Throngs of people visit Yuyuan Garden in Shanghai during the Lantern Festival on February 5, 2023. Photo: cnsphoto

Although there are still great uncertainties ahead, the Chinese economy is likely to rebound strongly in 2023. This observation is based on two rationales. First, because of the low base GDP growth rate of 3 percent in 2022, the base effect will play an important role in shaping China's growth rate in 2023. Second, China still has ample room to implement expansionary macroeconomic policies to stimulate the economy when necessary. Barring "black swan" events, China's GDP growth rate in 2023 should exceed 5 percent. To boost confidence, the Chinese government could set the GDP growth target at 6 percent for 2023.

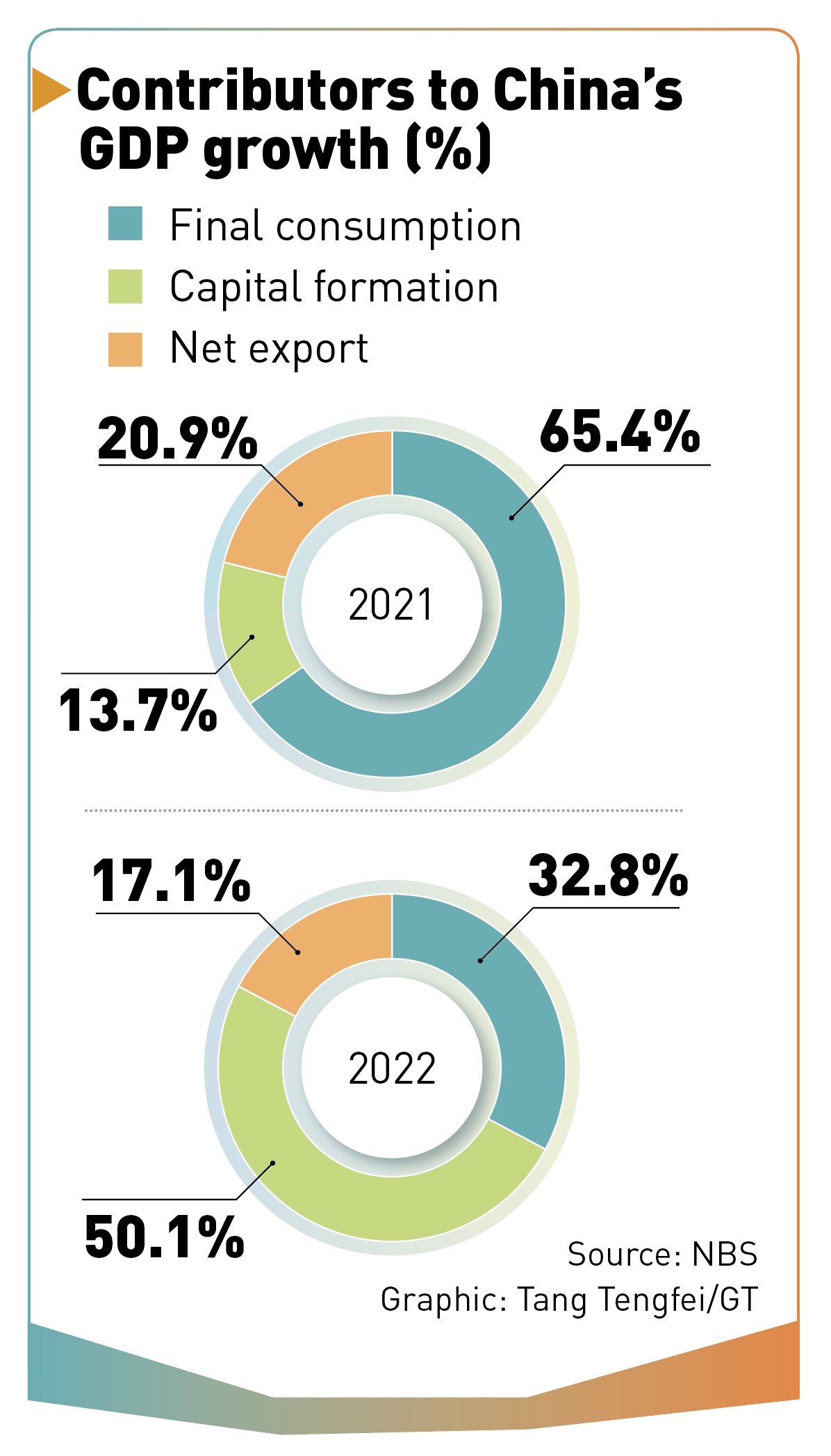

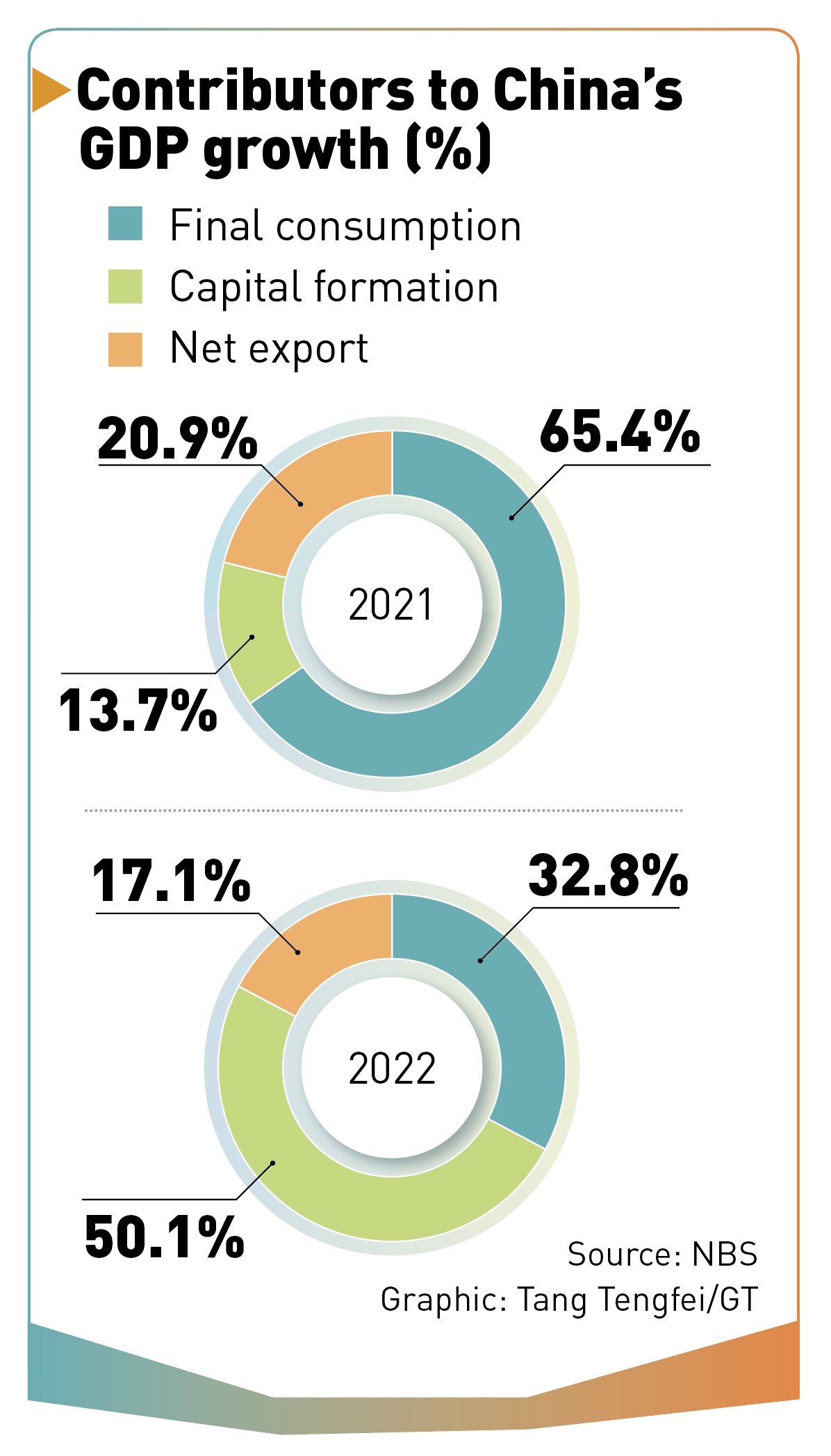

The most recent official statistics show that the contributions of final consumption, capital formation, and net exports to China's GDP growth in 2022 were 1 percent, 1.5 percent, and 0.5 percent, respectively.

Consumption accounted for some 55 percent of GDP. It should be the most important contributor to GDP growth. In fact, in 2021, its share of the contribution to GDP growth was 65.4 percent. However, in 2022 the share shrank to just 32.8 percent. Certainly, China needs to see a strong recovery of consumer demand, but it remains unclear how direct stimulation measures will work out. While consumption may "rebound with a vengeance" in the short term, it won't last if household incomes fail to increase and income expectations fail to improve. Measures such as issuing consumer coupons, as advocated by many scholars, may be necessary for poverty alleviation and social stabilization. But these measures may not work to encourage