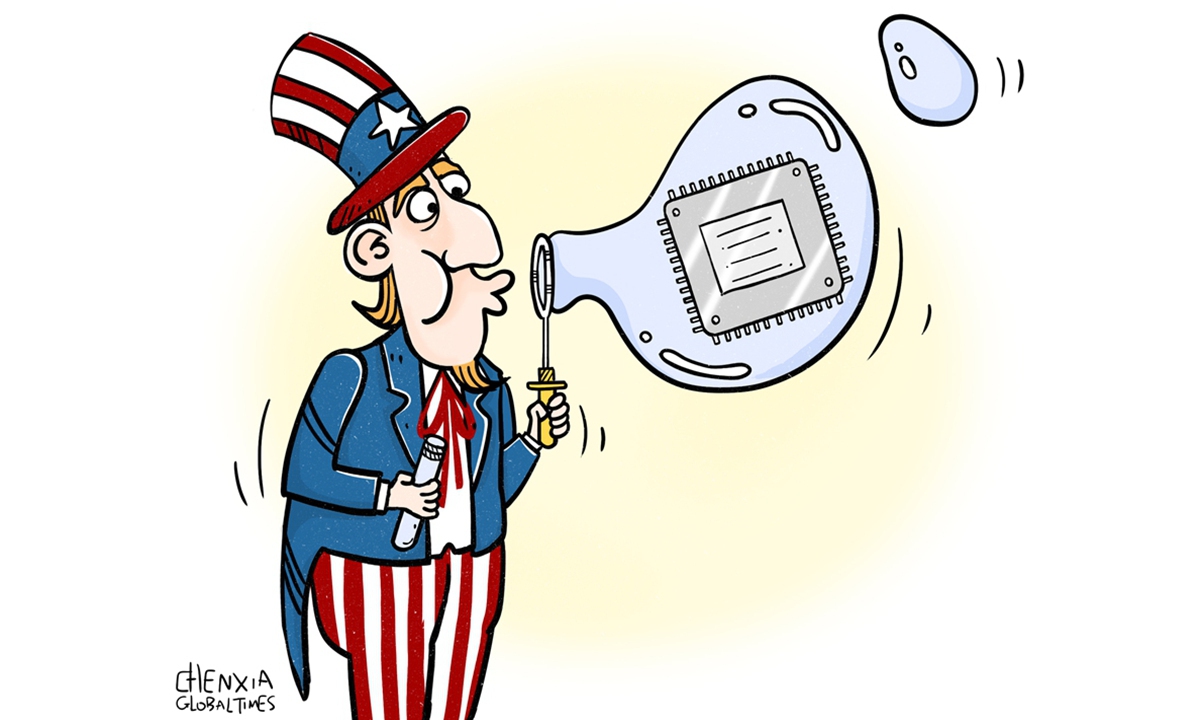

Illustration: Chen Xia/Global Times

Semiconductor companies seeking US funds under the US' CHIPS Act, which is designed to counter China in the semiconductor sector by luring companies to establish factories in the US with subsidies, will be asked to provide confidential business information including core financial information and detailed profit projections, Wall Street Journal reported, citing the Commerce Department. It has aroused concerns and dissatisfaction among Asian companies that are planning to build chip-making plants in the US.Even the sale price of South Korean semiconductors is required to be submitted. The US side has gone too far and has put Samsung and SK Hynix in a difficult position, South Korean media outlet Financial News reported on Tuesday. Samsung and SK Hynix's frustration and complaints are understandable as their plans to build chip-making plants have already been grappling with challenges including rising costs and recruitment difficulties in the US.

TSMC, a semiconductor company in China's Taiwan island, is also in the same awkward position as Samsung and SK Hynix. At the end of last year, TSMC announced that it would increase the investment in its new plant in Arizona, US, to $40 billion, more than twice the original plan. Regarding the unreasonable demands of the US subsidies, Economic Daily, a media outlet in the Taiwan island, said on Tuesday that Taiwan's semiconductor industry has become a chess piece or bargaining chip in the US' geopolitical games.

In 2021, the US government required major global chip manufacturers to submit core business data on the grounds of "improving the transparency of the supply chain," even deliberately using national power to force companies from other countries and regions to hand over their core business information. Under pressure from the US, companies such as TSMC and Samsung finally succumbed. The blatant chip hegemony of the US has accumulated too much dissatisfaction and anger among semiconductor companies in its allies.

For Asian semiconductor companies such as TSMC and Samsung, building factories in the US is not an independent business decision based solely on market rules, but a decision made under the interference and restrictions of international relations and geopolitics. Now the US has once again plundered core commercial secrets, it has exposed its sinister intentions to revitalize its semiconductor industry at the expense of companies from other regions. For Samsung and TSMC, the Biden administration's offer of subsidies for building plants looks more like a bait rather than an opportunity.

The US' CHIPS Act would harm the interest of Asian chip enterprises by forcing them to adjust their global development strategies and layout. Moreover, the subsidy will attach more strings on these companies' future business operation in the US. After its core business secrets were plundered by the US, in the competition with American semiconductor companies, only failures and losses awaited companies such as Samsung and TSMC.

In fact, Asian chip companies have started taking a cautious attitude toward the so-called chip subsidy of the US. Samsung and SK Hynix took a cautious stance toward the US government's announcement on the specifics of the CHIPS act for funding, saying that it is too early for them to decide whether or not to apply for the subsidies, according to South Korean media outlet The Korea Times.

As the US' repeated overbearing moves under its chip hegemony may spook Asian semiconductor companies like Samsung and TSMC, the US' attempt to disrupt the global industrial chain to contain China's development in the semiconductor is expected to encounter greater resistance in the future.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn