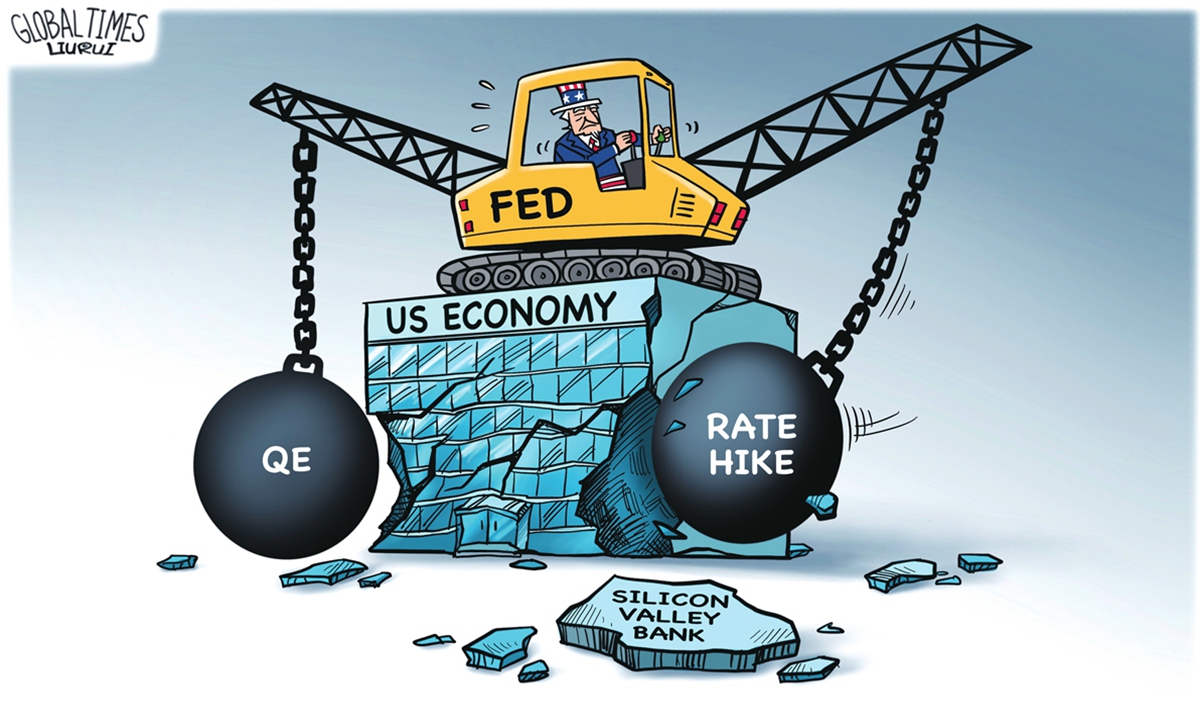

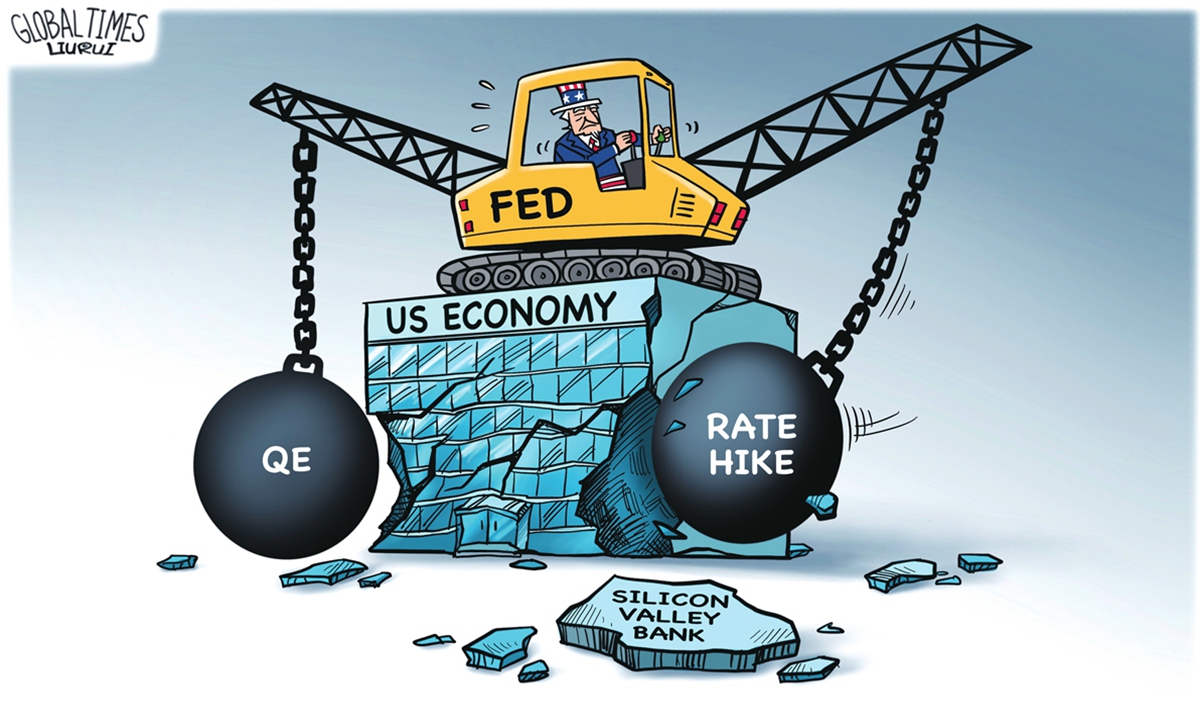

Illustration: Liu Rui/GT

On March 10, the Silicon Valley Bank (SVB) collapsed in what appeared to be just days after being in business for nearly 40 years. It was reportedly the 16th largest bank in the US and the largest collapse since the 2008 financial crisis. In addition, on March 12, the large New York-based Signature Bank was taken over by the Federal Deposit Insurance Corporation (FDIC). The response from the federal government, however, reveals deep internal contradictions in the US.

For starters, this has now raised massive questions about US financial stability. In the wake of SVB's untimely demise, depositors at Signature withdrew more than $10 billion in cash, which led to it falling as the next domino. Barney Frank, a former House of Representatives member and co-sponsor of the Dodd-Frank legislation, which was enacted in the wake of the 2008 financial crisis, told CNBC that this was a contagion effect - raising questions of further contamination in the banking sector.

Immediately, the Federal Reserve and FDIC, with total backing from the administration of President Joe Biden, said they would do "whatever is needed" to provide coverage for uninsured depositors at SVB, most of whom are extremely wealthy, and increase liquidity provisions for banks due to suspected "systemic risks." Many analysts saw this as an abandonment of free market principles and encouraging banks not to do their due diligence in risk mitigation.

However, it must be said that the death of SVB was precipitated by a number of factors owed to the Fed's interest rate hikes over the past year, as it works overtime to dampen inflation. Before the Fed tightened the monetary belt, it was essentially giving money out for free as interest rates sat at zero. This helped the highly speculative tech sector and start-up environment, but the money dried up once interest rates soared, which caused a bank run.

SVB invested its Fed-granted free money in 2020 and 2021, during the height of the ongoing COVID-19 pandemic when the Fed heavily intervened in the economy, into Treasury bonds and mortgage-backed securities. Interest rate spikes essentially turned these assets into dust, leading SVB to major losses when it sold them to catch up with cash withdrawals. Then the FDIC intervened when no other options were on the table.

