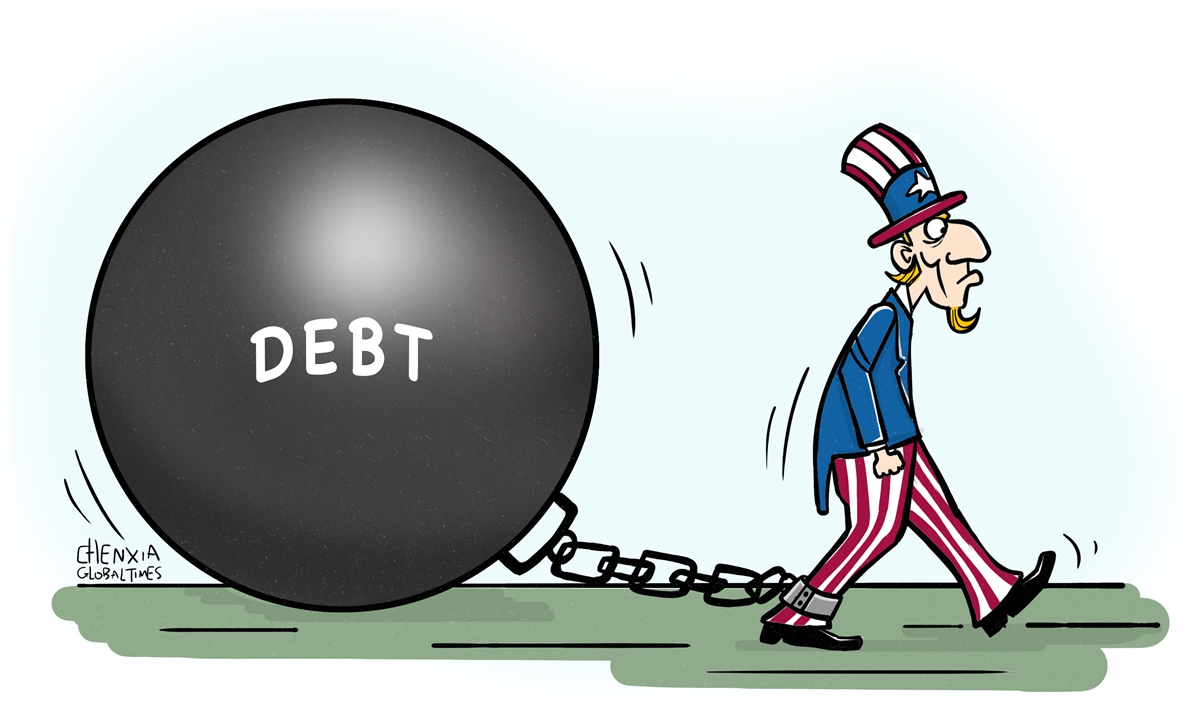

Illustration: Chen Xia/Global Times

With new leadership in the US House of Representatives, a clash between Democrats and Republicans over the debt ceiling faces a new round of crisis. The division and polarization in the US politics have already begun to erode the US economy, and if Democrats and Republicans are unable to compromise on raising the nation's rapidly approaching borrowing limit, the global economy may also feel the chill.With the US rapidly approaching the statutory debt limit, US Treasury Secretary Janet Yellen said in a letter to congressional leaders on Friday, "it is...critical that Congress act in a timely manner to increase or suspend the debt limit. Failure to meet the government's obligations would cause irreparable harm to the US economy, the livelihoods of all Americans, and global financial stability," the Financial Times reported.

The debt limit is a ceiling imposed by Congress on the amount of debt that the US Federal government can have outstanding. If the Federal government exhausts available resources, the US government would not have enough money coming in to make all of its payments, which go toward social programs such as Medicare, and toward important government functions, such as national defense and transportation.

After Republican Kevin McCarthy was elected speaker of the US House of Representatives earlier this month after a historic and embarrassing deadlock and 15 rounds of voting, many fear Republicans will use the battle over the US borrowing limit as political leverage to impose pressure on the Democratic-controlled White House. In his effort to gain the support of far-right House members, McCarthy has reportedly agreed to refuse an increase in the debt limit unless Democrats agree on major spending cuts. Expectedly, McCarthy was quoted as saying in a Reuters report on Sunday that he believes Democrats would agree to cap government spending to avoid a US debt default, although many analysts expect it won't be easy to find a bipartisan compromise plan over the debt ceiling.

As it's certain that Republicans will try their best to block anything proposed by Democrats and to make trouble for the Biden administration, the division and polarization in the US politics will be escalated. What happened in the highest hall of "US democracy" has become a political thriller with huge destructiveness, and it has generated a spillover effect on economic issues. This not only worries Americans, but also observers from quite a few countries internationally.

The frequently repeated risks of US government defaults on debt reflect the inefficiency of its governance system. This has become a major risk source to the US' economic growth and capital market fluctuation. Its spillover impacts have been passed on global economy through US Treasury bonds, US dollar and financial market, threatening global economic recovery and financial stability.

The division and polarization in the US politics can result in a standoff between the Republican-controlled House and the Democratic-controlled White House over the debt ceiling. If the US doesn't raise the debt limit, it may cause the US federal government shutdown due to a lack of funds. The US government debt default is likely to exacerbate economic damage from COVID-19, trigger sharp declines in stock prices and other financial turmoil, or make the US economy plunged into recession. The economic predicament will in turn push the government to expand expenditure in social relief to deal with unemployment, which will further worsen the government's financial position.

Moreover, once the US government debt default takes place, its national credibility will be severely affected. Investors will lose interests in US Treasury bonds. Considering that the US dollar is the main currency for international trade and savings, a default of the US government debt and the depreciation of the dollar would lead to rising international raw material prices, business difficulties and even bankruptcy, triggering a new round of global financial crisis.

Even if the two parties in the US Congress temporarily put aside their differences and raise the debt ceiling again to avoid a government shutdown, it may only delay the crisis temporarily.

The US politicians and lawmakers from both parties should take responsibility to manage spending reasonably and reshape fiscal sustainability, instead of waiting until the debt level is approaching the red line repeatedly and using raising the debt ceiling as a bargaining chip for political interests, which is irresponsible to the US economy, but also to the global economy.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn