S.Korea's Yoon set to face 'strong US coercion' to contain China

Seoul’s extreme diplomatic policy unsustainable, self-destructive: experts

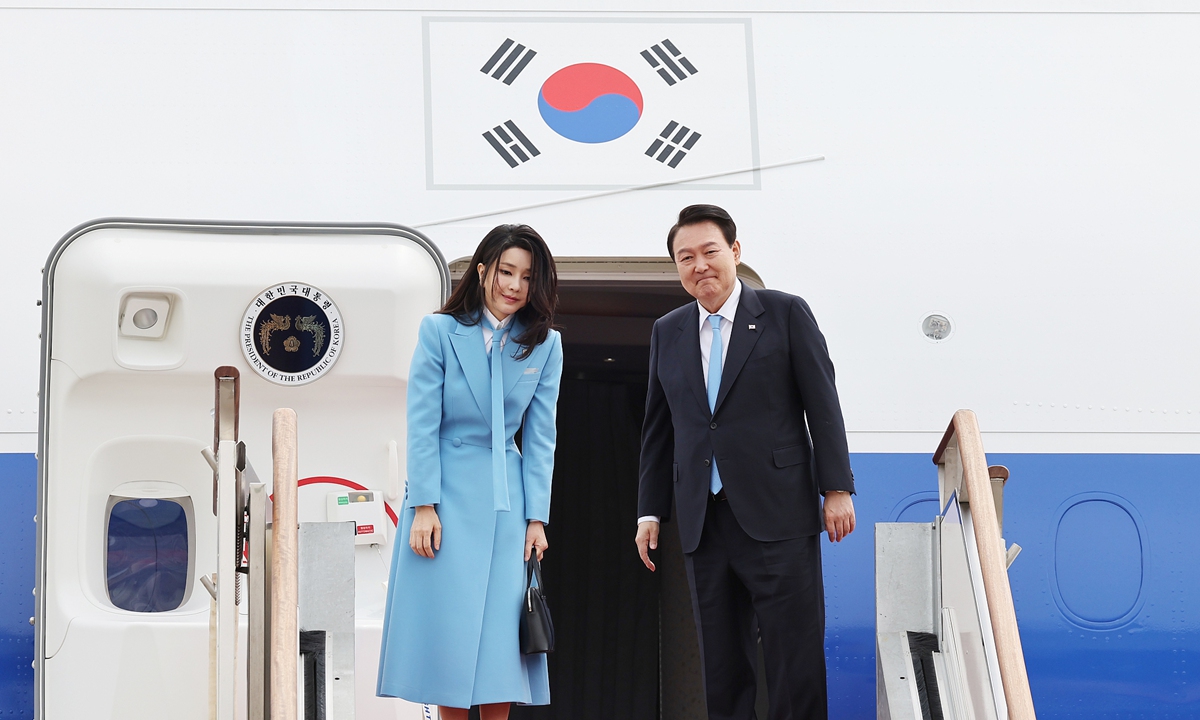

South Korean President Yoon Suk-yeol (right) and his wife Kim Keon-hee board a plane as they leave for Washington on April 24, 2023. Photo: VCG

South Korean President Yoon Suk-yeol left for the US on Monday for a visit during which he is anticipated to face greater US coercion to serve Washington's strategy to contain China, particularly in the chip sector.

Chinese experts predicted that Yoon is likely to become more assertive in implementing the US' instructions, but such an approach means South Korea has become "consumables" in the US' Indo-Pacific Strategy at the cost of its own independence and interests, which is unsustainable and self-destructive.

According to a Financial Times report on Monday, the US government has asked the South Korean government to encourage some of its leading chipmakers - Samsung Electronics and SK Hynix - not to fill the market gap if China bans the US-based chip giant Micron Technology from selling chips in the Chinese mainland.

The report came as South Korean President Yoon departs for the US for a state visit.

Chinese Foreign Ministry spokesperson Mao Ning said at a routine press conference on Monday, "To maintain its hegemony and seek selfish interest, the US has pushed for 'decoupling' and severing supply chains and even coerced its allies to join the campaign to contain China."

"We hope the government and business community of the country concerned will be clear-eyed, do the right thing, and be part of the efforts to safeguard the multilateral trade system and keep the global industrial and supply chains stable," Mao remarked.

China announced on March 31 to conduct a cybersecurity review on products sold in the Chinese market by US-based memory chip producer Micron. The move was seen by foreign media as a retaliation against US chip bans and other related sanctions against China.

War of chips

Ma Jihua, founder of Beijing DARUI Management Consulting Co and a veteran tech analyst, told the Global Times on Monday that the US knows that it cannot do much to hurt China in terms of the memory chip market, and as a result, it wants to push South Korean chipmakers to the frontline of the chip war.

Ma predicted that chips will be an important issue for discussion during Yoon's US visit, and there is a possibility that South Korea might make some gestures, such as verbal promises, to show that it aligns with the US on the issue.

But if Yoon is a leader who prioritizes national interests, he won't follow the US order to restrict South Korean companies' business in China, as that will bring "tremendous losses" to them, especially to several chip industry giants, Ma noted.

Some experts also pointed out that China's domestic memory chip manufacturing industry is developing rapidly to replace overseas supplies, and the US and its allies' move will not have too much impact on China.

"The Chinese market used to rely greatly on Micron supplies in the past," Xiang Ligang, a veteran tech analyst, told the Global Times on Monday. "But nowadays, with the fast growth of domestic chip companies like Yangtze Memory, this reliance has decreased greatly, as it [China] can achieve self-sufficiency in many components."

In 2022, South Korea's exports of memory chips dropped by 10.7 percent on a yearly basis, the country's customs data showed. The Chinese mainland has been the largest importer of South Korean memory chip products in recent years.

According to Xiang, the real problem Yoon will have to face is not whether he should follow Washington's orders, but that South Korean companies might lose the market to Chinese competitors.

Price of being a pawn

Han Xiandong, a professor of Korean studies at China University of Political Science and Law, told the Global Times on Monday that Seoul and Washington are likely to reach a new agreement to jointly contain China during Yoon's visit, and it could affect the Taiwan question, the core of China's core interests.

Yoon has made extremely aggressive and very unusual comments on the Taiwan question, which is not an accident resulting from the ignorance of Seoul's foreign affairs team, but more likely an act that is aimed at proving South Korea's loyalty to the US ahead of Yoon's visit, Han said.

By doing so, Yoon is sacrificing South Korea's national interests in exchange for US endorsement of his shaky political power in Seoul, as his approval rate at home continues to drop, and the state visit is like an award given by Washington to encourage Yoon's performance, Han said.

Yoon's approval rating fell for the third straight week after his remarks on Ukraine and the island of Taiwan had raised tensions with Russia and China, the Korea Times reported on Monday.

In the poll of 2,520 adults aged 18 or older conducted by the South Korean poll institution Realmeter, the positive assessment of Yoon's performance inched down 1 percentage point from the previous week to 32.6 percent. Yoon's disapproval rating climbed up 1.3 percentage points to 64.7 percent.

Li Haidong, a professor at the China Foreign Affairs University, said the US is using South Korea as "consumables" to serve its strategy of containing China, and Yoon has been chosen to be the executor of this plan.

Han said South Korea's foreign policy has totally lost balance, and will continue to seriously damage the security and economic interests of Yoon's country, which will lead to more chaotic situations in internal politics and South Korean society.