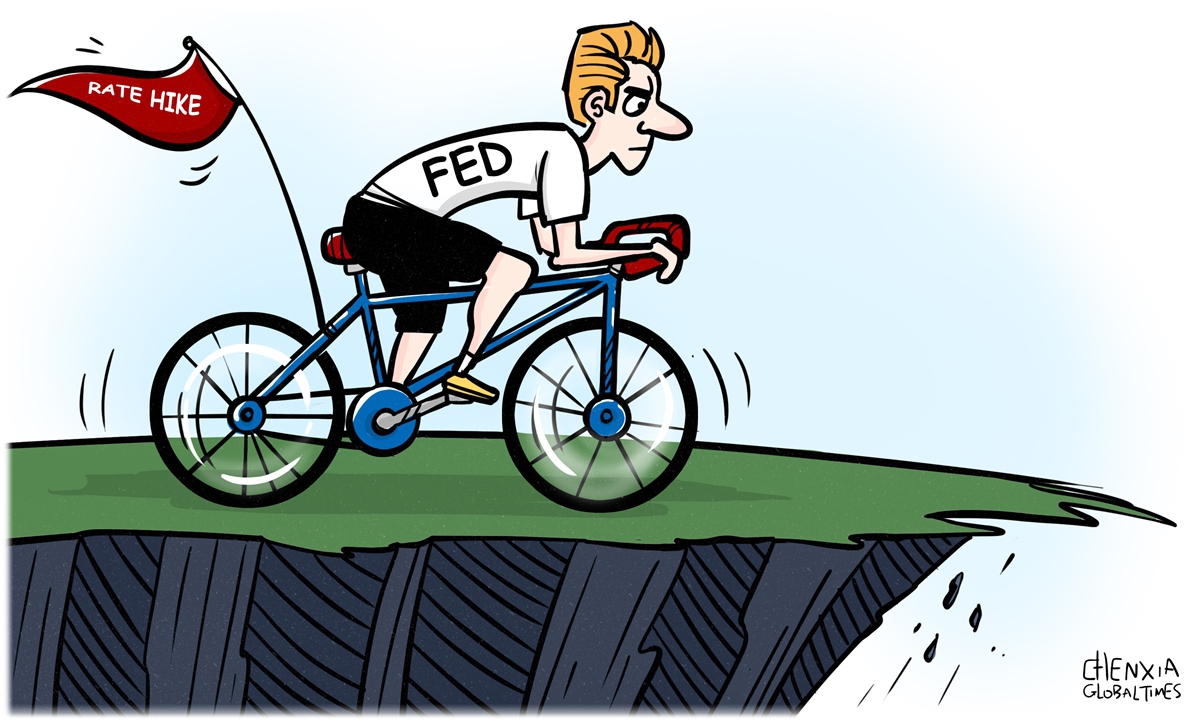

Western banking sector crisis may deteriorate if central banks insist on raising rates

Illustration: Chen Xia/Global Times

The banking crisis emerging in the US and Europe will most likely continue, if not deteriorate, and the global capital market will keep teetering due to this evolving grave uncertainty since the 2008 subprime crisis, despite knee-jerk and scrambled attempts by governments and central banks to rescue failed lenders and inject massive liquidity to prevent a credit crunch. Another chaotic run on a weak bank may occur at any time.Global investor's concerns are far from being defused as they are determined to sell off shares of small and mid-size banks which are vulnerable to a sudden run. Market confidence has been severely shaken across the board. The financially troubled midsize bank, First Republic Bank, based in San Francisco, California, saw its share price plunge more than 47% on Monday. Its market capitalization is down nearly 90 percent since the beginning of this month.

Last Thursday, 11 largest commercial banks in the US threw together a $30 billion cash rescue lifeline for the First Republic Bank, a move they hope to increase wealthy depositors' confidence in the lender and stick by the bank. But a run aided with internet technology on the lender seems to be ongoing, as jittery depositors act in a hurry to move their money from the lender to the country's largest banks.

To make things worse, more than 170 smaller banks in the US are reportedly set to face excessive exposure to market volatility over the coming weeks. After Silicon Valley Bank and Signature Bank went belly-up, investors are racing to figure out which other banks might be susceptible to similar troubles, as American depositors have kept withdrawing their savings from the weaker banks. The regulators tried to reassure spooked depositors and investors by emphasizing that the country's financial system is well capitalized and remains "safe and sound", but who knows what else the dirt is under carpet.

And the contagion has already spread to Europe. The capsizing banking giant Credit Suisse, with a 167-year history, is being acquired by UBS, in an emergency rescue deal facilitated by the Swiss government and its central bank in order to stem the financial market panic unleashed by the collapse of two American banks earlier this month. Investors feel baffled and dazed by Credit Suisse's rapid demise, one of the largest banks in Europe.

Extraordinarily, the takeover deal will not need the approval of shareholders after the Swiss government agreed to change the law to remove any uncertainty about the fire-sale of Credit Suisse to UBS. For a long time, banks in Switzerland have been renowned for their financial stability, attracting capital from all around the world. Now the financial storm is rendering the country's position as one of investor havens precarious.

Economists believe the latest round of banking crisis in Western countries is caused by the central banks, which rushed to raise the cost of borrowing in their attempts to curb runaway inflation and dampen rising consumer prices. After years of very low interest rates, that has come as a shock to those smaller banks whose capital adequacy can hardly match the big banks. Many smaller banks are trying to sell parts of their assets to hoard cash. If the US Federal Reserve and other Western central banks insist on bringing inflation to below 3 percent or even 2 percent by raising interest rates even higher, more banks are likely to collapse as their finances worsen.

The crisis triggered by the meltdown of SVB, Signature Bank and Credit Suisse will produce a negative impact on Western economies. The most immediate impact will be on bank lending, while the affected banks will voluntarily move to shore up their finances in order to survive a run.

Businesses and households will face mounting difficulty to borrow money from the banks as a result. So the episode will inevitably take a toll on the economies, which makes recessions more likely. Real estate developers, manufacturers and the services sector that rely on bank loans to finance business operations will pull back on expansion plans.

To stop the shockwaves from evolving into a bigger crisis, six Western central banks including the Federal Reverse, the Bank of England, European Central Bank and Swiss National Bank have rushed to keep cash flowing through global financial systems. In a statement, the six central banks said they had launched a coordinated and collective action to keep credit flowing. Under the arrangement, banks will be able to go directly to the six central banks for capital injections instead of borrowing on the open market. And, banks will be able to access this funding on a daily basis till the end of April.

The central banks said the move served as an "important backstop to ease strains in global funding markets" and reduce the impact on a tight credit supply on the global economy. This measure was last seen during the 2008 financial debacle and after the outbreak of the COVID pandemic.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn