ASML Photo: VCG

In an interview with the Financial Times published on Thursday, Peter Wennink, chief executive officer of Netherlands-based chip equipment maker ASML, called on the Dutch government to opt for "reasonable" controls on chip equipment exports to China that will not have a "major impact" on key global industries.

The boss of Europe's biggest chipmaker also said in another interview with Bloomberg News that US government-led export control measures against China could eventually push Beijing to successfully develop its own technology to churn out advanced chip-making machines.

His comments came as media reports said that Dutch and the US officials are set to meet in Washington on Friday to discuss potential new controls on exporting chip-making equipment and technology to China and that the Netherlands will soon agree to join the US in tightening export restrictions to contain China’s rise.

It is not hard to see how desperately ASML wants Dutch government to give more consideration to corporate interests in talks with the US government, when it comes to the chip technology export bans, which are most likely to disrupt the global semiconductor industrial chain.

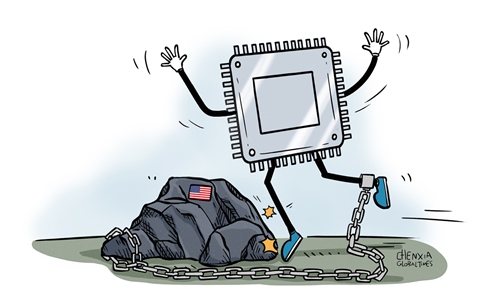

The reason behind their stance is obvious. The global semiconductor industrial chain is one that embodies broad collaboration and global division of labor, and China is already the world's largest semiconductor consumption market. Given China's position in the global semiconductor supply chain, it seems to be self-defeating for the US to coerce its allies into cooperating with its highly discriminative and unethical export bans, which will only make more companies like ASML fall victim to Washington’s geopolitical game.

For instance, Wennink said in October that the latest US controls on exports of semiconductor technology could affect up to 5 percent of ASML's order backlog, according to an earlier Reuter report.

And, what the Biden administration has done to contain China’s tech rise is now hurting America’s own businesses. Just take a look at what Lam Research, one of the three biggest providers of chip-making equipment in the US, is facing to see the heavy price of passively being cannon fodder of Washington’s trade ban -- a prospect that all non-US semiconductor companies should note with alarm.

During Lam's second-quarter 2023 earnings call on Wednesday, its CEO announced that it would lay off 1,300 employees, or about 7 percent of its workforce, as it expects to lose out on as much as $2.5 billion, or about 13 percent of its 2022 revenues in the year as a direct result of the Biden administration's latest export ban against China.

However, it should be noted that while there will be no winners in the US-led technological war against China, it is still essential for China to consider the big picture with regards to how to shore up cooperation and reduce losses. No matter what stance the Dutch government takes when it comes to the US export ban, it doesn't necessarily mean China needs to reduce cooperation as a means of retaliation, or it would fall into the planned US trap.

Take ASML as an example. Even if the company were restricted from selling certain advanced machines to China, other forms of cooperation between Chinese companies and ASML could still be allowed. In fact, in some new technology areas, leading Chinese enterprises have shown growing capacity for independent innovation and research, and they can strengthen cooperation with ASML.

The same logic also applies to China-Netherlands high-tech cooperation. The Netherlands is one of the most competitive and innovative countries in the world, while China is pursuing an innovation-driven growth strategy, which means there is great potential in bilateral cooperation. Indeed, recent years have already seen the two countries establish a solid foundation in tech partnership in clean energy, batteries and carbon neutrality.

Most importantly, China provides a huge market space for the market-oriented application of advanced technologies, which could serve as a continuous impetus for technological innovation in the Netherlands.