rmb File photo:VCG

Argentina on Wednesday (local time) reportedly announced plans to use Chinese currency yuan to pay for goods imported from China amid an emerging de-dollarization wave pushed by countries and regions in order to decrease reliance on the US dollar.

Argentina's Economy Minister Sergio Massa announced at a press conference that the South American country will stop using US dollars to pay for Chinese imports and will instead use yuan for settlement. Chinese Ambassador to Argentina Zou Xiaoli was invited to attend the press conference, China Media Group (CMG) reported on Thursday.

Argentina will use yuan to pay for Chinese imports worth about $1.04 billion in April. The use of yuan can accelerate the pace of Chinese imports over coming months, while the efficiency of relevant authorizations will be higher, Massa said.

It is expected that from May, Argentina will use yuan to pay for Chinese imports worth between $790 million and $1 billion per month, he added.

Per data from China's General Administration of Customs, bilateral trade between China and Argentina recorded 142.85 billion yuan ($20.66 billion) in 2022, up 24.2 percent year-on-year. China's exports to Argentina came in at 84.8 billion yuan, up 23 percent.

In addition, Massa emphasized that the use of yuan can boost the expectations of Argentina's net foreign exchange reserves and brings greater flexibility.

Argentina's central bank announced in January that Argentina and China have officially expanded their currency swap agreement, which will strengthen Argentina's existing 130-billion-yuan foreign exchange reserves and activate 35 billion yuan of disposable funds, CMG reported.

Argentina is not the first South American country expanding the use of yuan recently, Brazil in February signed a memorandum of cooperation with China to establish yuan clearing arrangements in Brazil.

The two large South American countries increasing yuan usage will generate great demonstration effect for neighboring countries and even countries in other regions, Xi Junyang, a professor at the Shanghai University of Finance and Economics, told the Global Times on Thursday.

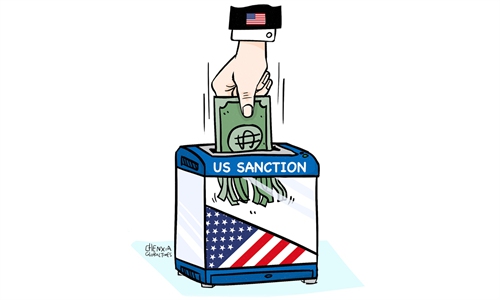

Dong Dengxin, director of the Finance and Securities Institute from the Wuhan University of Science and Technology, echoed that as the US "weaponizes" its currency and even arbitrarily freezes the dollar assets of other countries, more and more countries and regions have seen weakened trust on US dollar and realized the significance to seek a more diversified international monetary system.

Though the globalization of a currency takes a long period of time, among major non-dollar currencies, the Chinese yuan is expected to see faster growth, experts said.

For starters, China remains the world's largest trading country which will generate huge demand for yuan settlement. The nation has been expanding the opening-up of its financial activities and the exchange rates of the Chinese yuan have been relatively stable compared to other major currencies, Xi noted.

For the first time, yuan overtook the US dollar as China's most used cross-border currency in March, with its share hitting a record high at 48 percent, while the greenback's share of China's cross-border payments and receipts declined to 47 percent, Bloomberg reported on Wednesday.

In addition to the payment sector, the yuan's role as a financing currency has also become more prominent against the backdrop of the US and European countries' tightening liquidity, Ming Ming, chief macroeconomist at CITIC Securities, told the Global Times.

Citing data from market data provider Wind, Ming noted that the total stock of offshore yuan-denominated bonds reached 521.28 billion yuan as of April 6, an increase of 8.2 percent from the end of 2022.

China has been a leading driver for the growth of the global economy. With stable political environment, sound industrial chain and continuingly expanding consumer market, the Chinese market has become indispensable for not only global traders but also investors, Dong said, noting that it has formed a solid foundation for the yuan globalization.

China's cross-border receipts and payments settled in yuan totaled 42 trillion yuan in 2022, an increase of 3.4 times from 2017, according to data released by the People's Bank of China, the country's central bank.

The yuan has become the world's fifth largest payment currency, third largest trade finance currency and fifth largest international reserve currency. The yuan's share of the global foreign exchange market increased to 7 percent in 2022, making it the fastest growing currency in nearly three years.

The central banks of Thailand and China are negotiating over the expansion of local currency settlements for bilateral trade, aiming to come up with the most attractive methods which benefit companies in both countries amid fluctuations of the US dollar, Thai media reported on Thursday, citing the governor of Thailand's central bank.