneficiaries of globalization.

They are as dependent as the West upon the smooth functioning of an open global economy for their economic success and political stability. They want to see changes in the worldwide architecture but are not system changers.

"The West must adapt to developing world's rise and learn from them." This is how Haico Ebbers, a professor of international economics at Nyenrode Business University in the Netherlands, warned the West as he believes the world is moving toward an "emerging market century." His concept of "NEP-9," a group of nine major emerging markets - China, India, Brazil, Russia, South Africa, Indonesia, Mexico, Turkey and South Korea - is increasingly gaining attention in the field of economics, as he argued that these emerging new economic powers (NEP) will translate into crucial global geopolitical power in the near future, or say, makers and shapers of the new world order.''

Ebbers had teaching experience in China and became a visiting professor at Renmin University of China in Beijing since 2010. Global Times reporters Hu Yuwei and Gu Di (GT) recently had an exclusive interview with Professor Ebbers (Ebbers) to learn more about his view on China's economic development, the West's "economic defense" against China, and the right way for Western powers to get along with the emerging markets.

City view of Shenzhen, South China’s Guangdong Province Photo: VCG

GT: Why should we emphasize the impact of new economic powers? What is their future global role?

Ebbers: The world is changing in the coming decades toward the larger emerging markets. For the first time in 300 years, Western countries cannot dominate the world economy and politics as they did. This changing world can be seen in many respects: First, in 2050, eight out of the 10 largest economies will be today's emerging markets. The economic catching-up will continue, despite several short-term economic crises, the longer-term growth of these countries will be higher than long-term economic growth of Western countries. Second, in 2030, 70 percent of the global middle class will be situated in Asia.

The larger emerging markets may have large differences in economics and politics, but countries such as China, India, Turkey, Indonesia all have the viewpoint that a market also needs a government intervention to solve the market failures. It is "market and government" instead of "market versus government." They do not believe in the so-called Washington Consensus, but are moving toward the Beijing Consensus.

GT: You have said "the rise of China and other emerging markets should be seen as an unstoppable shift of power." What conflicts might this bring? Are we experiencing these conflicts right now?

Ebbers: It is clear that many countries have a choice today about the economic system they want and is best for the people. It is not only implementing the Western, IMF-driven way of economic development with more market and less government, but there is clearly an alternative economic system in which the government is more visible. This emphasis on government intervention ̶ if it is needed ̶ to reduce market failures brings China and other emerging markets in conflict with WTO because the paradigm of this organization is more liberalization in trade, services and investments.

However, the outdated dichotomy between private capitalism and neoliberalism on the one hand and state capitalism and government intervention on the other hand does not work anymore. Modern state capitalism today in countries such as South Korea and Singapore is very close to the private capitalism in countries such as the Netherlands, Sweden and Denmark. -

So, the clash in economic systems is there, but I think the differences in both systems are overstated.

The new world in which the larger emerging markets are powerful will bring tensions in the trade flows and within the WTO. But again, we should not overestimate these problems. China is in favor of the WTO, and it knows how much prosperity it brings.

At the same time, there are elements in the trade system that do not fit the emerging markets and consequently, adjustments may be needed. Of course, this gives discomfort to the West, but it is time to implement a system that works for all countries - high-income as well as emerging markets or developing states.

Haico Ebbers Photo: Courtesy of Ebbers

GT: What do you think are the advantages of China's economic development, especially considering the background that wide Western voices are advocating the collapse of the Chinese economy hit by the pandemic?

Ebbers: As you can read in my 2019 book Unravelling Modern China, I'm optimistic about China's longer-term economic development. I emphasize that the longer-term drivers behind economic development are still healthy, despite challenges such as aging, the fall in the labor force and environmental issues.

I am quite optimistic about the rise in productivity and efficiency in the coming decades and see the positive impact of focusing on inclusive development instead of the single GDP indicator. It does not say that we will not see years of low economic growth… For sure we will see that, but the underlying structural trend is positive.

GT: You started to study the overseas mergers and acquisitions of Chinese companies as early as 10 years ago. In recent years, Chinese companies have acquired a large number of European and American companies. Is this positive for globalization, as well as for China and relevant countries?

Ebbers: This development of international mergers and acquisitions (M&As) is logical if an economy and its domestic companies are growing. This international M&A is also part of today's globalization.

M&A means taking over control of local management and this may generate some discomfort in the West. A Chinese company becomes the owner of an iconic domestic company and it is obvious that it will create discussions.

