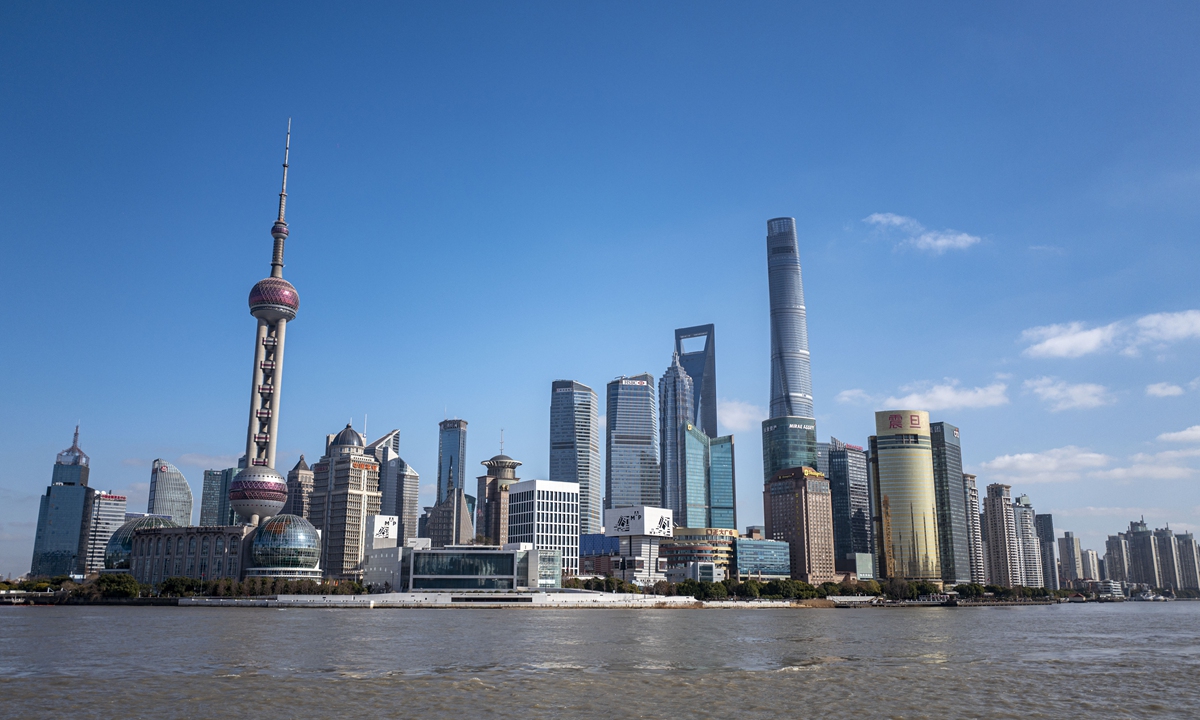

A view of Shanghai's Lujiazui financial district Photo: VCG

In the first two months this year, Shanghai's import and export value set a new record for the same period, reaching 681.56 billion yuan ($98.96 billion), an increase of 0.7 percent year-on-year, China Media Group reported on Wednesday.

Imports totaled 415.99 billion yuan, up 4.7 percent from a 4.7 percent decline in the fourth quarter of last year; exports reached 265.57 billion yuan, down 4.9 percent year-on-year.

One of the highlights of Shanghai's foreign trade operation is that private enterprises assumed the role as the "main force" of the city's foreign trade growth.

In January and February, the total import and export of Shanghai's private enterprises stood at 208.48 billion yuan, an increase of 13.1 percent, accounting for 30.6 percent of the total value of the city's foreign trade. The result lifted up the city's overall import and export growth of 3.6 percentage points, playing a vital role in stabilizing foreign trade and optimizing structure.

In addition, trade with other RCEP member countries gained pace. In the first two months, Shanghai's import and export to other RCEP economies reached 231.87 billion yuan, an increase of 2.5 percent.

The city's trade with the EU totaled 137.45 billion yuan, an increase of 5 percent, accounting for 20.2 percent of Shanghai's total foreign trade. High-grade auto imports and new-energy vehicle exports are the major drivers.

Imports and exports to the US reached 76.52 billion yuan, down 8.6 percent year-on-year.

New-energy industry exports maintained robust growth. Exports of electric cars increased a whopping 61.1 percent, lithium batteries soared 194.8 percent and solar panel exports rose 58.9 percent.

Exports of electronic products didn't fare well, with laptop exports falling 48.7 percent and cell phone exports down 18.6 percent.

Consumer goods such as automobiles and medicines became the main driving force of imports. With the gradual recovery of domestic consumption, imports of gold, vehicles and pharmaceutical products saw a significant increase.

China's official manufacturing PMI in February rebounded by 2.5 percentage points to 52.6, showing that the country's manufacturing activities boom up, so the demand for energy and minerals witnessed a sizable growth. In the first two months, the city's imports of iron ore increased 15.3 percent, with coal imports up 59.3 percent and aluminum ore imports soaring 192.4 percent.