An oil pump is seen in Almetyevsky District, Republic of Tatarstan, Russia. File Photo: CFP

European countries began to stop oil and gas imports from Russia in 2023, which will inevitably deepen the continent's energy crisis this year, experts said on Tuesday.

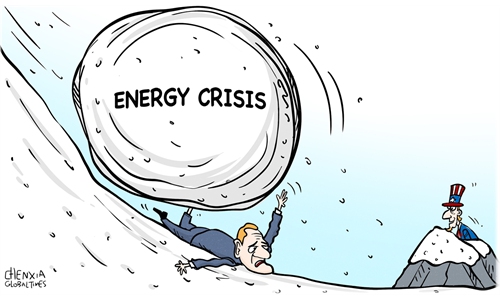

They said the US would become the biggest winner by instigating the prolonged Russia-Ukraine conflict and deliberately stoking Europe's energy "decoupling" from Russia, making Europe a victim of the US' pursuit of global hegemony.

While Germany's oil import halt from Russian pipelines reportedly took effect on Sunday, the British Foreign, Commonwealth and Development Office confirmed in a post on Twitter on the same day that Britain has ended all imports of Russian liquefied natural gas (LNG).

Moscow said earlier that it will ban the supply of crude oil and oil products from February 1, 2023 for five months to countries that agreed to the $60 per barrel price cap imposed on Russian seaborne crude.

"European countries will see a real energy supply crisis in 2023," Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University, told the Global Times on Tuesday.

Although European countries claimed they will stop importing Russian crude, they raced to stock up on cheap oil and natural gas from Russia through a variety of channels in 2022.

Now these countries began to take material action to stop importing Russian energy in 2023, but it will take a long time for the construction of pipelines needed for the transportation of oil and gas from other suppliers, and the continent will face a worse energy crunch in 2023, Lin said.

Experts blamed Europe's worsening energy crisis on the US manipulation, as the Biden administration wants to use the Russia-Ukraine conflict to strengthen Washington's network of allies, and, American energy giants want to replace Russia in order to force the exports of expensive American LNG to Europe.

Europe is heavily dependent on Russian energy. In 2021, EU members imported 155 billion cubic meters of natural gas from Russia, which accounted for 45 percent of the bloc's gas imports, according to figures released by the International Energy Agency (IEA).

However, Europe has been deeply hurt by the sweeping sanctions the West imposed on Russia since the outbreak of the Russia-Ukraine conflict, exacerbating the severe energy shortage there.

Russian gas giant Gazprom exported 100.9 billion cubic meters of natural gas to countries outside the former Soviet Union in 2022, down 46 percent year-on-year, Bloomberg reported, citing Gazprom CEO Alexey Miller.

The company's deliveries to Europe have been shrinking for months, as Russia hits back at Europe's sanctions, according to the report.

The EU could face a shortfall of nearly 30 billion cubic meters of natural gas in 2023, according to the IEA. The agency predicted that the EU's potential gas supply-demand gap could reach 7.6 percent of the EU's total natural gas demand, which is estimated at 395 billion cubic meters for 2023.

The EU will probably become "a piece of fat meat" for the US, as the US is striving to replace Russia to be the largest energy supplier to Europe by pushing it to cut Russian supplies, Zhang Hong, an associate research fellow at the Institute of Russian, Eastern European and Central Asian Studies of the Chinese Academy of Social Sciences, told the Global Times on Tuesday.

In addition to weakening Russia through the sweeping sanctioning measures, the US also wants to weaken the global competitiveness of the EU - the only power capable of competing with the US in cutting-edge technologies at present - and to reap political, economic and energy benefits, Zhang said.

The European Commission in November predicted that the 27-nation EU bloc would contract both in the fourth quarter of 2022 and the first quarter of 2023.

European industry is losing its competitiveness and appeal among investors due to high energy prices, Thomas Schäfer, brand chief executive officer (CEO) of German carmaker Volkswagen, said in a post on social media in late November.

"Europe is not cost-competitive in many areas, in particular, when it comes to the costs of electricity and gas," he said.

As a result, some European businesses in certain industries have been forced to relocate or will go bankrupt, while some countries have injected liquidity into enterprises in trouble, according to media reports.

Uncertainties and challenges will continue to batter Europe, and the continent should resist the impact of US geopolitics and economic hegemony, according to Lin.