S.Korea exports drop amid its diplomatic gesture, Chinese emerging industries’ rise

Losing luster

Photo: A view of containers at the Port of Busan, the largest port in South Korea, on February 1, 2023

South Korea's exports

Once a much-needed supplier of products ranging from chips to ships for China, South Korea is increasingly facing a predicament as its products become less popular, and even start to be replaced by Chinese suppliers.

Shifting dynamics has led to changes in bilateral relations between the two countries who have historically been close trading partners, with South Korea showing an inclination to side with the US to fill the vacuum left by declining exports to China, while China is also diversifying its sources of imports.

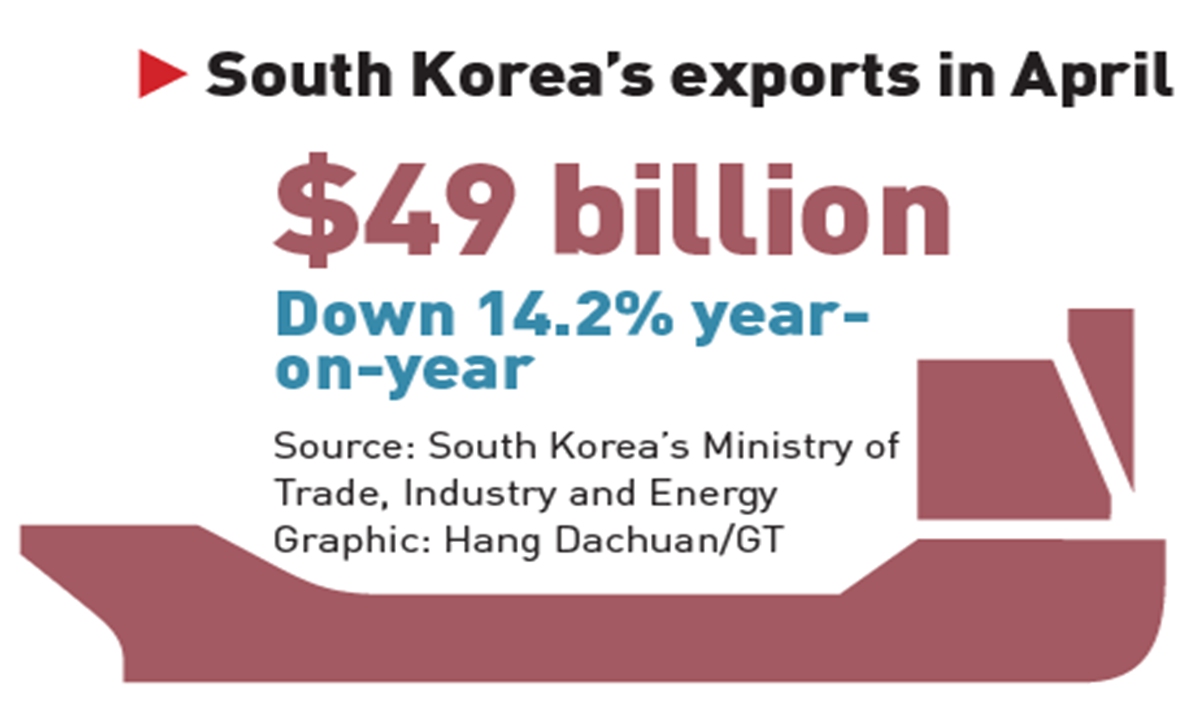

According to recent data published by Reuters, South Korea's exports fell for a seventh straight month in April, which represents their "longest losing streak" for three years. The country's exports dropped by 14.2 percent year-on-year to $49 billion for the month, the report stated.

One important reason behind the nation's dropping exports is its decreasing sales to the Chinese market. According to trade statistics published by the Korea International Trade Association (KITA), the country's share of exports to China totaled 19.5 percent in the first quarter of this year. This marks the first time since 2005 that South Korea's share of exports to China has fallen below 20 percent.

