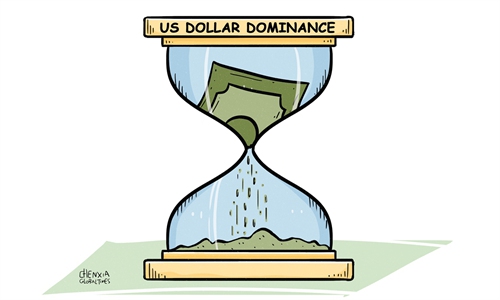

The trend toward de-dollarization has become clearer as dollar weaponization damages its credibility

Photo taken on March 17, 2020 shows U.S. dollar banknotes in Washington, D.C., the United States.(Photo: Xinhua)

The US Federal Reserve (Fed) is scheduled to announce its interest rate decision on May 3. A Reuters poll forecast the Fed would raise rates by 25 basis points in May and then keep rates on hold for the rest of the year. St. Louis Fed President James Bullard called for a much higher peak policy rate than currently expected, as inflation remains stubbornly high, according to Reuters.

In order to tame the worst inflation in four decades caused by US' monetary easing since the COVID-19 pandemic, the Fed radically raised interest rates at a rare pace and intensity in 2022, which accelerated the flow of international capital to the US, causing exchange rates plummet, financial market turmoil, and debt defaults in some countries.

Analysis now generally believes that this round of interest rate hikes by the Fed is approaching an end, and the momentum of international capital flows to the US is expected to slow down. But, as interest rates in the US remain at a high level, economies across the world, especially developing countries facing domestic economic problems, should not take lightly the spillover impact from the US monetary policy.

For a long time, driven by the "America First" approach, the Fed has used the status of the US dollar as an international key currency to ease the economic problems in the US at the expense of the interests of other countries, which has seriously impacted the world's financial and economic stability. What is even more worrying is that the US has intensified its efforts to turn the hegemony of the dollar into a geopolitical weapon, frequently resorting to sanctions and other reckless measures. In this context, many countries have begun to explore de-dollarization and seek to get rid of the hegemony of the dollar.

At present, an increasing number of countries are considering or have changed the US dollar payment settlement to bilateral local currency payments. According to incomplete statistics, a total of 85 countries have joined the de-dollarization process in various ways. In the future, the trend of de-dollarization is expected to become even clearer. The main reasons are as follows:

For starters, the world's economic and political landscape is undergoing major changes, which is one of the important causes of the trend of de-dollarization. The global political and economic rules constructed by the US are becoming increasingly unable to meet the needs of world economic development. Global rules dominated by the US have changed from promoting the development of the world economy to maintaining the US' hegemony, and have caused global concerns about the hegemony of the dollar.

Secondly, the development trend of the world economy "rising of the East and the declining of the West" has made the proportion of the US economy in global economy to drop. Economic strength is the basis for the international status of a currency. As the global share of the US economy declines and de-dollarization continues to develop, the share of the US dollar in global payment settlements and official foreign exchange reserves will inevitably continue to decline.

Third, the weaponization of the dollar has made the dollar face a growing credibility crisis. Since 2022, the US has led a series of economic sanctions against Russia. Russia is an important resource exporter in the world. The "plundering" sanctions against Russia have made countries that have economic and trade relations with Russia worry that they may be implicated. Meanwhile, this has also exacerbated the dissatisfaction of global economic entities with the hegemony of the US dollar, and their distrust and concerns about the US dollar have continued to increase. As a result, countries have tried to bypass the US dollar and establish bilateral local currency settlement or regional currency settlement systems.

In a very short period of time, many countries have collectively launched the de-dollarization action, which is likely to become the beginning of the accelerated process of de-dollarization. However, changing dollar dominance is a complex issue. In the short term, the US dollar will still dominate the international monetary system, which is determined by the inertia of international transactions formed by the global US dollar transaction stock. With the drastic changes in the world's economic and political situation in the coming period, the weakening of the US dollar's dominance may accelerate in stages. Overall, the change in the dominance of the US dollar will not happen overnight, and de-dollarization will be a long-term evolutionary process.

Yuan internationalization is not direct substitute of de-dollarization, but the evolution of de-dollarization is a development opportunity for yuan internationalization. Out of fear of the hegemony of the US dollar and doubts about the credibility of the US dollar, countries will gradually promote the process of de-dollarization, thereby changing the situation in which the US dollar dominates the international monetary system and moving toward a diversified international monetary system. In this process, the demand for dollars in various countries will gradually shift to other currencies. This will bring more demand for the international use of yuan with a solid economic transaction foundation and good credit, thereby enhancing the yuan internationalization.

De-dollarization has opened up new space for the internationalization of the yuan. China should take advantage of the trend, seize the opportunity, take the initiative, and promote the internationalization of the yuan in an orderly manner. China's constant efforts on boosting economic growth can provide good fundamental support for yuan internationalization. By promoting high-level opening-up and cooperation, more application scenarios can be provided for yuan internationalization.

Moreover, continuing to implement a prudent monetary policy will help China maintain the stability of the yuan exchange rate. Actively promoting the formation and development of domestic and overseas offshore yuan markets can be an important condition and basis for the development of yuan internationalization.

The author is chief economist and head of the Zhixin Investment Research Institute. bizopinion@globaltimes.com.cn