Illustration: Tang Tengfei/Global Times

Recent financial market tensions have "added new downside risks and have made the risk assessment blurrier," European Central Bank President Christine Lagarde warned in a speech on Wednesday, during which she painted a rather grim, uncertain outlook for the eurozone.

While Lagarde refrained from pointing fingers during the speech, recent media reports suggest that European regulators are blaming the US for the current financial turmoil. The Financial Times reported on March 16 that European leaders criticized US "incompetence" over the Silicon Valley Bank (SVB)'s collapse, labeling the US handling of SVB's failure a "disaster" and claiming that Washington was failing to adhere to global rules. And on Thursday, CNBC reported that "European lawmakers are quietly miffed at US regulators over SVB's collapse," as regulators and officials across the EU have been nervous about potential contagion to their banking sectors after the turmoil in the US.

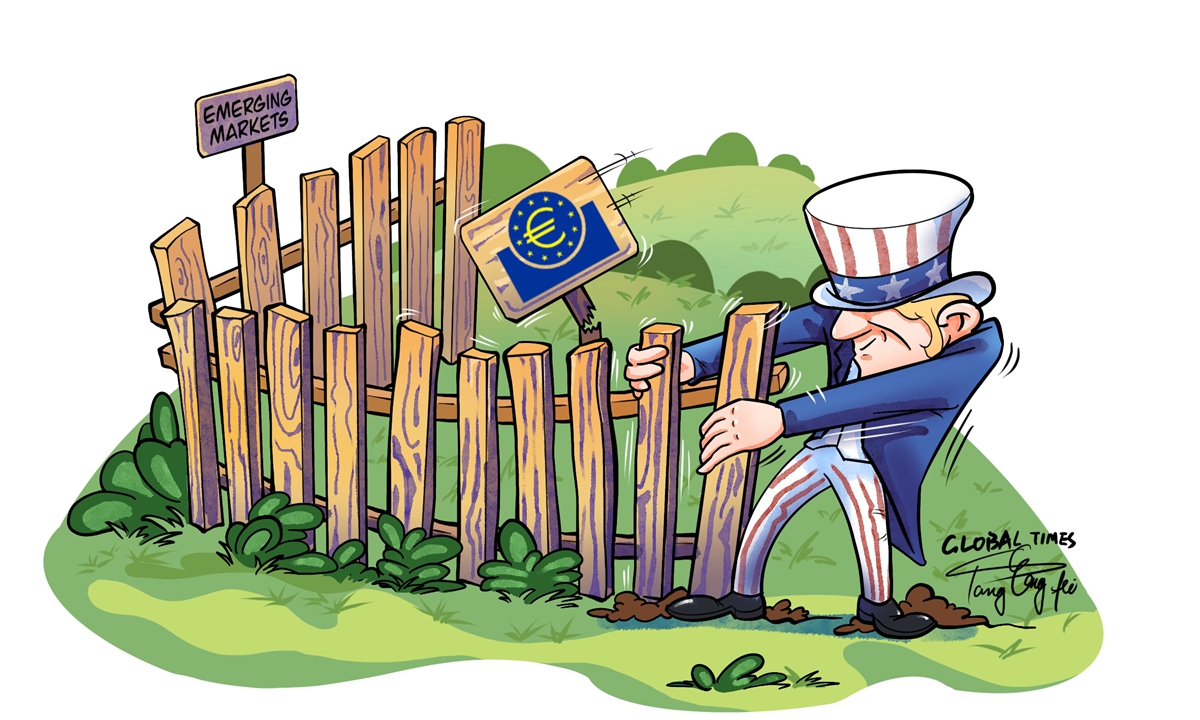

European leaders' nervousness and frustration is well justified, as the current market turmoil and profound uncertainty ahead is indeed caused by the US. In fact, the international community as a whole should be outraged by Washington's policy failures that have caused serious risks and challenges for the global economy. And yet, such risks and challenges appear almost certain to further intensify, as the US continues on its selfish path.

On Wednesday, the US Federal Reserve raised interest rates by a quarter of a percentage point, despite expectations that it might pause its aggressive rate hikes in light of the bank collapses. The move instantly sparked a chain reaction and poses a systemic risk to the global economy. Given the US dollar hegemony, such a move causes serious troubles for the global economy.

Going forward, Europe, as Lagarde suggested, will face a period of great uncertainty. Financial stability in Europe has been eroded by the US' abuse of its financial hegemony and irresponsible monetary policies. Regrettably, Europe is far from the only area that will face greater risks from the US' move. Emerging market economies around the world will also face serious challenges.

So, now is the time for emerging market economies to stay highly alert to possible systemic risks in the financial system. As the world has entered a period of turbulence and the global economy is facing a grim outlook, emerging market economies should be prepared for a severe financial shock spreading from the US to Europe and then Asia.

Indeed, the US had already caused plenty of trouble for emerging market economies with its aggressive rate hikes. In 2022, a spate of currency devaluations highlighted the intense pressure on many emerging market economies, as the Fed's rapid interest rate hikes contributed to the strengthening of the US dollar against other currencies. What's more, global debt has risen to dangerous levels, and some countries, like Sri Lanka, have been struggling under the weight of excessive liabilities of those outside its borders, mostly in the West.

And the situation has just become even worse. Fears of a global banking crisis increased following the bank failures in the US and Europe. Financial turbulence also triggered drops in yields for US Treasuries and Eurozone bonds, some of which are held by financial institutions in emerging markets. At the very least, some small banks may have to pull back on loans to preserve liquidity in the face of a potential banking crisis. Some analysts believe corporate defaults may also rise amid the tightening monetary environment.

Can emerging economies afford more rate hikes by the US, a stronger US dollar, accelerated capital outflow, higher borrowing costs, and turmoil in Western banking systems? The answer is not very reassuring. The US' abuse of its financial hegemony may lead to an outbreak of financial risks in some emerging countries in the foreseeable future. This is not a course anyone could take lightly.

In continuing its aggressive rate hikes, the US has clearly given too little consideration to the negative impact of its move on the global economy. If the US continues to adhere to its selfish policies and export financial risks, more emerging markets may suffer from prolonged financial turmoil. For now, holding a grossly irresponsible US accountable seems too hard. Yet, the US government is chipping away at its own economic hegemony with such irresponsible deeds.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn