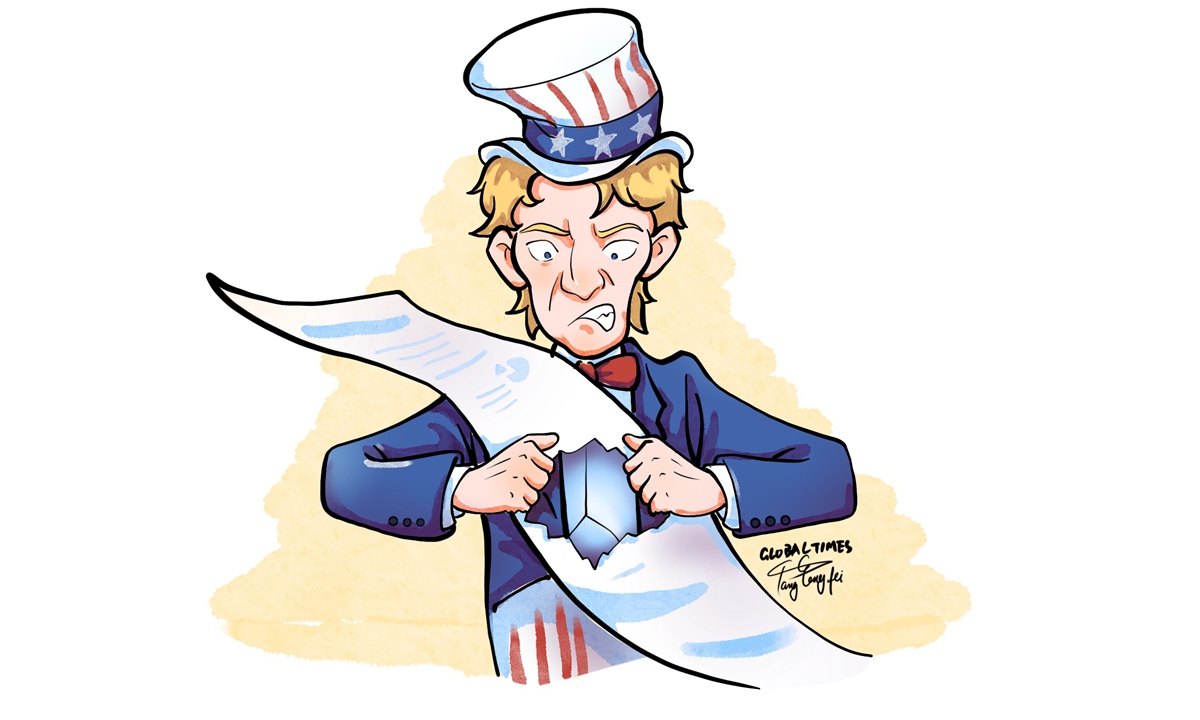

Illustration: Tang Tengfei/Global Time

The IMF said recently the global economy will largely remain dormant in the coming five years, growing by merely 3 percent annually because of inflation and higher borrowing costs in the developed countries led by the US. The figure is well below the average 3.8 percent GDP growth the world has attained during the past two decades.

The advanced economies' feeble performance is the result of their reckless policymaking during the COVID-19 public health crisis, as they relied on monetary and fiscal splurges to get out of the crisis, which turned out to give a free leash to inflation.

To make things worse, their current economic weakness will inevitably be aggravated by the US-led trade protectionism and technology "decoupling" attempt aimed at suppressing and containing China's growth.

In her curtain-raiser speech before the IMF's annual spring meeting to be held in Washington DC this week, managing director Kristalina Georgieva warned that as many as 90 percent of the advanced economies will experience a decline in their growth rate this year, with economic activity in the US and the eurozone broadly hampered by higher interest rates, set by their central banks.

With stubbornly elevated inflation, mounting geopolitical tensions and increasing fragmentation of global investment and trade system, the world's economy is on track to drop below 3 percent in 2023 and remain weak in the medium-term, Georgieva said. It is the IMF's most downbeat forecast for global economy in the past 30 years.

However, China's strengthened development will be a pleasant exception, which will give China's neighbors and faithful economic partners a relief.

Shrugging off the pandemic-related restrictive measures at the end of 2022, China's economy is humming again. Top Chinese officials have emphasized that China's economic growth is "strong," with March's performance ever better than that of January and February. Such official remarks were proved by two key indexes measuring the strength of the country's massive manufacturing sector and broader services. The official manufacturing PMI stood at 51.9, while the non-manufacturing PMI soared to 58.2 in March, according to the National Bureau of Statistics.

Other indicators have also shown an upward spiral for the economy. In the first two months, the country's total retail sales of consumer goods rose by 3.5 percent year-on-year, turning from negative to positive growth and fixed asset investment grew by 5.5 percent, 0.4 percentage points faster than the growth rate of the whole of last year. Exports also registered a positive growth. The real estate sector slump is coming to an end.

The fact that China's economy is gaining rising traction while the economies of the US, the UK, Japan and others are struggling, is a clear vindication that Chinese economy is already a juggernaut and an inexorable force that largely depends on "organic growth, self-efficiency and innovation" regardless of the nefarious impediment and sabotage by the US government.

Increasingly, China's neighbors and economic partners are to gain more benefits from interacting and integrating with China's giant economy, as evidenced by the booming ASEAN economy, the willing partners of the wealth-creating Belt and Road Initiative (BRI), and those economies that have maintained normal trade and investment agreements with China.

It is almost certain that any country, big or small, that aspires to contain China's growth by levying exceptionally high tariffs on Chinese goods, or imposing technology restrictions on China, is doomed to fail. Also, those measures are to backfire, as being proved by the persisting high inflation in the US since 2021. Without price stability, a country is unable to attain any factual economic growth, as the public will always gripe about cost of living woes.

The IMF said it expected that China and India will account for more than 50 percent of the global economic growth this year. Thanks to the stronger-than-expected economic recovery since January, particularly in retail, catering, tourism, construction and green manufacturing, Chinese economy will expand by 5.2 percent in 2023, according to IMF forecasts. Other international organizations have also successively raised their forecasts for Chinese growth, with Goldman Sachs predicting China's GDP growth to reach 6 percent in 2023.

The strong PMI data of the country immediately lifted investor sentiment, as global capital has kept flowing in to purchase Chinese assets. In light of the deteriorating growth outlook in the US and other developed economies in the aftermath of Silicon Valley Bank and Credit Suisse's sudden failures, foreign investors are more willing to park their capital in the yuan-denominated investment portfolios.

Highlighting one of the leading themes discussed by global economists, the IMF's managing director said key barricades to growth are increasing economic fragmentation and geopolitical tensions. What the IMF didn't say explicitly is that trade protectionism and technology "decoupling" being pursued by the US against China will continue to impede the growth of the US and others.

Globalization has helped raise growth rates and pull tens of millions of people out of poverty in the world. Now, economic fragmentation headed by the US government is eating away at the fruitful results of globalization. Georgieva said quite bluntly: "The path back to robust growth is rough and foggy. The ropes that hold us together may be weaker now than they were just a few years ago." She warned that the global banking system is not that solid at all, with hidden vulnerabilities remaining in the corners. Now it's not time for complacency.

The trend points to China's growth consistently regaining pace while "de-globalization and decoupling" efforts led by the US leading to weakened economy, eroded prosperity, and divided world. Visionary leaders in Asia, Europe, Latin America and elsewhere have come to know the difference and distinction of Chinese and American decision-making. Before long, those countries will recalibrate their own policies.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn