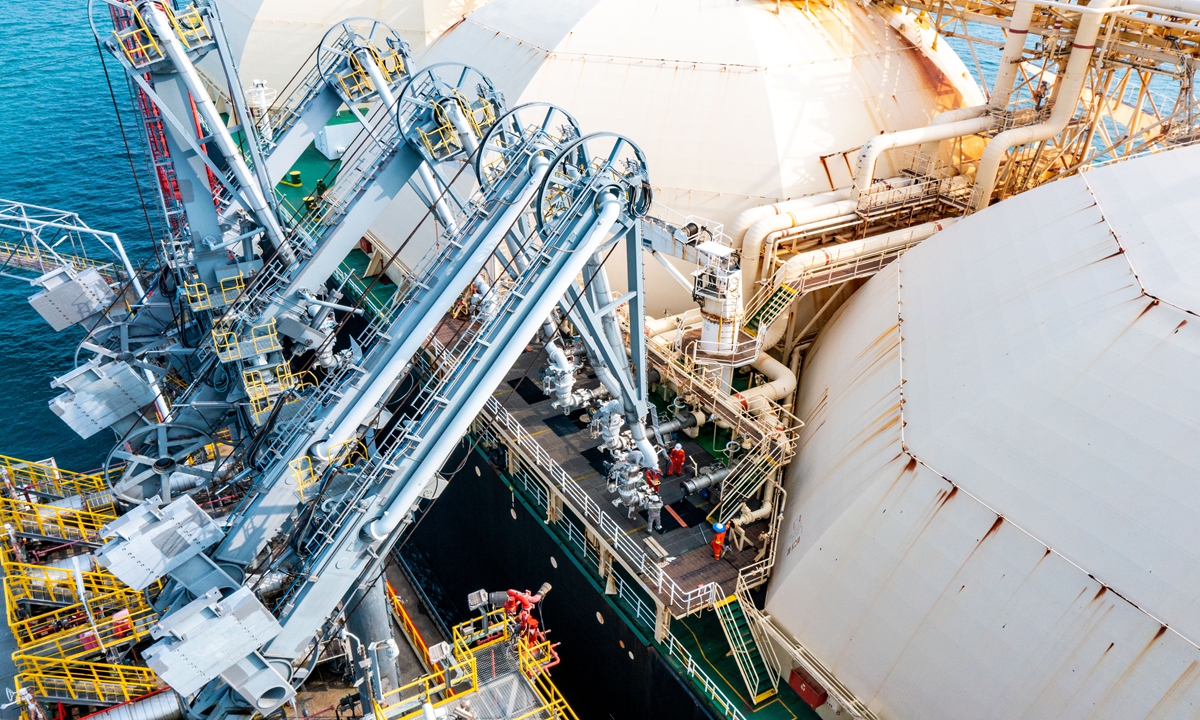

Photo: Courtesy of CNOOC

The completed offloading of Mraweh ship carrying liquefied natural gas (LNG) from United Arab Emirates (UAE) in South China's Guangdong Province on Tuesday marks the first LNG import in China settled in Chinese yuan, marking progress in the nation's exploration of yuan settlement of cross-border energy trade, amid accelerating internationalization of the Chinese currency.

China National Offshore Oil Corporation (CNOOC), the largest offshore oil and gas producer in China, purchased a shipment of LNG from French TotalEnergies at Shanghai Petroleum and Natural Gas Exchange in March, and the transaction was done in Chinese yuan, the company told the Global Times on Tuesday in a statement.

The 65,000 tons of LNG produced in UAE carried by Mraweh arrived in CNOOC's Dapeng port terminal in Guangdong on Monday after 26 days of sea voyage. The LNG will be delivered to multiple users, including power plants to urban consumers after gasification, providing a strong guarantee for the stable natural gas supply in the Guangdong-Hong Kong-Macao Greater Bay Area, the company said.

China in 2022 imported more than 500 million tons of crude oil, more than 100 million tons of natural gas and 63.44 million tons of LNG, data from the General Administration of Customs showed. CNOOC noted that the condition for trading oil and gas in yuan has become ripe thanks to the growing internationalization of the yuan.

As yuan settlement is picking up pace amid the global de-dollarization push, a range of international enterprises and organizations are eyeing the opportunity.

The latest move came as Brazil's Suzano SA, the world's largest producer of hardwood pulp, may accept yuan for exports of its products to China, while China's largest commercial bank, Industrial and Commercial Bank of China, processed the first cross- border yuan settlement in Brazil at a local branch on April 12.

Later in April, Argentina's Economy Minister Sergio Massa announced at a press conference that the South American country will stop using US dollars to pay for Chinese imports and will instead use yuan for settlement, China Media Group reported.

Global Times