Illustration: Chen Xia/Global Times

The focus on the new central bank governor in Japan highlights the severity and complexity of the challenges facing the Japanese economy, especially at a time when Japan has been inclined to blindly follow Washington's "decoupling" push. The challenge for Japan is not only economic but also political.Kazuo Ueda began his first day as governor of the Bank of Japan (BOJ) on Monday, which has been watched closely for clues on how the central bank's 32nd governor would lead the Japanese economy out of its doldrums amid growing uncertainty from both home and abroad.

Both Japanese and Western media outlets unanimously believe that Ueda faces daunting challenge of finding an exit from the central bank's protracted monetary easing policy under his predecessor Haruhiko Kuroda, while also achieving its 2 percent inflation target and avoiding causing major problems to the sluggish Japanese economy.

Even for an economy recording steady growth, such a task would require complicated considerations and calculations, let alone for an economy that has been trapped in a prolonged period of stasis. In this sense, how to seek an effective way for the Japanese economy going out of its current predicament will put Ueda to tough test.

Judging from the current state of the Japanese economy, it seems that any option about monetary policy is problematic. It is in 2013 that the BOJ started adopting ultra-loose monetary policy, in an effort to stimulate Japan's economic recovery by keeping the yen's value at low levels and boosting stock prices. But there have been various side effects of the prolonged monetary easing. As the pressure from a weak yen and rising consumer prices is mounting, normalizing monetary policy seems to be inevitable.

Yet, on the other side, a shift in monetary policy could risk creating further shocks to the Japanese economy. When it comes to trade, for example, the central bank's long-term easy monetary policy has led to a devaluation of the yen, which has helped boost Japan's exports to a certain extent. If the policy starts swinging toward tightening, it is highly possible that exports will take a hit.

Indeed, all these policy dilemmas point to the fact that monetary policy alone is unlikely to play a significant role in helping Japan, which has been struggling with a weak yen, a shrinking economy and high trade deficit, and has been trying to find the key to much-needed economic recovery. Japan ran its biggest annual trade deficit of around $155.27 billion in 2022, as higher energy and raw material prices along with the yen's fall boosted import costs.

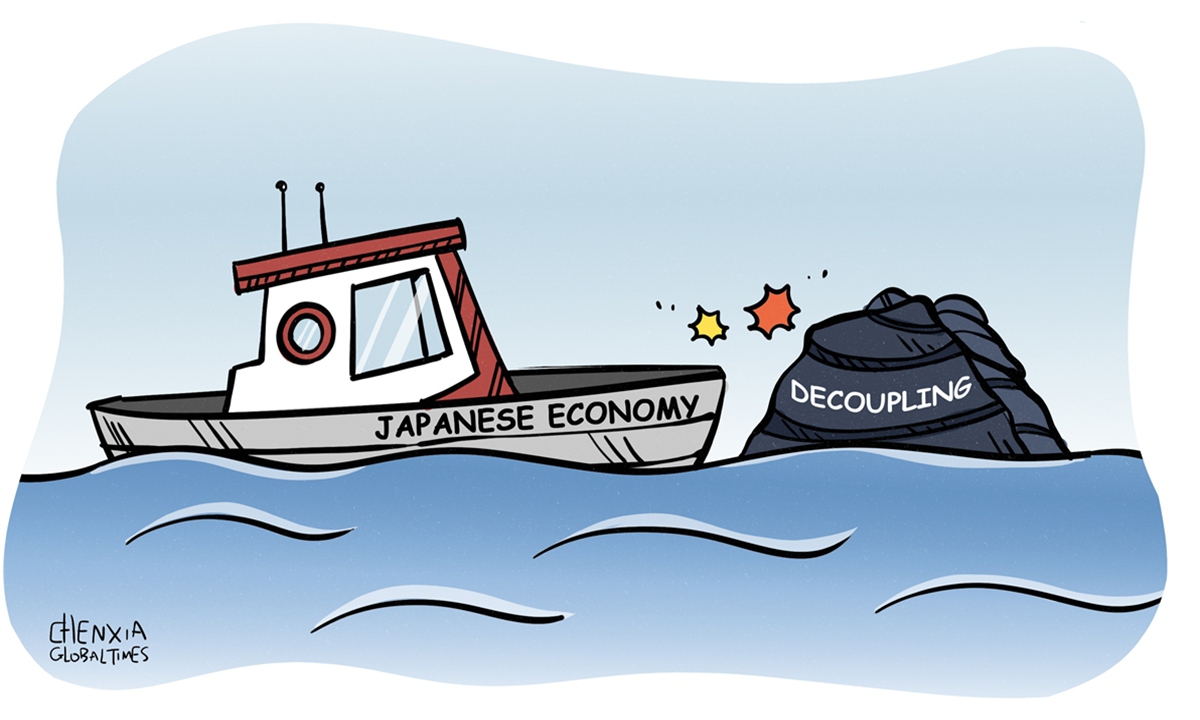

It should be noted that against the backdrop of the global economic slowdown, Japan remains heavily dependent on the external environment and is facing formidable challenges and great difficulties. Under such circumstances, Japan is supposed to strengthen economic and trade cooperation with the rest of the world to lift its economy out of the current predicament. But strangely, it has been doing the opposite, blindly following the US to engage in "decoupling" supply chains from China and increasing the difficulty and complexity of expanding exports to its biggest trading partner.

It is no secret that Japan wants to use the US power to become a major political power, but as the US has been promoting its "decoupling" push from China, the Japanese government has appeared quite cooperative in the US strategy of building technology alliance and supply chain alliance that exclude China. This is actually killing the possibility of cooperation between Japan and China.

China remains the largest market for Japanese consumer goods, especially consumer electronics. China is also the world's largest processing base for intermediate goods, which imports a lot of intermediate products from Japan to produce finished products for the Chinese market and the rest of the world.

Therefore, if Japan continues down the wrong path, endangering the regional supply and industrial chains, it will eventually backfire at the expense of Japan's economic future. Japan's economic structure determines its relationship with China and Asian industrial chain. If it chooses to "decouple," the loss of the Chinese market, an integral part of the Asian industrial chain, will distort its economic structure, driving the Japanese economy eventually to fall off a cliff.