Furthermore, if the Chinese company is a private company, Western policymakers may easily accept the takeover, but if the investment is made by a Chinese state-owned company, Western policymakers become nervous, in particular if the investment is in a strategic important sector such as logistics, energy or high tech.

The New Development Bank BRICS in Shanghai Photo: VCG

Interestingly, people in these Western economies are losing faith in globalization. Changes, particularly rapid ones, create discomfort and a perceived lack of control. So we see their defensive reactions.

Again, this is not new. When American companies took over many European companies in the 1960s and 1970s, there were voices in Europe against this process.

We may see the same in China. If a Western company wants to take over a Chinese firm, also the government may step in to discuss this transaction beforehand or even block the takeover. What is needed is to understand each other's motive and to achieve reciprocity as much as possible. This reciprocity is not 100 percent possible due to the fact that China's economic development differs from that of Western countries, but moving to this reciprocity is needed.

GT: Some Western scholars have touted China as a superpower. But China is clearly not, and does not want to be, a hegemon on the international stage. What do you think of these Western perceptions?

Ebbers: The size of the Chinese economy in purchasing power parity is already larger than that of the US and this trend will continue. In 2050, China's economy in purchasing power will be 40 percent larger than US'.

Also, in market exchange rates, China is second worldwide in 2022 and will become larger than the US in the mid-2030s. This economic size is transferred into soft power, geopolitical power, military power, negotiation power and so on… This is the perception in the West.

However, at the same time China's GDP per capita is much lower compared to the US and the Western countries. So, from this perspective, China is a middle-income country or an economy in transition. It has several developing country challenges, and many sectors in the economy are not mature.

Therefore, in the WTO, China sees itself as a developing country while the Western nations are asking China to change its status from a developing toward a developed nation. Both parties are partly correct. What is needed is to set a more concrete timeline about changing this status in the WTO. This needs flexibility from both parties.

GT: Why do you include those nine countries in your NEP-9 concept? What do they have in common?

Ebbers: The growing importance of the largest emerging markets is striking in many respects: demographically, economically, geopolitically, culturally, technologically and environmentally.

Demographics have shifted and will continue to move toward emerging markets. If the phrase "people are our greatest asset" is true, then emerg¬ing markets are rich indeed. In 2021, the population of emerging markets accounted for more than 87 percent of the world's population. In the top 10 countries with the highest population in 2021, nine are emerging mar¬kets. The only Western country on that list is the US. This development will continue in the coming decades

My book on the concept The Rise of the New Economic Powers and the Changing Global Landscape can help understand shifts in the political, economic and soci¬etal landscape of these countries and recognize the choices these countries are making, as they will affect you as a consumer, worker, policymaker, marketeer, strategist, global citizen or voter. Their growing impact on the world stage is visible everywhere.

The global center of gravity for research and technology is rapidly shifting toward emerging markets. Look at the ranking of emerging markets in the annual Global Innovation Index and the Global Competitiveness Report. Countries such as China, India, Brazil, and Russia were in the top 10 in terms of expenditures on Research & Development in 2019.

In 2003, I was working on the previously men¬tioned globalization book. Back then, the consensus view was that under¬developed educational systems and a lack of regulations aimed at stimulating creative thinking and innovative behavior were seriously hampering innovation in emerging markets. However, over the last decades, several emerging markets have been striving to develop skills and talent through educational policies.

Another reason we need to understand the new role of the largest emerging markets is that their rise and development will continue throughout the coming decades. Unfortunately, we will likely see short-term economic crises and social unrest, but the consensus view is that a different world will have emerged by 2050. We are moving toward an emerging market century.

GT: What kind of challenges and difficulties does NEP-9 face in getting more involved in global governance?

Ebbers: The NEP-9 countries face a dilemma in their orientation toward global governance. On the one hand, these countries are increasingly dependent on the existing institutional frameworks. On the other, their interventionist policies put them into tension with the doctrines of global institutions.

There are two views on this issue. The first view emphasizes confrontation. In this confrontation view, the NEP-9 threatens the current rules-based world order. This idea is supported by the more aggressive bargaining, coalition building, and growing regional initiatives, resulting in a standstill in the WTO discussions.

The second view accentuates coop¬eration. This is what I call the collaboration view and is, in my opinion, the correct way to look at the present situation. From this perspective, the NEP-9 uses the existing global governance order. Although they will seek incremental adaptations of the current rules and institutions, they do not want to change the system fundamentally because they have been the chief beneficiaries of globalization.

They are as dependent as the West upon the smooth functioning of an open global economy for their economic success and political stability. They want to see changes in the worldwide architecture but are not system changers.