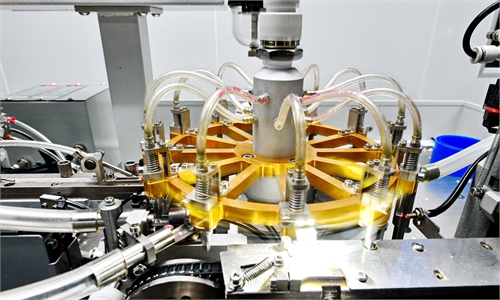

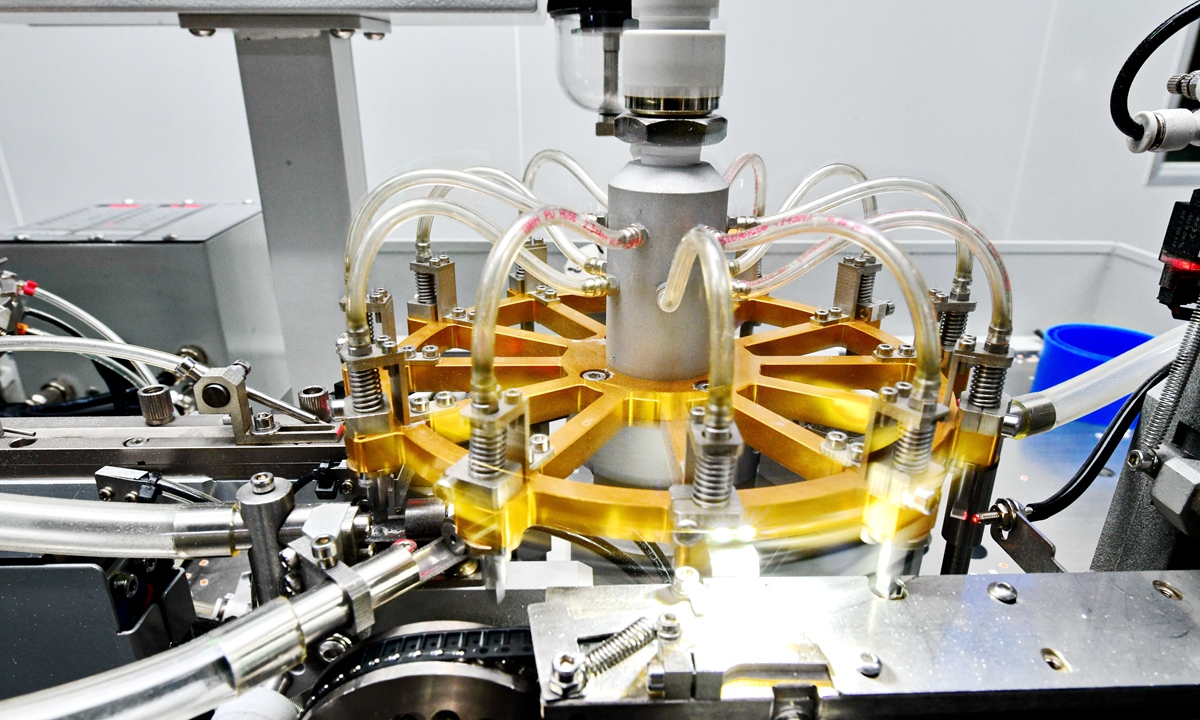

Manufacturing equipment of semiconductor products Photo: VCG

China's economic activity, measured by the manufacturing purchasing managers' index, has ticked up, as the PMI beat broad expectations, hitting 52.6 in January, the highest reading since April 2012. Barring any mishaps, the economy is projected to growth by at least 5.5 percent this year, according to a gauge by Chinese economists.A recent business survey shows that new orders have expanded for the first time since July and grew at the quickest pace since May 2021. The surveyed enterprises noted an improvement in foreign demand for Chinese manufactured goods, which provides some comfort for exporters amid slowing global economic growth, particularly in the developed economies like the US, EU and Japan.

In February, the economy saw a faster pace of recovery following a peak in the recent wave of COVID-19 infection cases as supply and demand both expanded, overseas demand kept rising, employment started to rebound, and logistics continue to recover rapidly.

At home, China has entered a new phase of COVID containment, with increased population mobility and consumer activity. Fine-tuning policy regarding the urban property sector and inspiring the internet-based platform enterprises has injected new impetus to the nation's economic recovery. The removal of stringent pandemic prevention and control measures has helped restore business operations and client demand, sending factory-output growth to the highest level since June 2022.

However, facing a complicated global geopolitical situation and the reckless and unrelenting technology decoupling by the US government, the foundation for China's economic recovery is not that solid, and it will take some time to fully restore consumers and investors' confidence, economists say. "We have the conditions, confidence and capabilities to ward off multiple risks and challenges," said Sheng Laiyun, deputy head of the National Bureau of Statistics.

China remains the world's second biggest economy as its GDP surpassed 121 trillion ($18 trillion) last year, pointing to a steady recovery trend despite a spate of headwinds including a gloomy global outlook and a weak property sector.

According to Chinese officials and economists, the country will maintain stable pro-growth macro-policies in 2023 with newly choreographed reform measures and increasingly optimized structural support to accelerate economic revival. Now with annual NPC and CPPCC (two sessions) approaching, investors and analysts are closely watching how the country will calibrate its monetary and fiscal policies when the top legislature and political advisory body meet in early March.

While there isn't any more room for the country's central bank to reduce interest rates or the required reserve ratio for commercial lenders this year, the country's relatively loose monetary policy is unlikely to be altered any time soon. At the same time, while a deficit-to-GDP ratio of 3 percent is traditionally considered a technical "fiscal red line", but the government could move to resort to an expansionary fiscal spending to help anchor a solid economic growth in 2023. There remains possible that the 3-percent ratio could be raised.

There are two effective ways to ramp up domestic demand - continuous elevated government spending on infrastructure build-up, such as inter-provincial expressways and high-speed railways and urban metro systems, and accelerating reforms aimed at increasing income levels of vast Chinese working families. An option would be to provide nationwide cash subsidies or consumption vouchers to low and middle-income households whose incomes were hit by the pandemic.

A consumption bounce back is already emerging bounce back, as sales revenue of consumption-related industries during the Chinese Spring Festival holidays which ended in late January, rose 12.2 percent year-on-year, and by 12.4 percent compared with the same period in 2019, according to the State Taxation Administration. Meanwhile, urban housing sale appear to be heating up after a three- year slump due to the pandemic and the government's deleveraging effort. Property development is expected to stabilize as policy adjustments filter through, helping this year's combined fixed asset investment growth in real estate to 4-5 percent this year.

In addition, the country's official data shows it has maintained its position as the world's largest manufacturing hub, with the value-added output of the whole manufacturing industry reaching 33.5 trillion yuan last year. Also, the country's gross domestic expenditure on science and technology research and development reached 3.1 trillion last year, a new record high.

The total added value for all industries exceeded 40 trillion yuan for the first time in 2022. The added value of the manufacturing sector reached 33.5 trillion yuan, showing that China maintained its status as the world's leading manufacturing hub. Also, the newly released data showed that 734 million jobs were created in 2022. Meanwhile, the increase of the consumer price index grew by 2 percent last year, significantly lower than 8 percent in the US, 8.4 percent in the EU and 9.1 percent in the UK, forming a sharp contrast between China's price stability and the "global inflation."

According to Chinese economists, while the overall strength of macroeconomic policies may be kept stable and moderate, the structure of support will likely be optimized to spur a consumption-led recovery and accelerate economic upgrading to increase the country's potential for high-quality development.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn