Europe remains largest importer of Chinese photovoltaic products

Exports expected to increase in 2023 amid energy and geopolitics crises

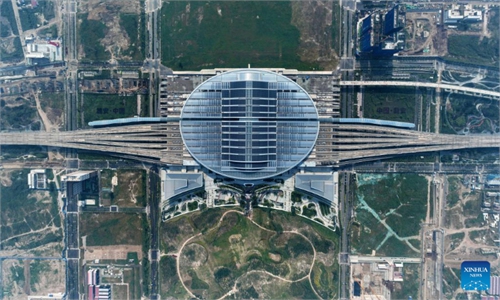

Photovoltaic panels in Sihong, East China's Jiangsu Province Photo: VCG

China recorded new highs in output value and the export of photovoltaic (PV) products in 2022, with Europe remaining the most important export market, accounting for more than 50 percent of total exports, data from domestic industry group showed. It means that China has made important contributions to maintaining global energy security and stability, especially alleviating energy crises in the EU region.

"With the rapid development of our PV industry, the iterative upgrading, which has exceeded the level and supply capacity of related equipment manufacturers in the EU, as well as being cost-effective, make our products best-sellers in the world," Qi Haishen, president of Beijing-based THE Solar Tech Co, told the Global Times on Sunday.

China has formed the world's most complete industrial chain from silicon materials, silicon ingots, rods and wafers, battery cells, and modules, as well as inverters to PV product applications. Its PV industry has taken a lead in the world, with about 70 percent of the global output.

World leader in PV

China, in fact, ranked first in PV module output for 16 consecutive years in 2022, with polysilicon output for 12 consecutive years, new PV installed capacity for 10 consecutive years, and cumulative PV installed capacity for eight consecutive years, according to data from China Photovoltaic Industry Association (CPIA).

In 2022, the PV industry output value totaled 1.4 trillion yuan ($204 billion), reaching a new high, according to statistics from the Ministry of Industry and Information Technology.

The total export of PV products, including silicon wafers, cells, and modules, exceeded $51.2 billion in 2022, up 80.3 percent year-on-year, effectively supporting the growth of the PV market at home and abroad, and the global demand for new energy, according to statistics from CPIA.

The Netherlands, Brazil, and Spain were the top three markets for China's PV module exports in 2022, accounting for 46 percent of the total export market. The demand for PV in Europe is also rising, and the export share accounts for more than half, with the export volume up 114.9 percent year-on-year. The market demand in Spain, Germany, and Poland is growing significantly, said CPIA on Thursday during an annual meeting.

The explosion in demand in Europe, fueled by anxiety over the Russia-Ukraine conflict and soaring energy prices, has made its plans for energy independence more urgent than ever, according to industry insiders.

PV products, which have a short assemblage period and flexible application scenarios, have become the first choice for increasing local energy in Europe.

According to preliminary statistics from the European Photovoltaic Industry Association, new PV installations in the 27 European Union countries surged by 47 percent in 2022 compared with the same period in 2021, more than double the number in 2020.

Opportunities vs. risks

Looking ahead to the year 2023, the European and global PV market is still expanding. Industry insiders said that China's PV exports may continue to increase as Europe is on the way to carbon neutrality and is diversifying energy supplies for security.

Faced with an energy crisis caused by geopolitics and extreme weather, the European Commission recently drew up plans for a massive bolstering of the PV sector.

Considering the comparative advantages of China's new energy industry chain in the global layout, especially the production capacity, supply chain stability, and price advantage, it is expected that the EU's demand for China's new energy products will maintain rapid growth in the future, Chen Jia, an independent analyst in international strategy, told the Global Times on Monday.

"In particular, the current high inflation and low economic growth in the EU will accelerate the demand for more cost-effective Chinese PV products," Chen noted.

With the gradual recovery of the global economy and the continuous promotion of environmental protection policies, the demand for Chinese PV products in the European market is still expected to continue to grow in the future, You Xi, co-founder of the Kandong app, told the Global Times.

However, analysts also warned that political risks remain for the development of Chinese PV enterprises in Europe and in the US.

Qi said that some politicians in Europe and the US use anti-dumping and countervailing investigations to initiate boycotts of or restrictions on China's PV industry, which happens frequently.

"However, China's PV industry chain has strong competitiveness, whether it be in the stable supply, the cost performance, or the advanced technology and technological upgrading, the comprehensive competitiveness is very strong in the world," said Qi.

The EU initiated anti-dumping and anti-subsidy investigations on imports of solar panels, cells, and wafers from China in 2012 and started imposing the duties in 2013, which was called an "industry earthquake" by an industry insider, whose company withdrew from the US market after 2012, when the US decided to increase tariffs imposed on Chinese solar panel and cell imports, which made it difficult for his company to "make ends meet."

"The US only took about 20 percent of China's PV export market, while the EU took more than half. If the US anti-dumping and anti-subsidy tariffs hurt China's PV industry, then EU tariffs would hit really hard," said the insider, who declined to be named.

He said that the whole industry worked together to rectify and come up with solutions. "It is important to let our European partners know that increasing tariffs on Chinese PV products will increase their own costs."

Chen also warned that the US is likely to step up pressure on the EU to start anti-dumping and countervailing investigations on China's direct and indirect exports of PV products to the EU this year.

According to Chen, the problem of energy supply in the EU is becoming more and more prominent after the year-long Russia-Ukraine conflict, and the EU's dependence on China's new energy exports is therefore increasing.