households to spend more in a sufficiently large and sustained way. Instead, households may save more, because they have purchased certain goods and services with coupons. The key to promoting household consumption is an increase in household incomes based on economic growth.

For decades, China's economic growth was mainly driven by investment. Though since 2010, the contribution to GDP growth by investment has decreased significantly. However, in 2022 growth in investment once again became the main driver for GDP growth. Its share of contribution to GDP growth surpassed 50 percent.

Investment in China consists of three main categories: Manufacturing investment, real estate investment, and infrastructure investment. In 2022, manufacturing investment increased by 9.1 percent over the previous year. A very encouraging development in manufacturing investment that emerged in 2022 was the rapid increase in investment in high-tech industry, an increase as high as of 18.9 percent.

Growth in real estate investment has been falling since 2021. It continued to fall in 2022, and registered a pathetic growth rate of minus 10 percent.

Infrastructure investment grew by 9.4 percent in 2022 and played a key role in offsetting the negative impact of the fall in real estate investment on the growth of fixed asset investment in 2022.

Fixed assets investment will probably continue to be the key driver for China's GDP growth in 2023. Among fixed asset investment, manufacturing investment is likely to be decided mainly by market forces related to industrial and technological development. Probably, growth in real estate investment will be stabilized in 2023 and regain positive ground, due to a series of new measures introduced by the government aimed at stabilizing real estate investment. It is difficult for real estate investment to become a major driver for GDP growth in 2023.

Infrastructure investment supported by governments will continue to play an important role, if not the most important role in driving China's growth in 2023. Contrary to arguments made by some economists, China does not have the problem of excessive infrastructure investment. The epidemic shows that China's public health infrastructure is far from enough. The same is true of many other areas. Compared with developed countries, China's infrastructure gap is huge on a per capita basis. It is undeniable that the waste in infrastructure investment is huge and China has built too many white elephant projects. However, the question is not whether investments should be made, but how.

China's net exports made important contributions to its GDP growth in 2022. Nevertheless, exports will face great uncertainties in 2023. With a grim global economic outlook, exports are less likely to become a strong driver for the economy. What's more, in order to implement the dual-circulation strategy, China should further adjust its export policy to improve efficiency in the cross-border allocation of resources. China should not fear running a trade deficit for a period of time to reduce its holdings of foreign exchange reserves. This is not advocating the giving up of the overseas market, but to argue for putting companies - both importers and exporters - on a level competitive playing field. Chinese companies should rely on their own competitive advantages to make inroads into overseas markets, rather than relying on market-distorting incentives such as increasing export tax rebates and maintaining an under-valued currency.

