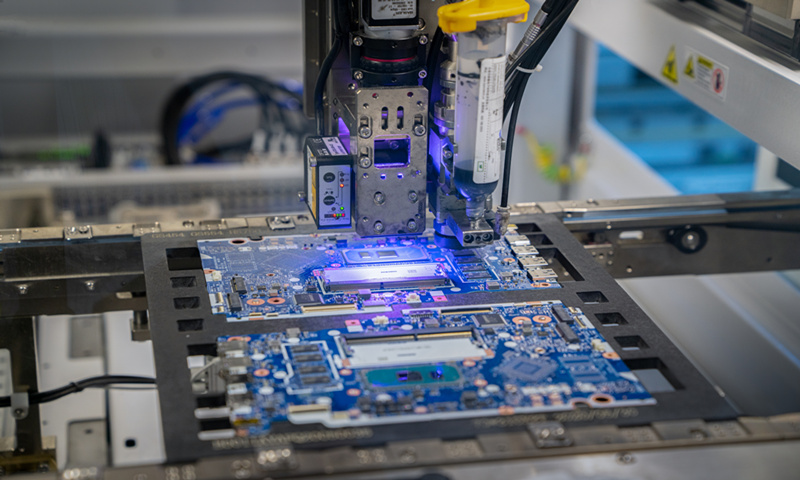

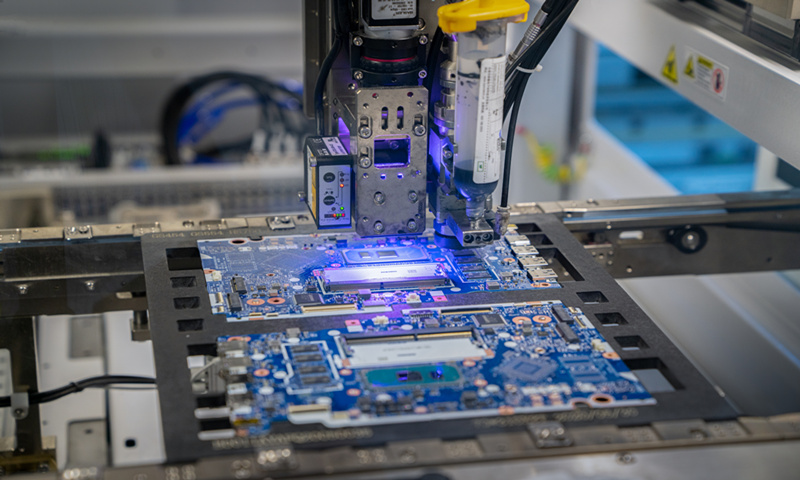

A chip manufacture machine Photo: VCG

Chinese smartphone maker Oppo unveiled its second self-developed microchip on Wednesday, a fresh effort as more Chinese hardware companies speed up investment in the semiconductor sector amid a relentless US crackdown on the Chinese technology industry.

The chip is called MariSilicon Y, and it is a flagship Bluetooth audio System-on-a-Chip (SOC) that significantly improves the audio quality and digital devices' intelligence, Jiang Bo, the senior director of Oppo's semiconductor sector, said on Wednesday during the Oppo Inno Day 2022 event.

The scaled-up efforts come as Washington mounts efforts to intensify crackdown on China's chip industry. In October, the US government announced a broad set of technology export controls, including a ban on shipments to China of certain semiconductor chips made anywhere in the world with US equipment. It is also reportedly ramping up pressure on its allies such as Japan and the Netherlands, attempting to get them on board with wider curbs to slow down China's capacities.

The US has repeatedly stretched the concept of national security and abused export controls to deliberately block and hobble foreign companies, which is pure economic coercion and technology bullying, China's Foreign Ministry spokesperson Wang Wenbin said on Wednesday in Beijing, in response to a reported US plan to blacklist more than 30 Chinese firms, including chip producer Yangtze Memory Technologies (YMTC) that would prevent them from buying certain American components.

China on Monday filed a lawsuit with the WTO over US export controls, firing the first shot against discriminatory US practices.

Other smartphone makers including Xiaomi and Vivo have prioritized self-developed chipsets in their strategies in recent years, following the trailblazing move of boosting chip self-sufficiency by Chinese tech giant Huawei.

This trend is a boon for the domestic chip sector, as it will mobilize resources across the industry and maximize the input, independent tech analyst Ma Jihua told the Global Times on Wednesday.

"Chinese vendors typically start with developing chips that are not of critical importance, such as those used for image processing and vehicles. But when the scale of domestic chip production and shipment reaches a tipping point, it will pave the way for advancing into more high-end chips, such as central processing units," Ma said.

After almost two years of work, domestic chip design and manufacturing firms have been making progress at a faster-than-expected speed, which industry insiders said would be consequential for pushing back the US-led blockade.

"China is adding about 100 new production lines of mature manufacturing processes every year, and the related technology is advancing faster than expected," Xiang Ligang, a veteran telecom industry observer, told the Global Times on Wednesday.

In a milestone, Shanghai-based companies have achieved mass production of semiconductors with 14-nanometer process, Chinese officials announced in September. China has also made breakthroughs in 90-nm lithography machines, 5-nm etching machines, 12-inch large silicon wafers, central processing units and 5G chips.

As China accelerates its self-sufficiency push, foreign semiconductor makers are displaying increasing resistance to align with US policies, which also leaves more room for the Chinese semiconductor industry to defy US unilateralism and expand global cooperation, analysts said.

According to a Bloomberg report on Monday, Japan and the Netherlands have agreed in principle to join the US in tightening controls over the export of advanced chip-making machinery to China.

On Tuesday, ASML CEO Peter Wennink questioned the US pressure on the Netherlands, saying that US companies have benefited from ASML's export suspension of most advanced lithography machines to China.

Xiang said that the comment indicated that selfish moves by the US would lead to severe losses for its allies, in particular companies like ASML. "It showed that ASML is dissatisfied with the US' double standards, which encouraged its own companies to sell high-end chips to Chinese companies but forbids its allies from doing so," Xiang said.

ASML has been expanding production of extreme ultraviolet lithography and deep ultraviolet lithography amid a crunch in chip supply that started in 2021. Tightened export restrictions involving the Chinese market would lead to an overstocked inventory for ASML and difficulties in its operation, he noted.

"Under US pressure, Japan and the Netherlands are not even allies but captive laborers who want to run away at any time," Xiang added.

Oppo's SOC is produced by the N6RF technique of TSMC, and will initially only be available for use in Oppo's phone series, according to Jiang.

Jiang said the launch of the new chipset signals that the company has made a further advance in building self-developed chip capability.

But it is just "a small step" in Oppo's development of self-made chips, a journey that is set to be long and difficult, he said.

The Chinese vendor launched its first self-developed 6-nm chip MariSilicon X, an image-processing neutral processing unit, in December 2021. The chipset is placed in the company's Find X series of smartphones, and shipments have exceeded 10 million to date.