In essence, SVB's heavy dependence on Treasury bonds and high-risk gameplay, which was informed by a view that the Fed would return to its lending-friendly policies in the near future, was the primary factor in its downfall. But now this raises questions about whether or not other banks are in a similar position, too dependent on holdings of Treasury bonds - and it turns out, as most analysts agree, that this is indeed the case, and the US banking sector is extraordinarily fragile.

In fact, the Financial Times just ran a story highlighting a study by economists at five major universities and found that "the US banking system's market value of assets is $2 trillion lower than suggested by their book value of assets." Moreover, it said, "10 percent of banks have larger unrecognized losses larger than those at SVB. Nor was SVB the worst capitalized bank, with 10 percent having a lower capitalization than SVB."

The report found, in no uncertain terms: "Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to insured depositors, with potentially $300 billion of insured deposits at risk… Overall, these calculations suggest that recent declines in bank asset values very significantly increased the fragility of the US banking system to uninsured depositor runs."

It's not just Treasury bonds that are faulty either, with the US real estate market presenting a major unrealized challenge. Due to the COVID-19 pandemic, and less of a need for commercial realization with many workplaces now online, the value of the commercial real estate has plummeted. This could prove a massive source of risk for banks around the country, which are heavily invested in the real estate market.

Regardless, in a country where uninsured cancer patients are left to fend for themselves and school children can accrue "lunch debt" for not having money for food, the Biden administration's immediate rescue of big banks and the ultra-wealthy reveals it to be yet another instrument of the capitalist class to protect its interests. Meanwhile, the Fed's rate hikes, which threaten domestic working-class wages and developing countries' prosperity, are also a systemic threat to the entire US financial sector.

The author is a Prague-based American journalist, columnist and political commentator. opinion@globaltimes.com.cn