Last month, South Korea's exports to China dropped by 26.5 percent to $9.52 billion, accounting for a $2.27 billion trade deficit with China, data from Yonhap News Agency showed.

China is still South Korea' s largest trading partner, while South Korea is China's fourth largest trade partner.

Changing trend

Analyzing the situation, experts said that changes have been occurring over an extended period. Chinese customers no longer rely on some of South Korea's "superior products" like electronic components and cars as much as they used to.

Instead, they are buying directly from Chinese suppliers.

A report published by a research academy under the KITA on Wednesday noted that Chinese exports account for the highest proportion in the world in three of five emerging industries - new-generation semiconductors, displays and rechargeable batteries. The other two emerging industries are biomedicine and electric cars, Yonhap News Agency reported.

From 2016 to 2021, the proportion of China's above-mentioned five emerging industries increased by 1.6 percentage points in terms of exports. Germany and Vietnam's industries increased by 0.9 percent and 0.7 percent respectively in terms of exports share, while the US, Japan and South Korea decreased by 1, 0.6 and 0.1 percentage point, the report noted.

In particular, South Korea's semiconductor products, which has been a major source of imports for China, has given way to the rise of local industries.

"There are three reasons why South Korea's semiconductor exports to China have suffered decline. First, many South Korean semiconductor companies are setting up plants on the Chinese mainland. Second, the production capability of Chinese local semiconductor firms has strengthened, with the ability to replace more expensive South Korean supplies. Third, South Korea is following the US' semiconductor policies, which restricts their business ties with China," Ma Jihua, a veteran tech analyst, told the Global Times on Thursday.

Lü Chao, a professor and Director of the Institute of the US and East Asian Studies at Liaoning University, shared a similar view.

According to Lü, China is currently the largest buyer of South Korea's medium- and low-end semiconductor products. However, imports are declining as China continues to upgrade its domestic production capacity and strengthen the research and development of relevant products, he told the Global Times on Thursday.

According to a report by South Korean news portal Pulse, South Korea's exports of chips fell 49.5 percent as of March 25 compared with the same period one year ago.

Ma believed that the changes across China's and South Korea's semiconductor industries are unlikely to reverse over the short term, which means that South Korea's declining exports to China will continue.

"Against the backdrop of current international situation and China-South Korea relations, it's likely that South Korea's semiconductor industry will decline not only in terms of exports, but also in terms of its position throughout global supply chains," Ma said.

Problematic policy

Facing a changing landscape, South Korea is increasingly showing an inclination to stand by the US in the latter's crackdown against China, with the intention to let the US market fill the vacuum left by declining exports to China, analysts said.

The US is also making efforts to rope in South Korean companies to exclude Chinese companies from global chip supply chains. For example, the US is intent on setting a chip alliance along with Asian economies including Japan and South Korea to counter China's semiconductor industrial rise.

South Korean chip giant and the world's second largest contract chip manufacturer Samsung also announced plans to establish a plant in Texas in 2021.

According to Lü, in more than 30 years since China and South Korean established formal diplomatic relations, the two countries have witnessed all-round and rapid development in bilateral relations with increasing common interests.

"However, Yoon Suk-yeol administration's unilateral actions to overturn this progress may drive South Korea's economy into a dead end," he said.

Experts said that South Korea's attempt to drift apart from China is an unwise policy, as there is no country in the world that can replace China's market scale, which is large enough to "digest" South Korea's production output of many products.

"South Korea is facing a dilemma that the US is pulling it away from China's semiconductor market, which is the largest buyer of South Korean electronic products," Lü said. "But the consequence is, there is no other market that has the same consumption potential as China."

On the other hand, with South Korea siding with the US to exclude China's semiconductor industries, it will further push domestic companies to accelerate replacement of overseas imports, which in turn will further squeeze the market share of South Korean products whether in China or across the globe, Ma noted.

"I think with South Korea's advantages in research and development for technology, there's still plenty of space for South Korean firms to cooperate with Chinese enterprises," Ma said. "The opportunities are there for them to grasp."