Lujiazui, a financial zone in Shanghai Photo: VCG

At a time when there is little doubt that China's economic recovery will be a major bright spot in a slowing global economy, it is strange to see some foreign companies' investment decisions appearing to be swimming against the tide.The American Chamber of Commerce in China said on Wednesday that for the first time in the 25-year history of its Business Climate Survey, China was no longer considered by most of its member companies as a top-three market, according to the South China Morning Post.

Also, David Livingstone, Citigroup Inc's chief executive officer for Europe, the Middle East and Africa, said in an interview with Bloomberg Television that the lender's clients are shifting supply chains away from China in a trend that is likely to last for years.

While Western narrative theory claimed that foreign investment is inclined to shun China due to geopolitical risks posed by tensions between China and the US, it cannot defy the fact that such golden investment opportunities presented by China's economic recovery are scarce in today's bearish global economic environment. If any foreign company misses out on the investment opportunity in China, it's their own problems to blame, not China's.

Indeed, latest data still suggests the Chinese market is no less attractive to foreign investment. In January, foreign direct investment into China, in actual use, hit at 127.69 billion yuan (18.49 billion), up 14.5 percent year-on-year, according to data from the Ministry of Commerce. The fact that China has kept a steady growth in attracting foreign investment is evident enough to show that most of the multinational companies are still optimistic about developing businesses in China in the long run.

This is because China's economic recovery has already been seen as the biggest certainty for the world economy this year. The IMF updated its World Economic Outlook and projected that China's economy will grow by 5.2 percent in 2023, 0.8 percentage points higher than the forecast in October last year. China will continue to be one of the major countries to see the strongest growth this year, and its contribution to global economic growth will stand at 30 percent, Steven Barnett, IMF Senior Resident Representative in China, said at a recent seminar on world economic situation.

Moreover, it should be noted that the Chinese economy is not just set to rebound, but also will achieve high-quality development. On the back of the economic momentum for recovery from the pandemic, China's economic transformation, which had slowed previously, has begun to return to the normal track, with signs of even accelerated pace.

For instance, the city of Yichun in East China's Jiangxi Province, known as Asia's lithium capital, recently announced to crack down on criminal activity, such as unlicensed and environmentally-damaging mining, with the view of protecting the environment and resources and ensuring the sustainable development of the industry. This could serve as a vivid example of the growing emphasis by authorities on the quality of economic growth by means of market guidance and supervision.

In fact, there are more and more signs that the high-quality development of the Chinese economy will be the basis for the formulation and implementation of economic policies and regulations in the coming period, which is also the foundation and path to the realization of common prosperity. Fundamentally speaking, high-quality development and common prosperity are both aimed at stabilizing residents' income sources and promoting consumption, so as to expand domestic demand and fuel economic growth. In other words, as the economic transformation proceeds, the improvement in market consumption and other economic aspects will be reflected in the more robust and sustainable economic growth.

Under such circumstances, China's high-quality growth will certainly create better investment opportunities for foreign companies. Of course, that also means to benefit and obtain greater returns from China's growth in the most efficient way, foreign companies need to make their investment plans in line with China's development trends.

It is possible that some foreign companies may encounter some difficulties, but they need to learn to coordinate with Chinese stakeholders to unlock solutions during the investment process.

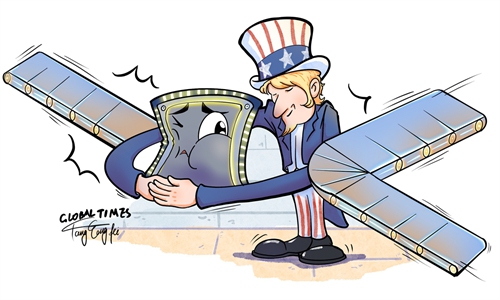

From the long-term and global perspective, there is almost no such colossal potential market as China with such large-scale manufacturing capability and logistics network, and not to mention China will continue to open up. If some foreign companies continue to find fault with the market, fail to seize the opportunity, or move with the US "decoupling" strategy, that is their problem and loss.