In the face of weak domestic demand, the main macro policy tool has to be expansionary fiscal policy. In 2023, China's fiscal deficit and the fiscal deficit to GDP ratio may need to be increased. There is no need for China to adhere rigidly to the "budget deficit to GDP ratio cannot exceed 3 percent" dogma. To cover the fiscal deficit, a significant increase in government bond issuance may be required. In order to facilitate the issuance of government bonds, it is important to strengthen cooperation between the Ministry of Finance and the central bank, and monetary policy should be conducive to minimizing the cost of the issuance of government bonds.

Graphics: GT

China still has room for expansionary monetary policy. As the most important monetary policy tool, the weighted average deposit reserve ratio of Chinese financial institutions is about 7.8 percent. In comparison, the reserve requirement rate in the US is zero. Various other policy interest rates in China, such as R007 and MLF still have room to further be lowered, when necessary. In particular, it should be emphasized that monetary policy should play an active role in helping small and medium-sized enterprises repair their supply chains, resume normal operations, and prevent them from going bankrupt due to liquidity shortages. On the other hand, lessons from the past should also be learned: Non-market-oriented methods should not be used to force commercial banks to expand credit to enterprises and households regardless of profitability and risks.

The room for China to implement expansionary fiscal and monetary policies essentially comes from China's low inflation in the last decade. In 2023, China's inflation rate is likely to rise. This may come from multiple sources. First, due to the epidemic over the last three years, China's production capacity has been seriously affected. The repairing of supply chains and elimination of production bottlenecks may need more time than expected. As a result, supply may not be able to respond quickly to the rebound in demand after the reopening. The imbalance between supply and demand may lead to an increase in inflation at least for a certain period of time in 2023. The rise in inflation will constrain the use of expansionary fiscal and monetary policies. Second, expansionary fiscal and monetary policies and some forms of fiscal deficit monetization per se will create certain inflationary pressures on the economy. Third, de-globalization, trade conflicts between China and the US, disruptions in global supply chains, and rising food and energy prices caused by the conflict between Russia and Ukraine all will create imported inflationary pressures on China. Fourth, the possibility of another round of depreciation of the yuan and the resulting inflationary pressure cannot be ruled out. Therefore, we should be fully prepared for the possibility of the building up of inflationary pressures in 2023. Yet, it should also be recognized that in order to maintain a decent economic growth rate, China may need to endure a higher inflation rate than in the past within a certain period of time. Perhaps, the government may need to set an inflation target for 2023 to constrain the use of expansionary macroeconomic policies. Besides macroeconomic policy, adequate preparations at the industrial and micro levels should be made to ensure a sufficient supply of food and other daily consumer goods.

Fundamentally speaking, expansionary macroeconomic policies only bought time to create conditions for deepening reforms. China cannot wait indefinitely until the inflation situation deteriorates and the room for using expansionary macroeconomic policies has been exhausted. Instead, while implementing expansionary macroeconomic policies, China needs to accelerate and deepen economic system reforms.

More specifically, China has to implement the program set by the Third Plenary Session of the 18th Central Committee of the Communist Party of China a decade ago, to "put in place a modern market system in which enterprises enjoy independent management and fair competition," "build a law-based and service-oriented government," and establish the basis "for the market to play a decisive role in the allocation of resources."

As long as China implements expansionary fiscal and monetary policies prudently while persisting unswervingly in reform and opening-up, it will surely be able to overcome the current difficulties, thereby ensuring the realization of its Two Centenary Goals.

The article was compiled based on a recent interview of Yu Yongding, Member of the Chinese Academy of Social Sciences. bizopinion@globaltimes.com.cn