De-dollarization is general trend, but ‘de-weaponization of the dollar’ is more urgent

Photo taken on Sep 18, 2019 shows US dollar banknotes in Washington DC, the United States. File photo:Xinhua

European Central Bank President Christine Lagarde warned on Monday that the US could not take for granted the US dollar's continued role as the go-to currency for world trade, though for now it remains unchallenged. US Treasury Secretary Janet Yellen also admitted that US economic sanctions against Russia and other countries may weaken the hegemony of the US dollar.

In fact, since the end of March and the beginning of April, developments in the international currency have attracted great attention. China and Brazil have reached an agreement that bilateral trade can be settled directly in their own currency, bypassing the US dollar; the meeting of finance ministers and central bank governors of ASEAN members held in Indonesia discussed how to reduce the dependence of financial transactions on the US dollar, the euro, the yen and the British pound and use local currency more for settlement; India and Malaysia agreed to use rupees for settlement, amongst other developments. De-dollarization has become a trending topic within the international media for an extended period.

There is no clear definition of de-dollarization. Currency performs functions such as valuation, payment, and value storage in international transactions. If the functions of the US dollar in these aspects are replaced, it can be called de-dollarization. If the transactions of strategic materials including commodities, energy and minerals have been settled in currencies instead of US dollars, and foreign holders have reduced their holdings of US dollar bonds, sold US dollar assets, and reduced US dollar reserves, these are all deemed as manifestations of de-dollarization.

De-dollarization means that there was "dollarization" to begin with, that is, a country other than the US mainly uses the US dollar as a trade, investment and reserve currency in international transactions, and a country that is completely dollarized even directly uses the US dollar instead of its own currency for domestic circulation. Once an economy takes measures to reduce the use of US dollar in international and domestic economic activities, it can be regarded as starting the de-dollarization process.

As the US economy was hit hard after the international financial crisis in 2008, calls for reform of the dollar-centered international monetary system gained traction. Emerging economies and developing countries have begun to increase regional and functional currency cooperation and reduce the use of US dollars to avoid exchange rate risks, debt risks, and asset risks caused by excessive reliance on US dollar settlement, valuation, and reserves. The EU and others also support the diversification of reserve currencies. The US dollar's share of total official international reserve currencies peaked at 85 percent in 1977 and is now around 59 percent.

Changes in international relations and geopolitical conflicts have also stimulated the de-dollarization process. The US has imposed severe financial and economic sanctions on Iran and Russia, restricting their use of US dollars. Iran, Russia and other countries have embarked on the road of complete de-dollarization. Europe is trying to bypass the US dollar-dominated SWIFT system to finalize payments with Iran. India is trying to carry out ruble-rupee settlement with Russia. Other bilateral and multilateral non-US dollar currency settlement agreements are also emerging.

At present, the US economy is facing recession, inflation remains high, national debt levels continue to climb to new heights, and even a banking industry crisis occurred. A potential crisis may break out at any time, which prompts some countries to consider avoiding short-term and long-term risks of the US dollar. Russia, Iran and other countries have no choice but to de-dollarize because they face severe sanctions and find it difficult to carry out normal international trade. The measures taken by India and Europe to bypass the US dollar are related to their need to conduct transactions with sanctioned Russia and Iran, and how to use the ruble foreign exchange formed by India's trade surplus with Russia is also an issue.

Therefore, de-dollarization moves of different countries require specific analysis. The non-US dollar foreign exchange formed by various countries bypassing the US dollar transaction is still inferior to the US dollar in terms of liquidity, value preservation function, and credit rating. The US dollar system has been formed and operated for too long, and the "path dependence" on the US dollar has greatly increased the transaction costs of bypassing the system, and the cost of building a new system is even higher.

Compared with the long-term hegemony of the US dollar, de-dollarization is still at a relatively early stage at this stage. Dollarization is not achieved overnight, and de-dollarization cannot be achieved in one stroke. The increase in de-dollarization actions is a response to market changes made by countries based on their own economic and financial conditions, and their decisions are still mainly spontaneous, partial, and decentralized.

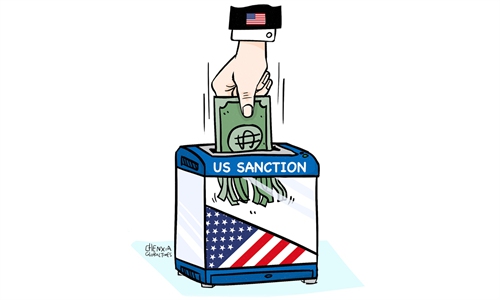

The US dollar does not only serve as public good to the international community, it has also been used by the US as a strategic tool, and has become a pillar of US hegemony alongside military power. The US government has also increasingly weaponized it. De-dollarization is of course crucial and is the general trend, but the "de-weaponization of the dollar" is even more urgent.

The conflict between Russia and Ukraine has caused profound changes to the global political structure. The US has severely sanctioned Russia and Iran, frozen and even declared that it will confiscate the US dollar assets of Afghanistan and Russia, seriously shaking the international credibility of the US and the US dollar.

De-dollarization is not only a necessary measure for countries to avoid currency and financial risks and increase asset returns, but also an inevitable choice to enhance national financial security, especially overseas asset security. If all kinds of de-dollarization actions converge into a trend, they may have an impact on the US dollar's strategic tool effect.

There are many insurmountable risks and natural defects for a single sovereign currency to act as an international central currency for a long time. For example, the conflict between the US monetary policy and the policies of other countries, the US alone cannot balance the balance of payments, and the monopoly power of the US dollar will encourage the US to use it as a strategic tool to attack opponents, and opponents will inevitably try to disintegrate their rights from a strategic perspective.

From a long-term perspective, a single sovereign currency as the main international currency is not in line with the reality of a multipolar world. The evolution direction of the international monetary system may be that multiple sovereign currencies coexist, check and balance each other, and jointly undertake the important task of stabilizing the international monetary and financial environment; there may also be a super-sovereign currency, or technological progress leads to institutional innovation, such as the widespread application of digital currency replace the existing flat currency system. Either way, it means a weakening of the dollar's status. It's just that the process can be long and tortuous. In the face of major changes unseen in a century, whether there will be milestone changes in the new wave of de-dollarization process, although it is worth looking forward to, still needs to be observed.

The author is director of the Institute of Peaceful Development of the Chinese Academy of Social Sciences. bizopinion@globaltimes.com.cn